Greek comedy

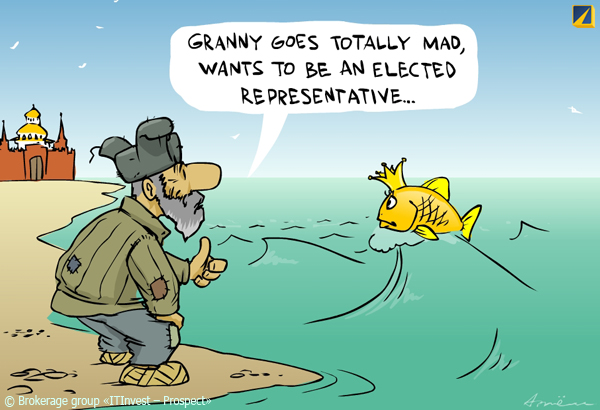

Good afternoon. The political part of last week was abundant – but stupid: G20 had another orgy – but what is the sense? Leading politicians spoke their usual speeches (long and idle) like haughty turkeys and broke up in grandeur. However, there are innovations: Saudi Prince Khalid Bin Talal promised a million bucks to anyone who kidnap an Israeli military and will be able to barter him for Arab prisoners, as has happened recently – characteristically, no one bombed Riyadh or overthrew the cursed tyrants. In the USA, weird extremists were found: four terrorists decided to blow up the administrative buildings and police force for the liberation of their native state of Georgia (not to be confused with the Caucasian Georgia) – but FBI is vigil and already knows the villains’ plans; the case is, however, that the conspirators arrested are more than 65 years old – and now the public tries to understand how to interpret terrorists-granddads and the brave security forces. The latter are powerless against weather elements – a week ago the Eastern States were stroke by heavy snowfalls, which brought up a lot of problems; FBI would be glad to arrest someone – alas.

![]()

Illustration: Artem Popov

The great strength of the rouble

Monetary markets. ECB cut the interest rate by 0.25% to 1.25% per annum – as soon as Trichet resigned the governing council, headed by the new president Draghi, immediately showed some signs of adequacy; it is understandable – Draghi is himself an Italian, so he is well aware that there are other views on the issue of the base rate, except the hardcore monetarist ones, adhered by Trichet. Reserve Bank of Australia also lowered the rate by 0.25% - down to 4.50% per annum; it has also made clear that the new acts of monetary easing are quite likely in the near future. The rate was reduced by the Danish central bank too – from 1.55% to 1.20% per annum. A meeting of the Fed took place – the rates there remain unchanged, while the memorandum text is very similar to the previous one; the noted economic recovery was attributed to the termination of the momentary factors (probably the impact of the Japanese earthquake is meant); the economic forecast was deteriorated (there was “some acceleration of growth expected” and now “only moderate growth expected”) – as well as the estimates of GDP and employment, while inflation is expected to worsen; “Operation Twist” will continue, as well as reinvestment in mortgage bonds.

It is interesting that the voting wasn’t unanimous again – but if the former dissident-hawks have joined the majority, there is now came a dove-dissident Charles Evans, head of the Federal Reserve Bank of Chicago, who called for the immediate launch of a new emission program. To balance up the overall impression a few hours later the head of the FRB of Dallas, Richard Fisher, a hard hawk, spoke – he said that the central bank can’t continuously print money to keep the irresponsible government in its pants – otherwise it will lead to hyperinflation. And the pants indeed fall down again: Treasury Secretary Geithner said that in the next two quarters he would have to borrow as much as $846 billion (you see, the revenues sagged and costs rose – and who would have thought!) – which is why at the turn of 2011 and 2012 the national debt will again bump into the ceiling recently raised by the Congress; and since no agreement on budget optimization is palpable in the parliament, we are probably to expect the blockbusters’ sequel – so you can start slowly stocking up popcorn.

