Football collateral

Good afternoon. The main event of last week was a wild massacre in Norway and its discussion in the spirit of conspiracy theories - it is difficult to believe for many people that such a vegan police is possible in this world; we would risk to suggest that the success of multiculturalism would cause not one act like that in the future - and mostly in the countries of northern Europe, who "succeeded" the most in a tolerant destruction of their identity. Of political news, we note a survey from Kyodo: the idea of reducing dependence on nuclear power is appreciated by 70% of the Japanese – this becomes a real trend. USA imposed sanctions against international groupings, among which is a Brothers' Circle from the CIS, which joined an honorable company of Neapolitan "Camorra" mafia. Dr. Nesimi of Bar-Ilan University (Israel) has exposed anti-Semitism in the books and films about Harry Potter: first, there is the theme of "good peoples" - but these are not Jews, which is awful, and secondly, there are Christian allusions – which is also offensive; it seems some people are frankly running up...

Give me a trillion!

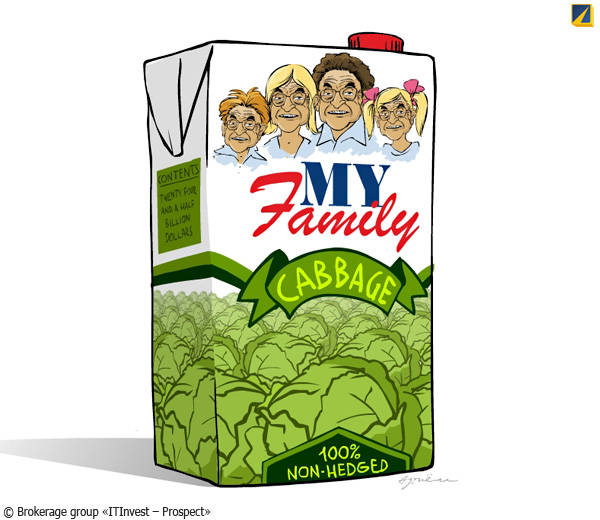

Monetary markets. Reserve Bank of India raised the rate by 0.5% to 8.0% per annum - given the inflation (9.4% in June), it does not seem like a final leverage. RBNZ left rates unchanged at 2.5%, but hinted that it may increase it in September; and its Australian counterpart may tighten monetary policy next Thursday. The ranks of critics of the quantitative easing were joined by Alan Greenspan - he said that the attempts of Bernanke did not give any good, but cheap dollar: not such a revelation – but still. Altercations on the debt ceiling continue - now there is a rumor that a compromise will be found and voted for on Sunday: we'll see. In the meantime, the process resembles Ilf and Petrov - Obama-Panikovsky grabs a hand of Boehner-Koreiko and mutters: "Give me a trillion, give me a trillion, give me a trillion!" - but he refuses to serve bucks on a silver platter. Next in line should be a telegram "Countess with a changing face runs to the pond" - conservative Republicans are ready to be postmen: Boehner had to call them to order at the party meeting – with the words "Get your ass in line". But people are more complex - according to CNN, two-thirds of the Americans think that the Republicans’ behavior is irresponsible, while Obama is considered to be adequate by more than half (52%). Also an event of the week was the decision of Soros to abandon control of third-party money - under the new rules, it makes one to register and disclose information about himself; the old rascal has decided to confine with the money of his family – which are, incidentally, account at $24.5 billion.

![]()

Illustration: Artyom Popov, ITinvest

European noise has died out after the EU summit, which gave Greece a lot of money. As expected, the agencies are dissatisfied: S&P lowered the rating by 2 points, and Moody's - by 3; Fitch will assign default ratings to the Greeks, when the exchange of old bonds for new will take place - that is, in late summer and early autumn. Comments of agencies are not so bad – they say there is a chance to stabilize the situation and cut the debt; and yet the default is the default - at the same time Cyprus got under fire and its rating was reduced by two levels. The Greeks have ceased to respond to all this - but said they wanted to end the relationship with the agencies, because those are "cheaters" (they should look at themselves). German Finance Minister Shauble said that he did not like the idea adopted by the EU to give stabilization fund right to buy bonds on the secondary market - and, in general, it is foolish to hope that a single summit can fix everything: apparently, he is also a "cheater" - but the Greeks prefer to remain silent in this case. Moody's wants to cut the rating of Spain - and has already lowered the indicators for six regions of the country. The Irish government sold its stake in the Bank of Ireland worth over €1 billion to investors; another big bank - Allied Irish – has also seen some stabilization recently, although the losses are growing (€2.2 billion in the second quarter, a year ago it was 1.7 billion) And the Süddeutsche Zeitung writes that the Spanish Bankia bank found a good collateral for a loan from ECB – these are the FC Real Madrid’s players Ronaldo and Kaka in whose purchase the bank was involved: if the bank becomes insolvent, and the club will not be able to return its loans, the players will go into possession of the ECB – what would it do with them?

Currency markets. The yen rose - and the Japanese stepped up their hints: Ministry of Finance said that it watches over the market not only "closely" - but "as closely as it did during a joint intervention in the spring". No actions have followed - Minister of Economy Yosano indicated that up to August, 2 (the deadline for increasing the US debt ceiling) intervention is unlikely. The head of the Bank of France Noyen surprised the audience, saying the words "strict vigilance", which are usually followed by rates hike - the euro jumped, but then the bank explained everything: it turns out, Noyen said not "strict vigilance" but "strict alertness" which is completely another matter - and the euro sank. Against other currencies the dollar fell - debt and the economy are really bad. Meanwhile, the systematic reduction in the allowable leverage on Forex from the Japanese regulators led to the fact that already in spring Singapore has surpassed Tokyo in turnover of currency transactions – since now in Japan the leverage is being cut (from 50 to 25 from August, 1), the gap will only grow.

![]()

Source: SmartTrade

Stock markets. The leading indexes fell - growth is too unreliable when there is no real reason for it. BP showed a profit against the loss a year ago - but oil production fell by 11% y/y since after the accident in the Gulf of Mexico the company sold a number of assets to cover losses. ExxonMobil and Chevron unexpectedly have not lasted up to expectations - how is this possible at such high oil prices is unclear. Dim are Dow Chemical and DuPont, the latter also has a weak forecast for the year: in general, oilers and chemists have disappointed. Daimler flashed, showing off with the sharp increase in demand for Mercedes cars; but Ford and Mazda did not gladden. Industrial giants are ambiguous: Boeing is fine - but the forecast for the current year is more modest than the expectations of the market; International Paper is not bad - but the division which specializes in consumer products is at a loss; 3M has not pleased with anything. Nokia has both losses and falling sales - and Moody's lowered the company's rating by 2 points; Motorola is also at a loss and slashed forecasts for the current year. Loss was also received by Sony - to blame the earthquake, but weak demand for TV sets is also a problem (they cause losses for 7 years). Amazon is good - but Juniper Networks is terrible, whose shares collapsed by 15%. Reductions in banks are widening: Credit Suisse is to fire 4% of staff; HSBC will get rid of 10 thousand people.

Commodity markets. Oil was in place; industrial metals rose in price (especially aluminum and palladium), gold hit peaks above $1630 per ounce. Food has fallen into summer hibernation - except for pork and restless milk which reached new peaks.

![]()

Source: SmartTrade

Ill demand

Asia and Oceania. Australian leading indicators turned down, and inflation does not recede: in the second quarter, producer prices added 0.8% and the consumer - 0.9%; annual growth reached 3.4% and 3.6% respectively. Lending to the private sector unexpectedly sank in June - in fact, the annual increase in mortgage was minimal since 1976. In Japan, prices of corporate services recouped the May decline in June - but the annual dynamics are still in the red (by 0.7%); consumer prices are growing for 3 months in a row. Industrial production grew by another 3.9% - but against the same month of the last year it fell by 1.6%; in July-August it is expected to increase by another 2% m/m; business activity has reached a 5-month peak, while the employment component showed an increase for the first time since March - but export orders sagged due to the reduction of Chinese demand. New construction and orders are yet in the plus against the past year - but the gain has reduced. Unemployment rate rose for another 0.1%; retail pleased with a jump by 2.9% m/m, which brought the annual dynamics into plus by 1.1%. At the same time, real household spending continued to decline - and even accelerated in this way: the annual decline was 4.2% after -1.9% in May - but it is not surprising, as real disposable incomes already fell by 6.6%.

