From one victory to another

Good afternoon. Since the publication of previous review a month ago the Bedouins of Cyrenaica month with the active help of white men of Britain and France overcame the Bedouins of Tripolitania (the leading NATO countries have problems with cash, so they could not drag out anymore) – after capturing the capital, the winners began to kill blacks, whom they think to be the hated mercenaries of Gaddafi. The Russian authorities finally recognized the reality, but while our monopolies try to save their investments in Libya, some does not know any sorrows: the infamous Gunvor, owned by Putin’s friend, Finnish citizen and the Swiss resident Timchenko, worked well with the rebels during the war - in August its tankers briskly shuttled between Novorossiysk and Benghazi. The Japanese Cabinet saw changing of the guard: as was intended, extremely unpopular PM Kan has resigned - after a brief inter-party struggle his place was taken by former Finance Minister Yoshihiko Noda, who ceded his job to Jun Azumi. The Australian PM Gillard strives to survive – her position is severely undermined by a scandal with Labour backbencher MP Thomson – the latter is accused in a heap of different offenses (mostly financial, but also in quite close contacts with prostitutes); the opposition is excited – but in the ruling party many people also feel that they made a mistake a year ago, replacing their former leader Rudd with senseless Julia.

The case of Strauss-Kahn came to its logical finale – Cyrus Vance Jr., the Manhattan district attorney, asked to stop it, after getting sick and tired of the “victim’s” continuous lies: outraged Diallo immediately initiated a civil lawsuit of “sadistic attack” – but the spunky Dominique and his family had already returned to France. The eastern United States saw the second strongest earthquake in history (for the area) – of magnitude 5.9; the epicentre was in Virginia, tremors and destruction were felt over a large territory, including the largest conurbation stretching from Boston to Washington via New York and Philadelphia; the Capitol and the Pentagon were evacuated, the New York airports were closed, the Cathedral of Peter and Paul in Washington suffered damage; according to scientists, in the next 5 years all of us should expect the increased seismic activity. Weather cataclysms don’t subside: they hit the New Zealand, where the streets of Oakland were covered with snow – such an event happened for the first time in the past 80 years. Not only elements are in rage, but also people: just as the South Sudan became independent, there happened another local war – one tribe tried to take away a herd of cows from another, causing bloodshed (more than 500 people died). Civilized people are not far away: for example, the famous actor Depardieu peed on the floor of aircraft in which he planned to fly to Ireland - and the crew had to pass a drunk actor to the police.

Illustration: Artyom Popov, ITinvest

Fortune letter

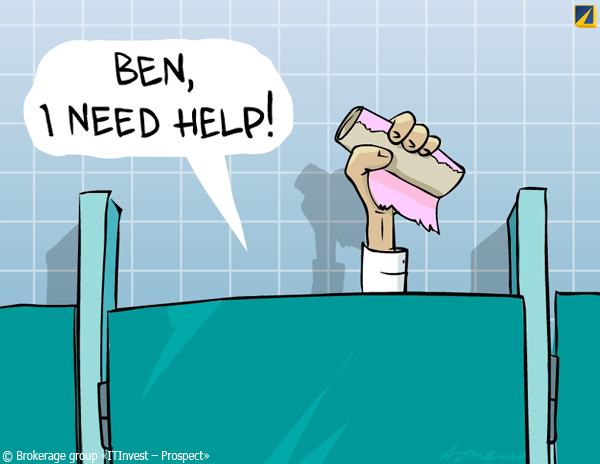

Monetary markets. All have been waiting for the performance of the Fed head Bernanke on the annual conference in Jackson Hole, Wyoming – QE2 was announced there a year ago. But the helicopter-Benny only issued a set of platitudes about the fundamental strength of the US economy - and the only specific point was that the September meeting of the FOMC would last two days instead of one. However, the protocol of the last meeting explained more: the Fed would discuss in September the specific plans for monetary stimulus – who would have doubted. Introduction of QE3 is not yet a foregone conclusion: inflationary background is too high, and if in August a moderate idea to fix the zero rates until mid-2013 led to protests of three members of the board, then the forced launch of a new wave of emission is able to escalate the situation even more - but the fourth dissident in the Committee of 10 people would be a nightmare for the markets, since the half-odd split means a complete uncertainty on the key issues of monetary policy in the long term. Bank of England, by contrast, returned to the unanimity - no one wants to raise rates, but to cut them is frightening, for the inflation is very high (5% per year); similar picture is with the ECB. The central bank of Iceland has raised the rate from 4.25% to 4.50% per annum, the head of the Reserve Bank of Australia Stevens made it clear that he would not ease nor tighten the monetary policy (and that had happened); the banks of Japan, Korea, Canada and Sweden also took a break - in general, the central banks are in anxious calm.

