"End of the world has begun"

Good afternoon. The doomsday, prophesized by Camping did not happen, but the prophet was not discouraged: he said, “End of the world has begun” and in 5 months all will be done. In the meantime, there were some local disasters: tornadoes killed hundreds of people in the United States and in Iceland the Grimsvotn volcano awoke forcing airlines to cancel hundreds of flights. Friends of Strauss-Kahn tried to bribe the Guinean relatives of the maid, so that she would refuse the earlier testimonies – but they refused to millions. Replacement of the defendant is ready – euro-heavyweights (Britain, France and Germany) have put forward the French Finance Minister Christine Lagarde. The Madame is quite worthy – she worked in the United States for many years (including in the Brzezinski’s institutions), and back at home got in the scandal with a football business rogue Bernard Tapie, whom she allegedly helped to get 300 million from the budget: the same story as of Trichet, who while working in Finance Ministry, “inadvertently” allowed Soros to get insider information on the privatization of Crédit Lyonnais bank - and such skeletons lie in the closets of all the prominent people of this world. Politics was like a circus: Obama’s Beast limo sat on the belly near the US Embassy in Dublin, and in South Africa crocodiles did not let the electoral commission to get to the poll station. In Spain, the ruling Socialist Party has failed in the regional elections – even losing control of the municipalities of Barcelona and Seville; and in the Basque region and neighbouring Navarra won not just the separatists, but frank terrorists.

Diagnosis to G8

Monetary markets. G8 gathered in the French resort of Deauville – and, as always, decided nothing: quarrelling about expensive raw materials (by the way, the same happened 3 years ago – and ended in autumn collapse), the leaders of major countries said that “the global recovery gathers pace and becomes more sustainable” – that is a diagnosis. The quantitative easing program in the US will finish in a month – and what are the results? Ovations are heard everywhere: inflation rose, the monetary multiplier has fallen to historic minimum, economic growth has slowed down, real estate market has strengthened its fall, and in the labour market 600-700 thousand people have moved from temporary to permanent works – gossips did not fail to note that each “redesigned” workplace cost nearly a million newly printed bucks; only thing obvious is the takeoff of financial markets – it is logical to decide that this was the aim in the first place. OECD calls on the Fed to raise the rate to at least 1% per annum by the end of the year; the head of the FRB of Minneapolis Kocherlakota also wants to start tightening – and, in general, the failure of Bernanke’s policy is clear. Nevertheless, the market rumours that a new round of emission is around the corner – for the economy is weakening again, and (in Bernanke’s logic) we should again throw bucks from the helicopter. However, the markets are ready for anything: the participants were actively buying credit default swaps on US government bonds – with every passing week the turnover of this segment is growing, and compared to the same period last year, the amount of such bonds issued has doubled.

Last week was a parade of agencies: S&P downgraded the forecast for rating of Italy, causing a stream of abuse from the country’s Ministry of Finance; Fitch threatens to lower the ratings of Japan and Belgium; Moody’s cut the indices of the major banks of the New Zealand and wants to beat down the ratings of the UK leading banks (HSBC, Barclays, Lloyds, RBS etc.); it also reduced the rating of Bahrain due to the problems of the financial system – whose total assets amount to 1000% of country’s GDP. The head of the Eurogroup Junker said that Greece is unlikely to get new bailout – saying that she does badly; there is money in the Greek treasury for only 2 months, so they started a new wave of government spending cuts and privatization – but the opposition rejected these plans, so the chances of default are rising. There is also some positive news: the Finnish parliament approved the bailout of Portugal, while the Chinese have promised to buy up many of her bonds; all German banks have successfully passed the stress-tests – however, these had little to do with the reality. Der Spiegel had an article about the ECB: not only its balance sheet is piled with Greek junk (€47 billion of bonds, €90 billion pumped into banks), but there is also another half a trillion euros of mortgage securities – large proportion of which is quite nasty; in contrast with the Fed, the ECB can’t solve the problem with emission. The head of the agency Trichet made ??an unexpectedly soft speech, hinting that he is not quite sure in the need for immediate rate hikes – it seems that the things of euro-periphery are indeed bad.

Currency markets. Euro continued to fall – which is not surprising in view of the above mentioned problems of the eurozone. Against the dollar it even fell below 1.40 – but quickly bounced back. Pound grew a little, yen stood on the spot – and only the franc steadily continued to swell up: the financial authorities of Switzerland have expressed “extreme concern” in the currency appreciation, which undermines exports and stimulates deflation – but the market simply has nowhere to go, for it is the only one of the major currencies which does not yet have serious negative processes in the base country that would undermine the currency stability. Therefore, euro-franc showed new historic minimum – and over the past 3.5 years it has fallen by almost a factor of 1.5.