Comparing in the previous review the bailout plan for Greece with the sticky tape on the windscreen of the aircraft, we couldn’t dare to think that the comparison will work immediately – the ink hasn’t dried on the text of the “fateful” EU plan, as the Athenian PM Papandreou suddenly decided to consult with the people by announcing a referendum; since the Greeks are set harshly against further cuts in wages and employment the fate of the vote is obvious. Euro-bureaucrats were speaking simultaneously: Sarkozy got “scared”, the head of the German FDP Bruderle “got mad” – and even the Greek finance minister Venizelos indignantly remarked that he should have been consulted with. Then the EU and the IMF structures made it clear that Greece will not see any money before the plebiscite takes place – including the already issued tranche of €8 billion. Meanwhile, in mid-November the Greeks have to repay bonds for 3.6 billion – and if they have money for this, after that they’ll be quite empty: they simply won’t have €12.1 billion left to pay before the end of the year. Foreseeing the inevitable, Euro-officials changed rhetoric: head of the Eurogroup Junker made it clear that it is not necessary to keep Greece in the eurozone “at any cost” – and that it's time to minimize the consequences of “the sack of Athens”, which is ever more likely. And then came Papandreou on a white stallion: he said that... he was just kidding – the opposition has finally behaved constructively, which is what he sought for: the referendum is no longer needed. Silent scene...

Other sufferers were not left aside. Portugal asks EU, ECB and the IMF to soften the terms of the €78 billion bailout: why to cut budget spending so harshly – anyway we do our best on the moment; annual budget deficit at 10% of GDP – oh, a trifle. Lisbon also appealed to Washington for it to help Europe; Paris asks Beijing; all eurozone countries hopefully look to Tokyo – where they want to create a fund to invest in foreign assets (which will weaken the yen), but they definitely don’t want to lose money there, so are cautious. Asking looks on BRIC are fruitless: Brazil and Russia have made it clear that they are willing to help only to the extent of their participation in the IMF – which is, of course, not enough. Berlusconi has not come to agreement on pension reform and the budget sequestration and is politically “hanged”; yield of the Italian bonds struck previous peaks – the ECB (led by Italian Draghi, we’ll recall) had to strengthen the purchases of Roman bonds. However, here it is far from the Greek situation – the latter’s 2-year securities have almost reached 100% per annum: 1998 in Russia is getting closer. The French bonds have also tumbled – but the Germans have an unexpected joy: they suddenly found €55 billion, lost God knows how in the course of the budgeting process. “Oh, we'd like that!” – sigh they with envy in London: their hole in the treasury is larger than the Portuguese, despite the “economy of austerity” – the Treasury wants to abolish inflation indexation of social benefits; it seems they’ll soon come to the conclusion that the greatest savings would happen if the pensioners and the sick would die at all.

Currency markets. The main event on FOREX was the powerful intervention of the Bank of Japan on Monday night – dollar-yen, only recently showing a new record low, soared by more than 4 units: from 75.50 to 79.60 – but the joy was short-lived and later the rate stabilized around 78.00. The dollar rose briskly against other currencies – euro dropped from 1.4250 to 1.3600 in a couple of days; in general, however, the main rates continue to fluctuate in the usual wide ranges. Dear Russians amused a lot – especially the most dear ones: First Deputy Prime Minister Shuvalov said that the risk on rouble is lower than on euro (which is clearly seen on the scoreboard); Bank of Russia urges banks to lower interest rates on foreign currency deposits – by all means it is necessary to prevent people from transferring from roubles to dollars and euros; but if the stregnth of rouble is such that it needs these crutches, then the future of the Russian currency is not very hairy at all.

![]()

Source: SmartTrade

Stock markets. The invisible hand of the market has recently become quite a tittup. One day she is full of unbridled optimism – and all grows rapidly; then suddenly the mood worsens – and the indices are flying down like the stone. For what reason, we wonder, the last week take-off was needed – if already on Monday and Tuesday the Dow fell by more than 600 points? And again everyone talks of collapse – but has anything changed? As a result, the Dow rose again. But there is a sovereign hand of the market – at the sovereign democracy, of course: while all exchanges toppled, MICEX proudly suspended trading for “technical reasons” – perhaps during the idle time Mr. Shuvalov held political information about the power of rouble assets? Of the reports we note Sony, receiving a loss from the global crisis, expensive yen and floods in Thailand; Pfizer is excellent – both in profits and revenues (but not inside the USA!), and in forecast for the year as a whole; AIG’s report is habitually awful – another $4.1 billion of loss. MF Global went bankrupt after the collapse of acquisition talks with Interactive Brokers; the company died due to the fall of Italian government bonds, which was invested in recklessly by former Goldman’s director (and former New Jersey Governor) Corzine – when it smelled fried, he, with the customary permissiveness of untouchable Wall Street managers, robbed hundreds of millions of client money to cover losses; this is how one bandit can destroy a company with 200 years of history. A funny character here was S&P agency, who proudly downgraded MF Global only when the company has already launched its bankruptcy: “how great is the foresight of agencies!” – sarcastically responded the traders. Credit Suisse is to cut another 1.5 thousand jobs in addition to the previously announced two thousand – the whole staff of the bank will decrease by 7%. That is in fact modest: AMD will dismiss 10% of its employees.