Moody'sdowngraded Japan’s rating by one level, citing the spectacular national debt and giant budget deficit of the country; outlook is stable. Fitch has affirmed the top rating and stable outlook for the USA - because of "exceptional solvency" of the country: i.e. it was said essentially that if there are problems, the Fed will print as much new bucks as necessary; at the same time the agency is threatening to look at China, whose prospects are not encouraging. Finally, the three leading rating agencies confirmed the rating and outlook for Germany. US Justice Department is investigating the methodology of S&P and similar institutions; since the methods, of course, are incorrect (remember what the agencies were doing until 2008) there will be something to make out of it – at the same time, agencies also have something to accuse the US government, whose rating is overvalued against grim debt realities. Actually, markets are well aware of all the gloom: for they saw a new panic wave, which dropped the yield on 10-year British government bonds below 2.5%, and American and German – below 2.0%; and all these values are the historical lows - the audience flees to safer assets, which are still considered to be the leading countries’ treasury bonds. In contrast, junk papers, which had recently flourished, are strongly damped – their offering in August was the lowest since December 2008. Another sign of stress – record sums that foreign governments and central banks now hold on the accounts at the US Federal Reserve: they have exceeded the peaks of the worst moments of the 2008 crisis.

Political games around monetary policy widen too. Republican favourite in the presidential race, Texas governor Rick Perry, responding to a question of an Iowa voter on Bernanke’s policy, said: “If this guy prints more money between now and the election, I don't know what y'all would do to him in Iowa but we would treat him pretty ugly down in Texas. Printing more money to play politics at this particular time in history is almost treasonous in my opinion”. The answer came immediately – the White House spokesman Jay Carney said: “When you're running for president you have to think about what you're saying because your words have greater impact… threatening the Fed chairman is probably not a good idea”. However, in reality, it is hard to find someone willing to work in such a respectable office as the Fed – for example, Obama nominated Harvard and Columbia professors Stein and Clarida for the two vacant seats in the central bank: so what? – the latter at once said that he feels quite good in PIMCO, where he works part-time, and that he doesn’t really want to work for Fed either. The ECB continues to buy bonds of the periphery – under a criticism from Germany (Merkel’s party loses elections in one land after another): ECB chief economist Stark wants to resign in protest, but what should they do? – Private demand for papers of Spain and Italy (and of Portugal and Greece even more so) is weak. Finland, Austria, the Netherlands, Slovakia and Slovenia demand collateral for their bailout loans to Greece, or they would not participate; other countries are against – and the euro-structures also gave to understand that collateral requirements are unacceptable.

However, with Greece everything has long been clear: yield of 1-year government bonds soared to 65% per annum and of 2-year – to 55%; cost of a 5-year credit default swap has reached 30%; experts of S&P believe that Greece will announce a default before the end of this year – quite likely. Merkel and Sarkozy met and decided nothing – besides the idea to establish a “European government”; neither the shared Eurobonds, nor the expansion of the stabilization fund were approved. US regulators are extremely concerned about the fact that European banks have a serious shortage of dollars – some even have to borrow from the ECB (bucks, not euros! – via the Fed’s swap line). Swiss National Bank also took the advantage of swaps from the Fed - and yet the shortage of dollars has brought 3-month LIBOR rate on the buck to 0.33%, the highest value since August last year. Banks do not have enough liquidity – and have only themselves to blame: as long as US lenders hoarded cash and built up capital, the Europeans ate the authorities’ optimism - and now the capital rate of the Euro-banks is twice lower than of the American ones, while dependence on market funding is 45% (against 25-30% in the USA). Things are better at the British banks, but not much – they now throw down doubtful assets, shifting them on the balance sheets of pension funds; but it is unlikely to mislead anyone.

In general, things look almost as bad as in 2008 – and it is not surprising that credit default swaps for major banks of Italy, Britain and even Germany struck the then maximums, heralding a new crisis of liquidity in the banking system in the near future. But if so, central banks would need to re-engage in monetary pumping – paying the price of inflation spike to rescue the financial system again, for some time. This scam seems to never end – and this great feeling is all around. The author of this review had recently received a “fortune letter” with the proposal to receive $10.5 million from the Ministry of Finance of Nigeria and the United Nations – quite a mundane thing (it is a long-standing and well-known fraud), but today an innovation has happened: if the previous letters of this kind were sent on behalf of various Nigerian government officials, now the sender field read quite a mocking inscription “Mr. Ben S. Bernanke” – so-so. And yet the bastards are right: in fact, their scam is different from the respectable practices of nowadays central banks only by the order of magnitude - in all other respects it is all the same. In addition, the architecture of the global financial system today is such that all the money – both honest and fraudulent – are ultimately made by the office of Mr. Ben S. Bernanke: the banking system is paralyzed – and all the monetary process is that central banks are printing money, which are then conveyed into many streams of individual turnovers.

![]()

Illustration: Artyom Popov, ITinvest

Currency markets. Swiss business complains about the expensive franc – particularly engineering and tourism. In response, the Swiss National Bank increases bank deposits on its balance sheets from 120 to 200 billion francs; the balance itself will expand by at least 40 billion (the sum is about 8% of country’s GDP). Moreover, according to market rumours, the central bank wrote a letter to the banks with the threat to levy a tax on “too high balance” - and even though the rumour was disproved, the bad feeling remained. For its part, the government has taken on two incentive programs at once – which include funding for infrastructure projects, support for exports and innovations. All these measures have made the franc LIBOR rate go into negative (from -0,017% for 2-week to -0,010% for 2-month) - and the suisse fell to 0.8240 against dollar and 1.1970 against the euro; however, the mood deterioration in the markets has forced the public to return to the franc as a safe haven – rates drew off to 0.77 and 1.10. On September, 6 SNB ran out of patience – it said it is prepared to intervene in any size, assuming a minimally acceptable value of the euro-franc at 1.20 (although it is “too expensive”). Euro-franc soared to 1.22 in a few minutes after the news came out, while the dollar-franc – to 0.8575; after a brief pause, the hike continued – USDCHF reached 0.8850. The Japanese interventions (at the total size of over ¥4.5 trillion) were in vain – the yen is back on track to the previous highs and even broke them, reaching 75.95; the Finance Ministry will allocate $100 billion to fight the currency growth – and meanwhile the business increased production transfer into developing countries, for the domestic costs are unbearable; there are rumours that the Japanese ask the G7 (which summons this weekend) for a joint intervention. Euro-dollar has not gone out of range 1.38/47 in the last 3 months – and the lion's share of this time it has spent between 1.40 and 1.45; but last Friday the rate showed a new minimum below 1.37.

![]()

Source: SmartTrade

Stock markets. Leading exchanges sank sharply, quickly bounced back and went down again. France, Italy, Spain and Belgium extended a ban on short positions on equities until late September – however, this does not help much. Recent reports for the second quarter have been mixed: indicators of Wal-Mart Stores aren’t bad – but domestic sales sat down; Home Depot pleased – while Dell disappointed, especially with the forecast for the second half of the year. Hewlett-Packard will throw down some of its business (tablets and smartphones) and divide some (including the production of personal computers, which will now change the brand name), it is scheduled to be replaced by the absorption of British software firm Autonomy for $10 billion; the market took the news badly - Moody's cut the rating outlook for HP down to negative. Google agreed to buy Motorola Mobility for $12.5 billion - the latter’s equities made an immediate vertical take-off; the logic of Google is that it will receive a hefty patents portfolio - and will use it to protect from competitors’ harassments. Steve Jobs has finally left Apple for health reasons – shares sat down slightly. The US Federal Housing Finance Agency has filed lawsuits to major banks in the amount of $200 billion on charges of fraudulent mixing of different quality loans – it seems that the reward for mortgage frauds will finally find its heroes.

