Overnight Snapshot

The Day Ahead

0830hrs UK SW Swedish Trade Balance (est SKr0.0bln vs previous SKr2.6bln)

0830hrs UK SW Swedish Retail Sales (est -0.16%mom / 2.0%yoy vs previous 1.2% / 2.9%)

European Union leaders meet in Brussels to discuss Korea, Yemen and Iran situations

No major earnings release from the UK, Europe, or US

UK Closed for Spring Bank Holiday, US Market closed for Memorial Day Holiday

HEADLINE NEWS: ITALY’S POPULISTS PULL OUT OF BID TO FORM GOVERNMENT – POSSIBLE CONSTITUTIONAL CRISIS?

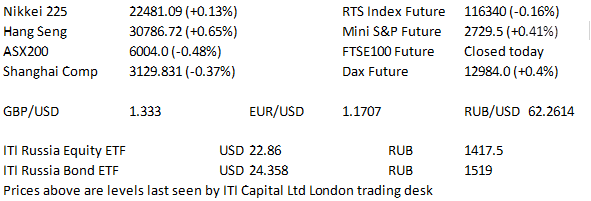

The Day So Far….

STOCKS: US stocks retreated on Friday, led by losses in energy stocks as oil retreated the most in almost a year after a Saudi minister said that petroleum supplies would likely rise in the second half of the year. Energy stocks lagged behind the other 10 industry groups in the S&P as WTI Oil futures dropped over 4%. On the political front, President Donald Trump described as “warm and productive” a conciliatory statement from North Korea saying they remained willing to meet with the US after Trump abruptly canceled their summit planned for June 12th. The S&P500 ended the week at 2721.33, down 6.43 points on the day but around 8 points up on the week. The Dow lost 58.67 points Friday to close at 24753.09, but similar to the S&P it eked out a small gain on the week. Without energy names to concern it, the Tech Nasdaq100 index closed 11.22 points higher on Friday at 6960.919, carving out a near 100 point gain on the week.

Asia Pac stocks struggled for traction today with energy shares tumbling after oil extended its Friday drop. Benchmarks have dipped in Australia and China, whilst Japan’s Nikkei225 managed a small gain, and Honk Kong holding gains as we near the close. South Korean stocks also saw early gains as did US index futures after President Trump appeared to confirm the Singapore Summit with North Korea was back on.

Dealers here in London on the ITI Capital Ltd trading desk expect a very muted session today with little or no economic news, no central bank speakers, and the UK and US markets closed for public holidays.

US TREASURYS: US 10-year yields eased a touch to around 2.93% Friday but futures have eased back a fraction overnight to see yields tick back up by around 1bp following

a surprise meeting between the 2 Koreas on Saturday.

OIL: OPEC and allied oil producers including Russia concluded that the crude market rebalanced in April, when their output cuts achieved a key goal of eliminating the global surplus. Top producers Saudi Arabia and Russia announced last week that they may boost output in the second half of the year. This sent WTI and Brent futures sharply lower on Friday with losses again today. WTI July futures currently trading at 66.9 dollars a barrel after closing Thursday last week at $70.71. Brent in a similar pattern trading now at $75.69 vs a $78.79 close last Thursday

GOLD: The safe haven yellow metal has eased on the Trump – Kim summit outlook and a steady greenback. Front month gold futures currently trading $1295.70 an ounce, down 8.0

FOREX: The EUR rallied after Italy’s President rejected a candidate for Finance Minister who has been skeptical of the pan European single currency.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk