The View From The Tower

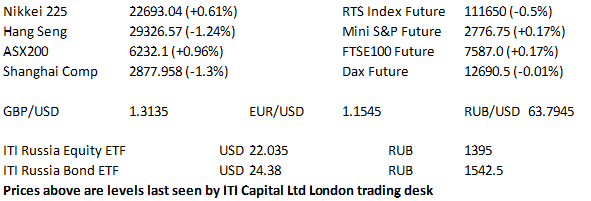

Overnight Snapshot

The Day Ahead

0800hrs UK FR Governor of the Bank of France, Francois Villeroy de Galhau speaks in Paris

0815hrs UK SW Swedish Government publish their economic forecast

0830hrs UK SZ Swiss National Bank Policy Decision (est Deposit -0.75% vs -0.75%)

0900hrs UK NO Norges Bank Policy Decision (est 0.5% vs previous 0.5%)

0930hrs UK UK Public Sector Net Borrowing (est £4.97bln vs previous £6.2bln)

1045hrs UK DE Bundesbank President / ECB Governing Council Member Jens Weidmann speaks in Paris

1200hrs UK UK Bank of England Rate Policy Decision (est 0.5% vs previous 0.5%)

1330hrs UK US Weekly Jobless Claims (est 221.36K vs previous 218K)

1330hrs UK US Philadelphia Fed Business Outlook (est 28.24 vs previous 34.4)

1400hrs UK US Minneapolis Fed President Neel Kashkari speaks in Minneapolis

1400hrs UK US FHFA House Price Index (est 0.48%mom vs previous 0.1%)

1430hrs UK EU ECB Governing Council Members Ewald Nowotny and Gaston Reinesch speak in Vienna

1500hrs UK EU EuroZone Consumer Confidence (est -0.05 vs previous 0.2)

2100hrs UK UK Bank of England Governor Mark Carney speaks in London

Earnings from the US today include The Kroger Co & Red Hat

Earnings from the UK include Dixons Carphone

FTSE100 Ex Dividend by 2.687 points (Compass Group, Experian, Land Securities, & United Utilities)

HEADLINE NEWS

: UK PM THERESA MAY WINS VITAL BREXIT VOTE

: BAE SYSTEMS WINS CONTRACT TO BUILD TANKS FOR US MARINES

: DISNEY RAISES FOX BID WITH $71BLN OFFER

The Day So Far….

STOCKS: The Nasdaq100 printed an all time high yesterday at 7309.992 lifted by a climb in large cap tech names whilst the Dow and the S&P remained constrained as the concerns over the US-China trade war simmered away. 21st Century Fox jumped 7.5% after Walt Disney (1% higher) sweetened it’s offer to $71.3bln trying to beat Comcast’s bid. The S&P500 snapped a three day losing streak as gains in media names helped send the consumer discretionary sector up 0.5%. The ‘FAANG’ names performed well, with Facebook up 2.3%, Alphabet and Amazon up 0.5% and 0.9% respectively and 4 of the 5 names hitting intra day highs yesterday as the S&P Tech sector closed 0.3% higher. The S&P500 closed 4.73 points higher at 2767.32, the Nasdaq100 closed 52.661 higher at 7280.7, while the Dow closed a touch softer, down 42.41 points at 24657.8

Asia-Pacific equity indices trading with mixed fortunes, with modest risk on flows apparent with a lack of headline catalysts apparent and despite comments from China's MOFCOM re: the trade war situation, showing that they have no intention of backing down following the latest round of U.S. sanctions headlines. The telecoms sector led the Nikkei 225 higher, while utilities provided the largest drag, but a strong finish to the morning session saw gains held in the afternoon. Elsewhere the Hang Seng and Shanghai Composite lagged their peers, with Morgan Stanley suggesting that the Hang Seng sell off is far from over after it slashed its 12-month target. Australia's ASX 200 added close to 1.0%, extending on its multi-year highs, with broad based gains apparent. ex. telecoms.

- US index futures traded higher, accelerating the move after they breached Wednesday's session highs.

US TSYS: T-Notes breached Wednesday's low on a round of risk off flows that lacked any headline catalyst, with US index futures breaching yesterday's highs. USD/JPY had a look above 110.60, and has consolidated just off of best levels despite comments from China's MOFCOM re: the trade war situation, showing that they have no intention of backing down following the latest round of U.S. sanctions headlines.

STOCKS: Asia-Pacific equity indices moved higher, with modest risk on flows apparent with a lack of headline catalysts apparent and despite comments from China's MOFCOM re: the trade war situation, showing that they have no intention of backing down following the latest round of U.S. sanctions headlines. - The telecoms sector led the Nikkei 225 higher, while utilities provided the largest drag. - Elsewhere the Hang Seng lagged its peers, with Morgan Stanley suggesting that the index's sell off is far from over after it slashed its 12-month target. China's CSI 300 added 0.8%, while Australia's ASX 200 added over 1.0%, extending on its multi-year highs, with broad based gains apparent. ex. telecoms.

- US index futures traded higher, accelerating the move after they breached Wednesday's session highs, with Sept S&P trading 5.75 higher and September Dow 22 points higher.

OIL: WTI printed slightly higher before reversing gains, with August futures at $65.29 last, down 42c. Brent August futures lost 53c last trading at $74.15, with the OPEC+ in Vienna dominating price action. - Chances of a deal at the summit have increased after the main protagonist pushing back against any production increase, Iran, seemingly softened its tone, as Iranian oil minister Zanganeh suggested that cartel members that had cut more than required in recent months could increase output back to higher agreed quotas. Elsewhere Saudi oil minister Al-Falih suggested that OPEC is "converging towards a good, positive decision" on raising output levels. - Multiple source reports have suggested that Saudi is pushing for the cartel and its partners to increase production by at least 600K bpd.

GOLD: The yellow metal continues to struggle, with August futures sliding $10 lower, last printing at $1264.2

FOREX: NZD continues to come under pressure. Traders had initially ignored the in-line headlines of the GDP release but are perhaps now paying more attention to the breakdown. The key disappointment was flat household consumption, this could have an impact on the RBNZ's monetary policy outlook. NZD/USD made a fresh YtD low at $0.6832, last $0.6840. - Modest risk on flows were noted with USD/JPY trading at Y110.60, T-Notes breaching yesterday's lows as US equity index futures pushed through Wednesday's highs, although headline

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk