Second wave of crisis

Good afternoon. Politics was on vacation last week - the getaway season, if not in the full swing, is close to that. We note the initiation of criminal proceedings against the new Head of the IMF Lagarde for a joint fraud with Tapie - and the Prime Minister Zapatero of Spain who decided to dissolve parliament in late September (after the adoption of major laws in the stabilization package) and to call for new elections on November 20. We should also mention the World Bank's decision to suspend drought aid to Kenya - according to the bank, corruption in the African country is so great that in the previous 5 years this aid simply has not reached the population. In the rest, the economy dominated - especially since the notorious "second wave of crisis" have just appeared.

Police on ratings

Monetary markets. Bank of Japan left rates in the range of 0.0-0.1%, but expanded the emission 1.5-fold - long-term government bond purchase will double. Reserve Bank of Australia, Bank of England and the European Central Bank left monetary policy settings unchanged - but the ECB will resume buying bonds of troubled countries, although Bundesbank is against that. In the United States, Democrats and Republicans have finally agreed on the debt ceiling - it will be raised in three stages, provided that there would be cuts without raising taxes: i.e. the Republicans’ plan was adopted - Democrats are dissatisfied (many of them voted “against”), but the default was real and they had to bend over. Agencies have retained the US ratings on the highest level - but Moody's put negative forecast and Fitch threatened to do the same by the end of August. Auctions treasuries will be quite curious - next week there would be placed 3-, 10- and 30-year bonds amounting to $72 billion: we think the demand will be decent, because the general panic has forced public to flee into safer assets – yield of 10-year papers fell to 2.45% per annum and of 2-year – to less than 0.3%. This caused a notable impact: Bank of New York Mellon announced the introduction of negative rates for large deposits - customers will pay the bank (and not the other way around!) 0.13% per annum for the amounts exceeding $50 million. Also interesting is the Fed meeting - the markets are waiting for the reaction to the sharp deterioration of the economy: it is unlikely to be KuKuKu - but some people (e.g. Harvard professor and the former IMF chief economist Kenneth Rogoff) ask for a new round of emissions, despite the apparent failure of the previous one. Sick people - what else can you say...

Europe is shaking again, despite the "fateful" decision on Greece. Yield of Spanish 10-years treasuries soared to 6.5%, and of Italian - to 6.3%; taking into account the debt burden, anxiety for Italy is more serious - especially because credit default swaps on her bond are written for $306 billion against $176 billion for Spain, so in case of any problems of CDS issuers they are unlikely to be resolved. This led to another round of fear: Spanish Prime Minister Zapatero postponed his vacation and Italian macho Berlusconi made a public admonition about the reliability of the country’s commitments, which he dodged the last six months of panic in the markets; Finance Minister Tremonti has enlisted the support of the EU structures - but that did not calm down the markets; in despair, the Italian police has even searched the offices of Moody's and S&P, to find out if they assign ratings honestly! However, Portugal and Spain were able to place another portion of treasuries - but only under very decent yield: for example, the rate of Spanish 3-yeare papers exceeded 4.8% per annum - and demand was low. Moody's lowered the rating of Athens - that was expected after a similar move for Greece as a whole. Serious crisis erupted in Cyprus – authorityies, under the UN sanctions, detained military cargo from Iran; none of the powers that be wished to store it – and it exploded on a naval base near Limassol, killing 13 people and damaging the country's largest power station; only the direct damage is estimated at €1 billion - for a country with annual budget of 8 billion that is absolutely unbearable, so the authorities of Cyprus have now requested assistance from the EU.

Currency markets. A new round of panic was marked by strong purchases of safe currencies, i.e. franc and yen – that fill up the cup of the financial authorities in Switzerland and Japan. The latter threatened speculators with punishment for a long time - but they did not understand: there had to be a real intervention in volume of ¥10-15 trillion – dollar-yen was thrown up from 76.5 to 80.0. Finance Minister Noda recalled that in 1995 a long series of interventions was carried out which helped to repel the rate from its lows (they were at 79.75 then) pretty far up - and then the yen began to cheapen itself, and so active that the authorities already had to interfere this process too. The Swiss have not yet run the risk to get into the market, keeping in mind the sad experience of the first half of last year, when the interventions were instantly absorbed by the market leaving the central bank with a huge loss. Means of monetary policy were used: rate was reduced to zero, rate for dollar repurchase agreements was increased slightly; it was promised to flood the markets with liquidity - and ??ominous warnings were made about the unacceptability of the rapid growth of the franc in general. The success of this venture is modest - dollar-franc was managed to repulse from 0.76 to 0.78, and euro-franc - from 1.080 to 1.115; but then, in the wake of the general panic, franc showed new highs. IMF said the Australian dollar is overvalued by 10-15% - and the Aussie collapsed versus buck from 1.11 to 1.04.

![]()

Source: SmartTrade

Stock markets. Leading indices raced down - on Wednesday they passed June lows, and in the Black Thursday of August 4, having made ??the worst day drop since December 1, 2008, showed a new low for this year; Europe fell even steeper. Of reports we note the auto industry in Japan: Nissan’s profit fell by 20%, Honda’s – by 9 times, Toyota’s - 165-fold, and Mazda’s loss has increased 12-fold; sector suffered a triple blow - earthquake, high yen and weak demand. Pfizer has not flashed nor with figures neither with forecasts for the remainder of the year; AIG’s report is not bad as that of Procter & Gamble - but forecasts have disappointed. HSBC’s plan to cut costs is bigger than expectations: 195 branches in the USA (primarily in New York) are sold, layoff is expected for not even 10 but 30 thousand people (10% of the global bank staff) - incidentally, the head of the company name is Gulliver: the evil tongues ??did not miss the chance to foretold the imminent transformation of bank into an Asian midget.

![]()

Source: SmartTrade

Commodity markets were finally impressed with a sharp deterioration in the global economy. Oil raced down - especially the American WTI, which reached a minimum for this year ($83 per barrel); industrial metals fell fairly. On the contrary, precious metals flew to the north - silver surpassed $42 per ounce, and gold - $1680; gold fever has reached South Korea, whose central bank has bought 25 tons of gold in the summer, which it have not done for 12 years; but a vertical growth is fraught with many threats - reaching a peak at $1683, gold collapsed by $40 in an hour. Reaction of market for agricultural products is mixed: forage and cooking oil are treading, grains and especially milk and meat (especially pork) continue to go up, fruits and sugar are stable near the extremes, cocoa and cotton evince the intent to become cheaper.

![]()

Source: Barchart.com

Fantasy for reforms

Asia and Oceania. The index of business activity in the industrial sector of China from HSBC was slightly higher than the provisional estimate - but still in the area of recession; however, the official figures still indicate a mini-growth; and expansion in the services sector is very high and is even accelerating. Australia can only dream of this: her manufacturing sector is in the area of depression, construction – in severe depression, and the service sector – recession; indicators of a number of other countries in the region fell there too - for example, Malaysia (composite index for all sectors of the economy). Australia's housing sector falls with terrible force: in June, sales of new homes have collapsed by 8.7% against May - that was the worst monthly dynamics over the past 5 years; the prospects are gloomy - building permits continue to fall (-3.0% m/m and --10.3 % y/y), as well as prices. Retail in the Green continent is also actively compressing (-0.1% aginst June after -0.6% in May); especially bad are the things in the key state of New South Wales - and for the country as a whole the annual dynamics of sales is worst today since the recession of 1961/62. Following active recovery, the Japanese economy starts to slow down - and performance began to deteriorate: in June, the average salary was 0.8% lower than a year ago (against +1.0% in May), while car sales fell in July by 27.6% y/y – stronger than in June (by 23.3%); the trade balance returned to the deficit again in July.

Europe. German industrial orders rose in June - but the structure of the indicator is bizarre: domestic demand fell by 10.8% m/m, but foreign soared by 13.7% - especially active were the EU countries, where Germany is the exclusive supplier for many groups of goods (especially capital ones). Industrial production declined in Spain and Italy; in Germany there is also a decline (by 1.1%) - but the Economy Ministry blamed the long weekends. In July, economic activity in the manufacturing sector in the eurozone had barely kept from falling into recession - and in Britain it did not manage to do so and fell below separating level of 50 points for the first time since June 2009; the eurozone service sector dropped to a 2-year low – and in England there happened an unexpected improvement; Switzerland looks good. Producer prices in the eurozone and Britain rose in June by 5.9% y/y (for Britain this is record since October 2008); British retail prices fell in July by 0.2% after a gain of 0.5% in June. Unemployment in the eurozone in June left in place (9.9%) - but the improvement in Italy pleases; in Spain in July employment growth has continued - this is a seasonal phenomenon linked with the tourism sector. Registration of new cars in Europe again went into the negative - everywhere except for Germany, which is still awash in export earnings. Swiss retail sales unexpectedly jumped in June at 7% both m/m and y/y – we think, briefly; the eurozone retail sales rose by 0.9% m/m (thanks to Germany - in other leading countries there is a recession), but fell by 0.4% y/y; as a whole for the second quarter, sales declined by 0.3% after declining by 0.2% in January-March and by 0.3% in October-December 2010.

America. Factory orders fell in the United States in June by 0.8% - by the way, this figure is a good illustration of the wickedness of official statistics: against June 2010 there marked an increase by 13.0%, and per capita - by 12.1%; but this is in dollars at current prices - inflation in the sector was officially 9.3%, and in fact – the whole 12.2%; thus, a seeming huge plus has in fact turned into a minus, though only by 0.1%; in general, since spring orders have begun to shrink actively - and the process is gaining momentum. It is not surprising that business activity in the manufacturing sector fell in July to a 2-year low, though still restrained from going into a zone of recession - and, incidentally, new orders are already in the red there, while employment fell at the worst monthly rate since October 2008. The services sector looks livelier - but it also darkens gradually, while the order portfolio of companies in the sector loses weight fast. In June, construction spending in the US was 4.7% lower than a year ago - particularly bad is the real estate. The index of consumer comfort from Bloomberg at the end of July fell to a minimum since the spring - women feel especially badly, being most pessimistic since the autumn of 2009.

Jobs on the Internet are less and less, and layoffs (according to Challenger) - all the more: in July they are maximum since March 2010; applications for unemployment benefits keep around 400 thousand; Labour Ministry says that the number of jobs has increased by 117 thousand - but the total number of employed fell by 38 thousand people in the same time: how is that possible? The unemployment rate declined slightly due to the expulsion of 193 million people from the labour force (and totally in the last year – of 2.2 million), but the average length of staying in unemployed status has reached a new peak of 40.4 weeks. Car sales in July rose by 1% y/y - but the statistics have worked on the seasonal adjustment, and 1% turned into 4%. Private spending fell in June by 0.2% against May - and although the official CPI was -0.2%, in fact, prices are standing still at best, so that spending in real terms has actually fell; statisticians reduced the figures of costs since 2004 to amount 4%; savings rate reached 5.4%. The answer for weak spending lies in the low income due to government policy of the last 30 years: we have already given a graph of per capita GDP, which is now at the level of 1990, as well as spending, which fell to the bottoms of the 1980s’ - but the real wages of the Americans have already fallen to the level of 1962. Previously, compensation was given by financial assets and loans - but now these instruments are dead: the demand is only supported by the treasury deficit - but this method will soon be exhausted too.

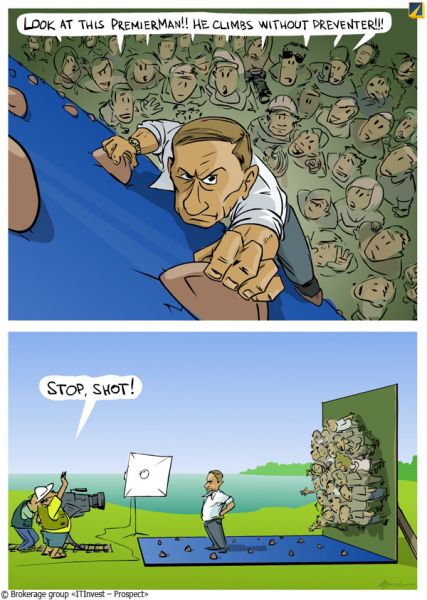

![]()

Source: Bureau of Economic Analysis and U.S. Department of Labour, independent assessment

Russia. In July, consumer prices have not changed against June, but swelled by 9.0% against July 2010. Rosstat surveyed households for income and expenditure in the first quarter - the result is very significant in terms of social policy: in Russia, the average per capita income of families with one child is higher than of those with three children by 2 times, in the USA – by 1.5 times; if one-child family is compared with the one in which there are at least four children, the difference in income in Russia is 3.5 times, while in the States - only 2. Ministry of Finance has turned down the plan of the Ministry of Regional Development to give Caucasus 4 trillion roubles in 14 years - Kudrin said there is "no money". But the plan to privatize key government companies in extracting, energy, transportation, infrastructure and finances is alive. Prime Minister Vladimir Putin visited Seliger, greeted with Kafkaesque posters of "Nashi" – there he claimed that the disagreements with Medvedev are purely of style, struggled with fat people, climbed the walls and agreed to star in a film about himself. Meanwhile, Matvienko is on her way to the Federation Council - municipal elections are scheduled, and for that nobody could stop them, the local newspaper had to fake the date of issue - otherwise it would not meet the statutory deadlines: shame and disgrace - but Matvienko is no stranger with that. Interior Minister Nurgaliev is concerned about extremism of youth and complained that they now don’t listen romance songs and waltzes - and, in general, we ought to find what people read, listen and watch today: it seems some people have gone nuts for good.

![]()

Illustration: Artyom Popov, ITinvest

But even amid such senility, the head of INSOR think-tank Jurgens has stood out - he burst into historical narrative of reforms in Russia: "We have a hundred-year cycles of not-listening to the need of reforms. I had by accident, or perhaps deliberately, looked at these cycles: in 1911 count Witte, the prime minister then, wrote to Nicholas II: if you won’t pass reforms – it will be so-and-so. That was just something that happened indeed. Another hundred years back, in 1811, Speransky said the same to his Emperor Alexander I: if there would be no institutional reforms it would be very bad. Well, the year 1812 and the next ones demonstrated that. In 1711, Peter almost got captured, escaped by a hair width from the Turkish captivity.... And got so ill that he wrote a will in which a need of reform is also visible. At least for the matter of hereditary transition - this never happened, as you know. After that - time of troubles and so on. Reckon a hundred years more, 1611... Do you remember ... the Poles came, and only on the teeth of the patriarch we held out, when at the last moment he, I think he was almost tortured then, blessed the transfer of power to the Poles. And he also said: Russian people - relatively speaking - reform yourself. And in a year time there arose Minin and Pozharsky, and so on and so forth". Well? Remember, this is not some kind of a crazy man, but the chief adviser on modernization strategy to the Kremlin. Have you appraised?

Have a nice week!