![]()

Source: SmartTrade

Stock markets. The leading stock exchanges continued to twitch nervously, for and positive side of the emission is being seriously blocked by the negative of the real economy. Of the joys we note a brilliant IPO of Yandex in the United States, which killed even the most optimistic expectations: already the price of initial public offering was overridden by almost 20%, and in the first day of secondary trading the shares jumped by another 56% - however, then began a harsh everyday humdrum, and the company lost 15% of peaks achieved. The US Treasury is beginning to dump shares of AIG, bought up in the midst of the crisis – to start it will sell 20% stake in the firm (from overall 92%) for $7.1 billion; the public received the news grimly – both since it is unclear why wait till the shares fall in price by half, and only then sell, and because if it goes on the Treasury will return only $30-35 billion of $182 billion offered to the insurer. US retailers are in grief – nasty consumers don’t want to splurge uncontrollably! Large networks Gap and Aeropostale lowered their forecasts for the current year because of this – and were immediately punished by shares collapsing by 15% odd. We think such news would soon be even more numerous.

Commodity markets. Oil and industrial metals are no longer willing to fall, while gold briskly went northward, confidently settling above $1500 per ounce – by the latest figures, Chinese demand has bypassed the Indian and became the world’s largest. Fears too left from agricultural and forest products: timber, meat, cotton, sugar, coffee and cocoa have ceased to cheapen; grain, forage and vegetable oil rise in price again; fruits and milk showed new peaks. The US regulators found intruders in the markets – in 2008, oil trader Parnon Energy has monopolized the trade for some time: in January of that year he and cronies bought up 66% of the total volume of oil futures, and in March – already 84%; all of which caused a feeling of fuel deficit in the market, provoking a rapid growth in prices and profits of speculators – and then the latter began to play the slide and begot a collapse. The picture is impressive – but the righteous anger is hampered by the fact that the villains, who supposedly wheeled the market as they wished for a year, have made ??the oil price to increase by $1 per barrel and earned only $50 million on these transactions, although the scale should have involved billions; it is strange – an impression is that the States simply like the Norwegian billionaire Fredriksen, who owns the firms, as a suitable candidate to be a scapegoat.

![]()

Source: Barchart.com

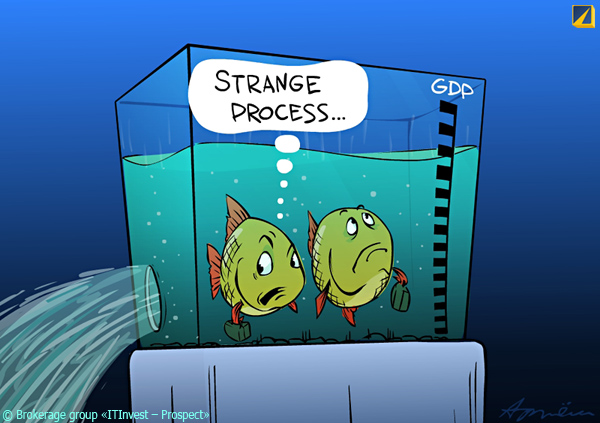

“Strange process”

Asia and Oceania. Australian investment grew in the first quarter by 3.4% y/y – and this was the only positive news from the region. Business activity in China, according to HSBC, fell to 10-month low in May, while staying in the zone of expansion; business conditions have also fell thoroughly (especially the new orders); the current account’s surplus declined in the first quarter by 18% over the same period in 2010. Japan’s trade balance in April has expectedly flown into hefty deficit because of the collapse of exports by 12.5% y/y (including to the United States – by 23.3%) after the earthquake. Total demand in Japan sank after the cataclysm – hence the fall in prices of corporate services in April, although small, but breaking the previous trend of appreciation; at the same time, consumer prices rose due to shortage of some commodities and the rapid growth of fuel prices. Weak demand has generated fall in sales of supermarkets; retail is also in the red in annual dynamics – but against March there was a jump of 4.1%, although the collapse of the previous month (by 7.6%) has not been recouped; situation is definitely bad only in car sales – here the annual decline has reached 38.0%. Construction in Australia is yet in positive territory – but its size is twice less than the forecasts. Inflationary expectations in the New Zealand are growing rapidly – not a lot of fun.

Europe. German GDP grew by 1.5% q/q; contribution of private consumption was only 0.2%, net exports added 0.5%, and investments – 0.9% (two thirds of which fell on temporarily intensified construction). More fun in Britain: GDP grew by 0.5%, but private consumption fell by 0.6% (the worst dynamics since April-June 2009) depriving the economy of 0.4%; another 1.2% were stolen by investments collapsing by 7.2%; government has contributed 0.2% to GDP, but this is too little – and all the joy was concentrated in net exports, which alone added 1.7%; but how long this export feast will last? Incidentally, the British deflator showed a 15-year maximum – in such circumstances sustained growth is unlikely. Industrial orders of the eurozone decreased in March by 1.8% versus February – France and Germany were not good, while Italy has pleased. Business confidence fell sharply everywhere in May: the mood in Belgium went into minus, France activity suddenly collapsed, in Italy the confidence continued to decline, and for the eurozone as a whole manufacturing index of activity PMI set an anti-record of monthly drop since November 2008 – and at the forefront of the fall was Germany; optimism preserved only in the business climate in Germany (according to IFO), but in general in the eurozone the similar index sank to a six-month minimum.