Particularly bad are the things of the Bank of America – there even went a rumour (though later disproved) of its takeover by J.P.Morgan Chase bank; in any case, however, the bank is mired in mortgage loans stronger than others – whose quality, of course, gets worse as the housing prices go down; the price of its equities have almost returned to the lows of 2009. Warren Buffett has helped BofA by investing $5 billion at serious conditions: he is guaranteed 6% of annual dividends – that is at present market yields! Nevertheless, Bank of America will dismiss 3.5 thousand people in this quarter, overall reductions could reach 40 thousand. All banks do this now: UBS will fire 3.5 thousand people, HSBC – 30 thousand, Lloyds – 15 thousand, Bank of New York Mellon – 1.5 thousand, ABN AMRO – 2.4 thousand. This is despite the fact that bank profits are growing (+38% in April-June against the same period last year) thanks to reduction of the reserves allocated for bad loans – and what will happen when profits would fall, or, horror of horrors, losses will occur? Mass reductions are in Australian steelworkers too – and soon, presumably, this fate will reach other sectors and regions of the world. But there is an exception: Manchester United football club went back in profit, and intends to hold IPO in Singapore – American owners hope to gain some £600 million from the sale of 30% stake in the club.

![]()

Source: Barchart.com

Commodity markets heard the smell of the probable future emission - and turned upwards. Brent crude oil almost reached almost the peak of summer – which isn’t true for quite lagging WTI; industrial metals also were excited for some time – but they are slowed down by the sense of weakening demand in the real sector. Gold jumped massively: first, it grew to $1913 per ounce, then collapsed to $1703, soared to $1927, fell again to $1793 and is growing again. Have not helped two consecutive raisings of margin requirements on the CME (up to 22% and 27%); and yet there still went a rumour that Italy and Spain, which had problems with cash, sold some of its gold reserves – but the market quickly reacted on it and grew again. The food market is prevailed with pessimism: US Department of Agriculture forecasts of corn and wheat crops were too optimistic – farmers believe that the season’s results will be much worse; in these conditions, grew up grains and legumes (especially corn, rice and soybeans), forage and vegetable oil. In contrast, meat and milk got a little cheaper; fruits fell in price too – but coffee flew north; cotton, sugar and cocoa are generally stable; timber is trying to move away from the recent lows.

![]()

Source: SmartTrade

Monte Carlo method

Asia and Oceania. The situation in global economy deteriorates. According to Nobel laureate Michael Spence, decline in the EU and the United States is likely to undermine growth in China – and, consequently, will plunge all developing economies into the crisis. In the meantime, doctors have followed the “Monte Carlo method”, well-known in mathematics: pumping up the global economy with the emission drug, they only making a random rambling from it. Japan’s GDP falls 3 quarters in a row – in April-June the decline was 0.5% against the first quarter and 1.1% against April-June 2010; domestic demand is still alive, external one has disappointed; production investments and profits are dark - but China’s foreign direct investment rose by 19.8% y/y. Australia’s GDP in the second quarter jumped 1.2% after falling for 0.9% in January-March; since then the situation in the Green continent deteriorated sharply. Japanese manufacturing is recovering from the earthquake – but the expansion is slowing down, and the annual dynamics are not out of the minus (-2.8% in July); orders in engineering collapsed in July by 8.2%, smashing the growth of June (+7.7%); the government worsened the assessment of the economy, while the index of economic observers went into the area of recession. In China, in August, industrial production slowed down to +13.5% y/y with +14.0% in July; capital investments swelled by 25.0% after +25.4% one month earlier.

In August, business confidence in the New Zealand collapsed; activity in the manufacturing sector of Australia fell to a minimum value in 2 years – and although the service sector is on the verge of growth, the construction sector is already in a depression (as in the New Zealand); in China, PMI indices fluctuate around the 50 points mark separating the growth and decline –indicator of service sector reached 6-years low; Japanese activity slows down, Korean and Taiwanese – falling. Trade balances of the region improved slightly in July – but for the first 20 days of August Japan flew into a deficit. Japanese and Australian prices stagnated in the second half of summer; Chinese CPI grew in August by 6.2% y/y after 6.5% in July (excluding food, the growth has accelerated); PPI slowed down from 7.5% to 7.3%. In Australia, sales of new houses sagged by 8.7% in June and a further 8.0% in July. Japanese wages are in the red, unemployment rises; and in Australia the number of jobs reduces, employment fell and unemployment rose to a peak since October 2010; labour hiring since the beginning of the year is worst in 8 years. Japanese retail sales fell in July by 0.3% m/m, but rose by 0.7% y/y; household spendings slipped by 2.1% y/y – sales of new cars are 26% weaker than a year ago. In China, retail sales rose in August by 1.4% m/m and 17.0% y/y (in July there was +17.2%).

Europe. GDP of the leading European countries during the second quarter showed a mini-growth (+0.2% in Spain and Britain, +0.1% in Germany – 2 years minimum); eurozone has +0.2% thanks to external demand and inventories – without them it would have been -0.1%; Switzerland pleased (+0.4%). Construction sector of eurozone fell in June by 1.8% m/m and 11.3% y/y; construction orders in Germany gone into negative, while the same figure in Britain fell in the second quarter by 16.3% versus January-March and by 23.2% versus April-June 2010 year, breaking the bottom of the year 1980 and reaching a record low. Industrial orders in the eurozone fell in June by 0.7% m/m, but rose by 11.1% y/y; the July numbers of Germany are -2.8% and +8.7%; Confederation of British Industry noted an improvement in August – but the optimism of consumers in the services sector fell; production in Britain fell again in July – but the German jumped, and the French increased by 1.5% after falling for 1.5% in the previous month. But already in August the capacity utilization has declined in France - as well as activity in the services sector. In Germany and Switzerland the ZEW expectations index has collapsed to a minimum since the end of 2008; business activity (PMI) in the eurozone has fallen in August to the lows since September 2009 and in Britain - since June of that year; economic sentiments are getting dimmer. Trade balances have deteriorated in Germany and France, the current account balances did that too; it got better only in Switzerland, despite the expensive franc. But the latter has caused deflation: producer prices fell in July by 0.7%, while consumer – by 0.8% and another 0.3% in August; deflation is also present in Hungary, whose loans market tied to the Swiss franc.

![]()

Source: UK National Statistics Office

In July, production inflation came to eurozone – and in Britain it is growing continuously (now it is +6.1% y/y); consumer inflation has receded a little – but this is a seasonal phenomenon caused by decreasing food prices in summer; a year ago it was about the same – so the pace of annual growth varies only slightly. Slowly reduced is the annual increase in money supply and loans in the eurozone - and in Britain, where the mortgage is stagnant, while house prices fall; the number of construction developments in France has decreased in May-July, but building permits grew up. Consumer confidence falls in Europe: in Italy down to a minimum in 2.5 years, and in the eurozone – since June 2010; mood of the Brits is very gloomy - and the Germans are moving the same direction. Unemployment is rising in Greece, Spain, Holland, and especially in Britain; in Italy and France the employment is stable, while in Germany it still grows – but very slowly. Retail sales stagnated or declined across Europe - in the eurozone as a whole for the second quarter it is down by 0.3% after declining by 0.1% in January-March; the British balance of sales in August reached a bottom since May 2010 - in general, demand is weak everywhere. And there is nothing to stimulate it with: budget deficit in Greece since the beginning of the year is 25% higher than a year ago (surprise!), while in Italy – by 18%; in Britain there was a temporary improvement in July – and the authorities proudly announced that their austerity program made the country an “asylum”. We ought to show them how someone spoke about “safe haven” – and how it ended.

America. The state of US economy was exhaustively described by Obama who declared in one speech “we are in a terrible recession” - it turned out that there were a confused tense, but the slip of the tongue was well-timed. President had to think up a plan to encourage the employment (infrastructure projects, tax cuts, subsidies to states and municipalities) at the cost of $445 billion - but because the sum is promised at the expense of other articles of treasury spending, the effect would be modest. Canadian GDP in the second quarter fell by 0.4% against January-March; US GDP grew by 0.2% due to statistical manipulations – in fact, per capita GDP shrank by 0.6% down to the low since the end of 1988; it is already 17.4% below the peak reached 11 years ago; real wages and bonuses fell by 1.3%, and in total since January-March 2000 – by 23.5%. Labour productivity declined, while labour costs increased (as in Canada) – a combination that presages the decline in the labour market. Industrial production rose in July by 0.9% due to the resumption of spare parts deliveries from Japan and the heat that caused additional demand for electricity – automobile production soared by 5.2%, while production of utilities jumped by 2.8%; with no increase in these sectors the growth would have amounted to 0.3% - and that also only thanks to external demand. Industrial orders rose by 2.4% at current prices - they were tossed upward by fuel which rose in price in July; and if we consider the real inflation and population growth, the annual increment of real orders will be only 0.4%. The same pattern is in durable goods - surge by 4% is due to singular factors, while the key component of net capital orders (non-military capital orders minus aircrafts) has even dropped by 1.5% m/m.

![]()

Source: U.S. Bureau of Economic Analysis

Regional indexes of business activity in the United States look very bad in August. Indicator of Kansas City Federal Reserve Bank left the plus to minus; indexes of the FRBs of Richmond and Dallas considerably worsened their already negative numbers – especially dipped the key components of new orders, shipments and employment; ISM business conditions of New York sat down - current situation assessment has simply collapsed; PMI of Chicago and the index of the Federal Reserve Bank of New York City experienced a decline both in general and in the orders component – employment resisted though; the most formidable collapse happened to Philadelphia Fed index, which fell to the bottom since March 2009 - all major components collapsed vertically. Against such backdrop, overall national economic activity has almost pleased: manufacturing sector has deteriorated - but restrained in the area of expansion; service sector has grown – but employment has fallen to the bottom since September 2010. Leading indicators rose in July by 0.5% - but this figure still has only a tiny touch with reality: once again it was raised by monetary aggregates and the spread between the yields of government bonds of different terms – indicators quite useless in assessing the economic prospects. Current account deficit of Canada has increased in the second quarter; trade deficits of Canada and the USA shrank stronger than expected in July – exports helped. The net inflow of foreign money in the long-term US securities nearly nulled in June – but what is curious is that at the same time China inflated her portfolio by $5.7 billion to $1.166 trillion.

In July, US export prices fell by 0.4% and import – grew by 0.3% (petrol – by 0.6%). Producers prices swelled by 0.2% m/m and 7.2% y/y – the latter figure is maximum since September 2008; disregarding food and fuel, prices increased by 2.5% y/y (a peak since June 2009) – the real gains are higher, but the statistical fun understate inflation; for all goods (not just the final ones) the annual increase in prices will officially be11.1% (peak since September 2008). Consumer prices are +0.5% m/m and +3.6% y/y (actually +0.7% and +6.9%) – a record since October 2008; net inflation swelled by 0.3% and 1.6% (by 0.5% and 4.8%) – maximum since December 2009; rent went up. In Canada, consumer prices rose by 0.2% m/m and 2.7% y/y - but there also exist the same revels in the calculation method. Realty prices in 20 major metropolitan areas in the United States in June, according to S&P/Case-Shiller, fell by another 0.1%, so that the annual decline is now 4.5%. Such dynamics immediately reflected on the quality of loans: according to the Mortgage Bankers Association, the share of loans secured by housing with overdue payments rose in the second quarter to 8.44% from 8.32% in January-March. The number of construction developments in the USA fell in July by 1.5% - despite the fact that the value for June was reduced by 2.6% from the previous estimate; single-family developments were immediately less by 4.9%; building permits fell by 2.6%; the number of houses actually built (both in general and single-family) per capita showed a new historic low. In Canada, the number of developments collapsed in August by as much as 10% versus July.

![]()

Source: U.S. Census Bureau

Pending house sales on the secondary market are -1.3%, complete are -3.5% (single-family -4.0%); sales of developments are -0.7%, despite the hard revision down of the numbers of April, May and June; overall construction spending -1.3; housing market index from NAHB/Wells Fargo remained in August at very low levels. Consumer sentiments are bad: Conference Board index in August hit bottom since April 2009, the numbers of the University of Michigan – since November 2008; expectations from Bloomberg have fallen down to the values of March 2009. According to Challenger, in August it is scheduled 47% more redundancies than a year ago, while the hiring plans have increased by only 8%; online ads for jobs are becoming less; employment trend has gone down; the number of jobs remained at the level of July, hourly wages and duration of the working week reduced; however, the labour report is not so bad as it looks – employment increased, while the long-term unemployment rates went slightly away from the worst values. Number of recipients of unemployment benefits is growing – though each week it is announced of its decline, the figure then is being revised upwards; the Canadian labour report for August is even worse than in the USA – employment fell and unemployment rose. Retail sales in Canada rose in June by 0.7%, but excluding cars they fell by 0.1%; in the USA in August new car sales declined by 1% against July; however, a month earlier the car sector got the lion's share of the increment in private spending – while the real incomes continue to fall; seemingly solid growth in consumer credit even fell behind the official inflation rate. In general, the prospects of US private demand continue to look bleak.

Russia. The July reports of Rosstat and the Ministry of Economic Development differ: industrial production against June rose by 0.4%, according to Rosstat, but fell by 0.2% according to the MED – the two agencies have different methods of adjustment for seasonal factors; the manufacturing sector showed a decrease of 0.4% m/m; annual growth was 5.2% in production in general and by 5.5% - in manufacturing; increase in cars dropped to 20.3% (a few months ago it reached 140%). Investments declined by 0.9% m/m, but rose by 7.9% y/y. Against July 2010, production in agriculture grew by only 0.6% - it is quite bad, for due to the terrible heat wave last year there was a low base effect; milk and eggs are in the red; logging is in the green only by 1.0%. In construction, the same base effect, however, is clear: the total amount is +17.6% y/y, introduction of housing +19.0%; it only makes one wonder that against June this figure has collapsed by 31.9%; freight transport +0.2% m/m and +4.4% y/y. Consumer prices remained at the level of June and rose by 9.0% against July 2010; the fixed set of goods and services rose by 11.5% y/y; producer prices are -1.0% m/m and +16.1% y/y. In August, CPI was -0.2% m/m and +8.2% y/y; utilities rose in price by 13% versus July 2010, and since the beginning of 2000 – by 19 times, although the CPI as a whole during this period increased only fourfold. Retail is +0.6% m/m and +5.6% y/y; paid services -2.6% m/m and 0.7% y/y; taking the real numbers for inflation, the annual growth rate of retail is 3-4 times weaker than the official one, while services fell by 3-4% .

But even this growth of sales is a borrowed binge: loans grew by 26.5% y/y. Disposable incomes added 0.6% y/y, and wages – 3.8%; adjusted for the craftiness of inflation, we get fall by 3-4% and 0-1% respectively. Unemployment, seasonally adjusted, increased from 6.5% to 6.9%. According to the MED, GDP in July rose by 0.4% m/m and 4.2% y/y; according to our estimates, the annual growth amounted to 1.0-1.5% - but a year ago in July there was one working day less: make a calendar adjustment – and the increase reaches 3.0-3.5%. Rosstat published GDP for the second quarter – it dropped down to +3.4% y/y from the preliminary +3.7% (our estimations give plus 1.5-2.0%); taking into account the seasonal factors, there is a fall against the first quarter by 1.3% - worst dynamics for the last 2 years. Expensive oil does not particularly help the treasury – in July, the federal budget surplus amounted only to 0.4% of GDP. In the foreign investments we see a sharp rise of trade and other types of loans for up to six months; while direct investment amounted only $3.1 billion; accumulation of foreign investment is exactly equal to the Russian capital’s transfer abroad. According to the Interior Ministry, in 2010 and January-March 2011, the illegal export of capital from Russia amounted to 5 trillion roubles. The drain is on the financial markets: withdrawal of foreign money from Russian stocks in August was much faster than even in 2008. According to the Bank of Russia, in January-July net outflow of private capital from Russia caught up the figure of 2010 – and yet there are still elections ahead.

The powers to be and the affiliated businesses continue to have fun. VTB bank sold a building in central London to a Chinese state bank about five times cheaper of market price – if you believe to the bank’s report, but what if you do not believe?.. The Accounting Chamber audited Gazprom – and it did not want to find something radical, but still in 2009 there have accumulated incomprehensible losses of 28 billion roubles: a sheer trifle. A year ago, Putin drove Lada Kalina on the Chita-Khabarovsk highway – but now the road (all of a sudden!) has gone “bubbles”; also the Prime Minister, with somewhat an ostentatious amazement, learned about “slightly” inflated road prices. Matvienko crawled to the Federation Council using the bosses’ conventional methods: deception, frauds, arrests and detentions of opposition press and disloyal politicians, illegal campaigning, distribution of food and clowns in the polling stations - and even with all of this only 30-35% of voters came to vote for her; she will be replaced as the Governor by the former Authorized Representative of the President to the Central Federal District Poltavchenko. Football blossoms: super-club Anji invited forward Eto'o for a salary of €20 million euros a year – quite modest for Dagestan; the fans also booed another latter-day player of this club at the national team game – in response, the Russian Football Union led by Fursenko decided to replace the irresponsible fans by students (the trustees of another Fursenko), who were handed out free tickets and instructed about correct behaviour on the stadium: a healthful climate came to the stands of such an abundance of the earth’s fruits. In today’s Russia the word “Fursenko” is a diagnosis or even a sentence.