Commodity markets sat down frightened at first – but then began to recoup. Oil recovered losses of Monday and Tuesday; industrial metals sat down, but not much; precious metals have even grew – gold is confident it will be needed in any case, since central banks have started a new wave of monetary easing. Grains and pulses, forage and vegetable oil were sluggishly still; beef, milk and fruits continue to go up.

![]()

Source: SmartTrade

Arithmetic of crooks and thieves

Asia and Oceania. Official index of business activity in China’s manufacturing sector fell unexpectedly in October down to a minimum since February 2009, barely holding above the key mark of 50 points – export orders have gone into recession zone; similar indicator of HSBC has grown up, but doesn’t impress with its value; indicator of services reduced significantly – in short, the Chinese economy slowly cools. The Australian manufacturing sector flounders in the zone of recession for a long time now – and now the services rushed there too. Alive is only the credit sector - but it’s rough: building permits collapsed in September by 13.6% after a surge for 10.4% a month earlier; similar index of the New Zealand went into minus in the annual dynamics. The construction sector of Japan suddenly sank: orders fell by 9.3% y/y (in August there was the same size growth), the number of developments has fallen by 10.8% (instead of +14.0% a month ago). In the New Zealand unemployment rose unexpectedly in the third quarter – and the employment statistics in general was disappointing; wages are not bad – but still don’t keep pace with inflation; Japanese wages are stagnating – as do the prices. Australian retail sales swelled in September by 0.4% against August; in general for the third quarter the gain is 0.6% against April-June – but it is in nominal terms, and since inflation for the period amounted to the same 0.6% there is stagnation; and since the price dynamics is always understated, there is even a recession in fact.

Europe. UK GDP rose by 0.5% q/q and by the same amount y/y in July-September; to blame the low base effect of the second quarter – therefore forecast for October-December is sombre (some expect the resumption of the recession). Orders in the engineering sector of Germany were only 1% higher in October than a year ago (internal even fell by 2%) – although in August the growth rate was 14%; industrial orders tumble for 3 consecutive months – during which time they already lost 8%. Activity in the manufacturing sector of the eurozone showed a low in October since July 2009, and in the UK – since June: in the latter case the new orders component collapsed. The British service sector also fails - but index yet keeps above 50 points; Switzerland got deeper into the recession zone; the eurozone is in depression. Producer prices in Italy and France swelled by 0.2% m/m, in the eurozone – by 0.3%; consumer prices rose again in October – so the annual gain is impressive (+3.0% in the eurozone, +3.8% in Italy). In the UK, the broad money supply (M4 aggregate) continues to fall; lending doesn’t look too good; realty prices stagnate. In the eurozone in September unemployment has unexpectedly rose to a peak since June 1998 – especially bad are the things in Spain, where it showed a new record (22.6%), but the unemployed also added in Germany – sadly. German retail isn’t happy: +0.4% after -2.7% a month earlier – this is clearly not something that can inspire.

![]()

Source: Eurostat

America. Canadian GDP grew in August by 0.3% against July due to the energy sector (+2.8%) – without which there would be a zero increase; manufacturing industry fell by 0.4%. And in the States productivity is increasing – by reducing labour costs: the latter promises further reduction of demand. In the meanwhile, the demand is more alive – and car sales are at the peak since February, but only because of an excess working day (adjusted for it there would be a negative against September). But all this is in any case achieved by a 3-year low in savings rate (3.6%) – and the economists argue that such phenomenon has arisen from the fact that Americans simply have nothing to save: it is symptomatic that the jump in consumer spending in the latest GDP report was caused by public utilities and health care – that is, those sectors where it is very difficult to save even if you really want too; it is clear that this can’t continue for long – and if the revenues do not cease to fall, the spending will follow them. Orders in manufacturing grew by 0.3% m/m - but the prices in the sector added exactly the same even according to official figures, really everything is worse – adjusted for real inflation, per capita orders shrank by 2% in the past 12 months. Indicators of business activity are mixed: the Federal Reserve Bank of Dallas showed an improvement – but deterioration was marked in the Federal Reserve Bank of Chicago, Chicago PMI and New York ISM. In general, the balance is negative – which was confirmed by the national figures: they have fallen, though held above the mark of 50 points – similar situation in Canada.