Prices in April have continued to grow, but because of the base effect their annual growth decreased slightly; broad money supply (M3) in the eurozone slowed down for the same reason; inflationary expectations of the Britons have jumped up in May, despite the depreciating fuel. According to the British Bankers' Association, approved applications for mortgages in April fell by 6.5% against March (while were expected to grow by 3.5%). In Germany, consumer sentiment deteriorated in May, but in France, Italy and Britain they have improved. Number of registered unemployed in France fell in April by 0.4% versus March - but the progress is slowing down. Britain suffered a difficult week during which large firms have announced the layoff of more than 4.5 thousand people – banks distinguished themselves particularly (Barclays, Lloyds and RBS), as well as the ruined retailer Focus. In March, the Italian retail sales unexpectedly slipped by 0.2% m/m, bringing the annual decline to 2.0% (the worst figure since January 2010); reduction was observed in most categories both food and on other goods. In Britain, the balance of retail sales has worsened, but remained positive – while the perspectives are not rosy: according to Markit, 35% of households said of deterioration of its financial position in May while only 7% noted an improvement. Deficit of the British budget in April showed a new record – it was the worst since 1993.

America. US GDP has not changed after refinement: in January-March the economy grew by 0.5% against October-December, and by 0.3% if you remove the hedonic indexes. The same figure, but calculated on income stream rather than on costs, (GDI) has officially grew by 0.2%, and actually fell by 0.1% - such “statistical discrepancy” is everywhere, so the world economy is quite worse than said even by the refined figures of GDPs. Remove net exports, inventories, bonded rents and deficit budget spending – and the rest (private domestic demand) is bad: over the past 5 years, it fell on average by 3% y/y, and over 3 years – by 4%; for all 60 years of observations nothing like that has been ever recorded. Orders for durable goods tumbled down in April at 3.6% m/m, and without transport – by 1.5%; net capital orders fell by 2.6% (annual anti-record); over the past 12 months, orders grew by 4.0% - but this is nominal figure, because the statistics do not take into account the inflation which is rather large now; worse of all is the communications equipment sector, whose orders had fallen by 1.5 times in year. Regional indices of manufacturing activity from the Federal Reserve Bank of Chicago, Richmond and Kansas City have collapsed, especially the key component of the new orders. Sales of construction developments and the index of consumer comfort from Bloomberg increased slightly, but remained at very low levels; new housing supply is at historic lows; pending sales on secondary market have collapsed by 11.6% m/m and 26.5% y/y; the number of applications for unemployment benefits increased again. Real disposable incomes of Americans remained in April at the level of March –since the beginning of the year they have not grown yet, and given the underestimation of inflation they actually fell; once again we face the same picture – the real demand falls.

![]()

Source: Bureau of Economic Analysis U.S.

Russia. In the April report of the Ministry of Economic Development good is only the retail (+0.7% against March), but this is a rant on loan – savings rate is falling, consumer credit is growing. Real disposable incomes are tumbling down: in March they sank by 1.6% m/m, in April – for a further 1.5%; since inflation is underestimated by 0.2-0.3% m/m, in fact in 2 months incomes fell by 3.5-4.0%, and in the past 12 months – by 10%. We also note the decline of extractive industries by 0.6% m/m, and construction – by 1.3%. Rosstat has cut the estimate of GDP for January-March against the ministerial one (+4.1% instead of +4.5%), MED had to clear the slacks: monthly dynamics for January fell from +0.1% to -0.1%, in February – from +0.2% to +0.1%, in March – from +0.3% to +0.2%; annual increase in March became thinner (from +4.2% to +3.8%). In April, MED gives +0.1% m/m and +3.3% y/y – we have +0.5% against April 2010; but this year had one working day less – adjusted it will be about +2.5%. Putin gave birth to a new plan – to raise GDP by 1.8 times in 10 years, i.e. in fact to catch up with Germany: well-well. In January-April, capital outflow from Russia continued and reached $30 billion: meanwhile, for the entire 2010 $35 billion were taken away – a clear advance. Comment of the head of Bank of Russia Ignatiev is wonderful – he said it is a “strange process” and “this process procrastinates, which is hard for me to explain; I hope that this year the inflow will resume”: an excellent illustration of the impotence of the Russian authorities. In other respects, our power-holders are true to themselves: officials-poachers were acquitted for helicopter hunting in Altai mountains; newly built houses for fire sufferers of Nizhny Novgorod are already falling apart; United Russia posted placards in St. Petersburg with quotations from scholars, writers and musicians under their own logo – after receiving a chorus of outrage, the creators recognized that they weren’t right to accept Pushkin posthumously in their party, and removed the posters.

![]()

Illustration: Artem Popov, ITinvest

Have a nice week!