Appetites of Moscow authorities are growing: the future capital will get as far as to the Kaluga region – it is symbolic that one of the nearby prominent Kaluga settlements will be Buhlovka village. Head of the Interior Ministry Nurgaliev said: “Over there, behind me in the past, were bribery, office abuse, corruption and all the negative stuff. It does not exist today” – no comments. There has established a sad trend for the power-holders: the ruling tandem’s ratings are falling, the proportion of those who believe that the country heads the wrong direction is reaching the 6-year peak, while the percent of optimists approached the 11-year low. The authorities woke up: bogus primaries in EdRo made Putin to impose them on the opposition; logical exasperation did not prevent the court to sing praises to Prime Minister’s wisdom and advice to dissolve all other parties – who needs them when there is such a remarkable EdRo? Putin-Medved went fishing in the Astrakhan region; PM headed the bike show in Novorossiysk and violated the traffic rules with regard to the requirements of wearing helmets. On the Moscow Aero Space Fair, Putin decided to buy an ice cream – his deputy Ivanov asked to buy him a portion too: “Sergei Borisovich is a hard-fisted man” – commented Putin – “After all, yesterday was the payday”. Medved has his own moves – September 8 has became henceforth the Financial Worker Day: “but why not August 17?” – asks the public. But the innovation fountain of president is unstoppable: “There is an idea: I'll call... people whose fortune begins... from a billion dollars, and I would them to teach in schools”. Yeah...

![]()

Illustration: Artyom Popov, ITinvest

But let’s forget about the majestic clowns, crooks and thieves. Roskosmos has only failures: GLONASS satellites were lost as well as one communication satellite, cargo ship, instead of the ISS, flew into the forests of Altai – killing 10 paintings by Shilov, who had hoped to bargain for his welfare by launching paintings into space. People are dying on ships and planes; the number of accidents and disasters is not acceptable for more or less developed country. The beginning of the school year should be noted – especially for Medvedev. All in all we have 47 thousand schools: one thousand of them are conducive to accident (Rospotrebnadzor banned the work of 900) and a lot of decrepit ones; 10 thousand need major repairs; sanitation is not present in 25% of schools, water – in 20%, heating – in 15%; one-third of schools do not have the appropriate canteens, half – medical service, two-thirds – gyms. Instead of solving the problems, the authorities are simply bullying, introducing the new standards – with them 99% of schools have to be closed for not having swimming pools, dance halls and electronic circulation of documents; moreover, SanPiN of 2008 spawned numerous poisonings of children in schools. In the 1990s 800 schools were closed, and in 2001-2011 – already 16.4 thousand, including over two thousand last year. If we calculate the dynamics of schools per capita, we can see that in the 1970s there was a reduction everywhere due to “consolidation”; in 1980s there came a stabilization; in the 1990s, the village slowly declined, but the city stood; and now there is an “optimization” – which sees the closure of schools in urban areas at the rate of the 1970s, and in rural areas and in provinces generally there is simply a disaster – and not just in education.

![]()

Source: Rosstat

According to the last census, there are 134 thousand villages in Russia, of which in 48 thousand there lives less than 10 people; in past decades, on average 1.0-1.5 thousand villages died per year, but in 2010 there disappeared 3 thousand. Cultivated area decreased in 1990-2010 by 1.6 times, including on grains – by 1.5, forage – by 2.5, fruits and berries – by 1.7, vineyards – by 2.4. The number of cattle contracted by 2.9 times (cows – by 2.3) pigs – by 2.2, sheep – by 2.8. Machine fleets in the agriculture are terrible: tractors are fewer by 4.4 times; grain harvesters – by 5.1, forage harvesters – by 6.0; mowers – by 6.7, headers – by 9.1; sprinkler and irrigation machines – by 14.7; milking machines – by 7.7. The farm itself has degraded: the amount of manure used dropped by 7.3 times, mineral fertilizers – by 5.2; area of acid soils’ liming – by 20.6, use of phosphorus (against 1993) – by 235.3 times; saline soils plastered are 1590 times less than 20 years ago. In most cases the decline of 2000s was accelerating with the full support of the authorities. In the metropolitan urban areas (population of 1 million and more) now lives more than 40% of the population of Russia – and this share is growing rapidly; in the developed world, only Anglo-Saxons have something similar (40% in Britain and Canada, 60% in the USA and Australia), but the density of population in their cities is five times lower than here. Russian Federation, considering the settlement type, becomes a second-rate developing country – not even China or Brazil, but Colombia or the Philippines; population density in Moscow is greater than in Shanghai or Rio de Janeiro and is only comparable with Manila and Santa Fe de Bogota. Sovereign democrats are going the right way – from one victory to another!

Have a nice week!