Canadian inflation is still rising – producer prices were 5.3% higher in September than a year ago (versus +5.0% in August). Building permits in Canada fell by 4.9% in September after falling by 10.1% in August. The US construction spending increased in nominal terms – but inflation has more than eaten the increase. The index of consumer comfort from Bloomberg broke the September lows in late October and is now at the worst crisis levels of 2009. In October, according to Challenger, employers had more extensive hiring and firing plans than a year ago. The number of recipients of unemployment benefits fell by 15 thousand in the end of October – but the previous week’s figure was revised up by 53 thousand, i.e. actually there is a deterioration. Monster employment index has improved, ADP report on private sector employment showed a pleasant +110 thousand jobs - alas, that is less than the average increase in the number of people entering working age. The official report of the Ministry of Labour gave pretty much the same picture – 80 thousand jobs created, while September was revised upwards to 158 thousand; the unemployment rate fell from 9.1% to 9.0%; all indicators of long-term unemployment have improved. Similar report of Canada is horrible – employment has fallen sharply (especially full-time), unemployment jumped by 0.2%. In general we can speak od stagnation in the labour market: the number of jobs is increasing in parallel with the population growth – so the levels of unemployment stay constant.

Russia. In October consumer price index resumed its growth, amounting to 0.5% m/m and 7.2% y/y – as always, utilities are leading (+12.9% y/y); impressive are the preschool education services (+12.0%). As we expected, the end of old car disposal scheme has affected sector badly - AvtoVAZ went to minus in October against the same month of 2010, while the absolute indicator of sales (49.3 thousand cars) was the worst since February: further decline seems inevitable. Bank of Russia has finally admitted the obvious – it has raised the official forecast of net capital exports for the year almost two-fold (from $36 to $70 billion); it is understandable, for already in January-September the outflow has reached $49.3 billion – and if the forecast is justified, then 2011 will be the second worst year in history after 2008, when in the last quarter there happened a panic run of capital. Acts of Russian authorities are disgustedly usual. Reception center for Moscow and region Emergency Service has been closed - coordination of different services is no longer needed: why not to save! Pathetic repair of the Bolshoi Theatre (at the cost of half a billion euros) was crowned with a grandiose opening – after which the set tumbled on service workers; tickets were not for sell – invitations were handed out by the presidential administration. In the Urals, 130 thousand placards with collages of naked opposition were seized – well, that is, so to speak, an innocent joke.

Izhevsk “city manager” (what a stupid post) Agashin said at a meeting with the veterans: “I violate neither the Constitution nor the elections law, for I am a member of the United Russia party... so I have every right to say so... Veterans Council reached us with a proposal that we adopted... a program to support veterans’ movement... Without voting for United Russia, we will not be given this money. Because today, starting from the very top... distribution of money, and all resources, of everything goes in such way. Who today supports the current government – he gets increased funding... If the party gets everything up to 51%, there is no change in funding... If the party gets... 51% to 54%, then I go out with a proposal to increase funding... by 500 thousand roubles... 55% to 59% - 700 thousand. More than 60% - a million.” Arithmetics of crooks and thieves. Some fan of EdRo proposed the eviction of pensioners into poor countries – where they would live better than in Russia. Kaliningrad activists of MGER put up stands, which featured war criminals, prisoners of Nazi concentration camps and killed during the Turkish genocide as the victims of Gulag - the crooks coolly retorted, saying, “we are right in the main thing”. The other day a naked Moldovan rammed 17 cars in Moscow, flying “on the wings of love” and thinking that everyone hinders him – EdRo is like this nutcase: flies to nourishing food bowl on the wings of love, mentioned in a joke – they say, love for the dear party is characteristic only to the Soviet people in the person of its best representatives. And these are best of the best!

![]()

Illustration: Artem Popov

Have a nice week!