Europe. British GDP grew in April-June by 0.2% q/q and 0.7% y/y - statisticians noted that the Japanese cataclysm, royal wedding and the April heat (!?) took out 0.5% from the figure. The components are bad: industry -1.4%, agriculture -1.3%; the whole positive outcome is given by the service sector (+0.5%), contribution to GDP is +0.4% q/q and +0.8% y/y, i.e. except for services, everything fell. Confederation of British Industry reported that factory orders have fallen sharply in July, and the pace of stockpiling has reached the maximum for eighteen months; business optimism and dynamics of orders are on the worst levels since the summer of 2009. Business confidence in July fell everywhere except for France - where everything grows, when everywhere else it falls, and vice versa; in the eurozone, economic sentiments reached an annual low, and the business climate - a two-year low; leading indicators of Switzerland gave the worst monthly dynamics since April 2009, i.e. since the peak of the crisis. In Germany, consumer prices began to rise again in July adding 0.5%; for the eurozone as a whole, rates have slowed down; the British realty continues to become cheaper, and mortgage permits are issued reluctantly (-6% in the last 12 months). Consumer sentiment behaved as did the business ones: fell everywhere – and grew in France. In Sweden, unemployment rose in June; and in Germany it is stable, while the number of employees is growing - but slowly. Retail in Spain slipped in June by 7.4% y/y; in Germany it jumped by 6.3% m/m, but fell by 1.0% y/y - and in general for the second quarter it shrank by 0.4% against January-March; the balance of sales in Britain darkens - orders and expectations in the retail sector are bad; the French built up their spending in June after a fall in May - but in the second quarter it has decreased by 1.8%.

America. "Beige Book" of the Fed noted economic slowdown in 8 of the 12 regions of the country - particularly in manufacturing. This thesis is confirmed by the regional indexes of business activity: they are in negative territory, except for areas of FRB Kansas City - but here there is a sharp drop too (from 22 to 2 points). Orders for durable goods fell in June by 2.1% m/m - key component of net capital orders declined by 0.4%. Realty prices from S&P/Case-Shiller fell again in May; pending home sales rose in June by 2.4% - but the annual dynamics is in negative territory by 17.0%; sales of developments fell by 1%, building permits for single-family homes were revised from +0.2% to -1.0%. Consumer confidence from the Conference Board grew up a bit, but the recent survey of Bloomberg showed a failure to the bottom since May - the state of the economy was positively evaluated only by 6% of the population (minimum since April 2009). In Canada employment and GDP unexpectedly declined in May; in the USA the total number of recipients of unemployment benefits fell last week by 17 thousand - but the figure of last week was increased by 22 thousand. The dessert was the US GDP – toppled with the revision of past data since 2003, everything has reduced - for 2008/10, there is now a decline rather than growth, despite the "optimization of methodology" (hedonic indexes became bolder). The first quarter of this year was revised from +0.5% to +0.1%, in the second it came out at +0.3% - but if we calculate deflator correctly, then the GDP per capita will give -0.5% q/q and -1.9% y/y: its level is already at the lows of early 1990s’ and is ready to go down to 1980s’.

![]()

Source: Bureau of Economic Analysis

Russia. Report of Ministry of Economic Development for June is interesting for its seasonally adjusted monthly dynamics. Production is +0.7% (manufacturing sector +1.1%), investment +0.4%, construction +0.8%; agriculture -1.1%. Retail and wages +0.5%, disposable incomes +2.7%; the latter jump is suspicious - but the Ministry says that Rosstat has revised the figure upwards, and it is now also have to raise previous estimates. Besides, methodology changes - the Russians, faced with banditry of retailers, are increasingly buying goods from abroad via Internet: now this spending would be taken into account - and thus the officialdom has judged, that it is necessary to adjust the new incomes to the new spending; kindergarten, and not an official statistics. Inflation is undervalued, so real incomes are still in the red - but spending is in positive territory: according to MED, in January-June, there were given 11.5% more consumer loans than a year ago - the savings rate falls. Due to expensive ruble, imports soared by 43% y/y - that is, the bubble of spending goes into the pocket of a foreign manufacturer. MED estimated GDP growth in June as 3.9% y/y, and for the second quarter - 3.7%; we have 2-3%. Nominal GDP in the second quarter of 2010 from MED is more than 3% higher than Rosstat has - nonsense! The rest is familiar: the North Caucasus will be paid tribute of 4 trillion rubles in 14 years; the money will be taken from the Russians through different things - for example, toll roads, where tariffs will be the biggest in Europe, except for France. The city of Penza was attacked by locusts - not surprising considering our heat: it is quite strange that elephants don’t wonder about the Moscow’s suburbs!

Have a nice week!