Sex, tax and football

Good afternoon. Political news was in abundance last week, even beyond the elections. The Americans met with the North Koreans in Beijing – and agreed that the United States will send 240 thousand tons of food in exchange for which the Juche have agreed to freeze nuclear exercises, to stop uranium enrichment and let the IAEA inspectors to the nuclear facilities – either they are in real trouble or the next sovereign Kim has more common sense than his predecessors. US also returned the Spaniards an ancient treasure from the frigate sunk by the malign British in 1804: Yankees are always happy to annoy the Brits – and the Iberians got a heartwarming catch of doubloons and piaster for a total weight of 15 tons. US Department of Health decided that the insurance will henceforth cover contraception and abortion – Catholics rebelled (why should our money pay for the godless cause), and a Yale professor came up with a true American answer proposing a tax on sex - $2 for each act of intimacy which will enrich the Treasury with $10 billion a year eliminating the need for extra contribution to health insurance; it remains only to find out the way to deal with tax evasion.

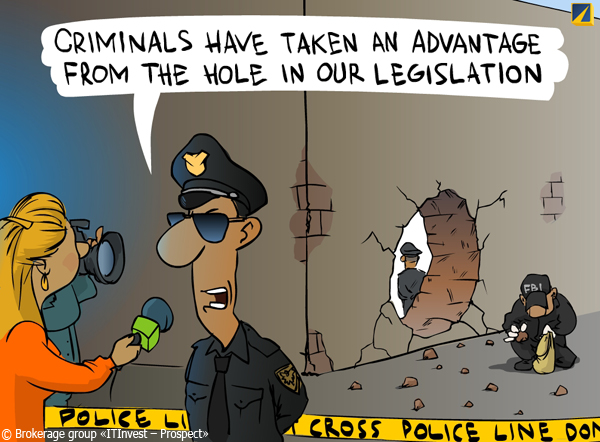

Illustration: Artem Popov

Others, though in some respects similar, things are happening in the Old World – the European Federation of Gay is violently outraged at the FC Real Madrid coach Mourinho: during the training before the game against CSKA Moscow he had a negligence to comment something with an unprintable Spanish words characterizing gays – and now the latter demand to punish the villain, emphasizing that on the day of the incident the international anti-homophobia week in football has started. And while the flagship of civilization have fun, our neighbors teach them a lesson of modernization - the administration of the President of Ukraine leased a remote office for the head of state until 2020: Yanukovych is now able to successfully run the country without leaving the village he lives in – a valuable experience, especially for the bosses of Russia, whi might follow the suit and come back to Ozero co-operative community without losing the high status.

Gas trap

Monetary markets. Central banks took a rest last week – but the Fed Chairman Bernanke addressed the Congress. He stayed a moderate pessimist about the economy – but expressed generally positive about the labor market (albeit cautiously); he didn’t mention the new program of quantitative easing, but told of the growth of inflation expectations – the markets got a little offended. Last weekend, the finance ministers and heads of the central banks of G20 met – they want to build up strength of the IMF with the help of bilateral loans or bonds; however, they made it clear that while Europe itself will not take any serious steps there is no sense to encourage developing countries to spend money on God knows what. There is a growing investigation into manipulation of global banks in the process of determining the LIBOR rate –US Department of Justice has already reclassified the case to the criminal one; it is reported that the slender ranks of the fraudsters saw a treason – the Swiss UBS has agreed to cooperate with the investigation and apparently told him many interesting things; currently parallel investigations are going in the USA, Canada, Japan and Switzerland.

The ECB held a second auction of three-year loans to banks – in addition to December's €489 billion another €530 billion were taken, totaling over a trillion; 800 banks participated (against 523 last time) – against this background the assurances that the ECB does not conduct quantitative easing look very funny. S&P has followed Fitch and gave Greece the default rating - simply because the procedure of exchanging old bonds for new no longer appears voluntary even on paper: holders of the Athenian papers are forced to lose three quarters of the investment - if this is not the default, then we didn’t have one either in 1998; S&P lowered the rating outlook for the Euro stabilization fund. And the High Court of Germany ruled unconstitutional the procedure of bailing out other eurozone countries – though mercifully allowed to continue buying up the bonds of problem countries on the market. Spain got the budget deficit of 8.5% of GDP in 2011 – instead of the planned 6% (the returning recession is to blame); Portugal has the same problems – it is expected that this year the economy will fall by 3.0-3.5%; and finally Ireland shocked the EU relegating the issue of fiscal union to the referendum with an unpredictable outcome (the law requires, they say) – Merkel is furious. On top of that there comes a new problem: Mavrodi decided to extend the MMM into Europe – that is just what we all longed for!

Currency markets. Key rates still move in narrow ranges – even the yen is not falling further, settling around 81.5. Euro is back to $1.32, the ruble also calmed down a little – in general, FOREX is so far of a very little interest.

Stock markets. The leading indexes aren’t very active too – it’s suffice to say that since the beginning of the year there were only two days when the closing values of the main US exchanges differed from the end of the previous trading session by more than 1% in either direction. The season report has ended – from corporate news we can only note the Apple's market capitalization passing $500 billion: in last 3 years the stock rose in price by 7 times, and by 90 in 9 years; well, well. Attention is drawn to the announcement of a strategic alliance between General Motors and Peugeot-Citroen: both groups are suffering huge losses in the European market (due to chronically weak private demand in the Old World) – and want to work together to save on the side spending, i.e. reducing the overall costs. Of course, this is just one case (although rather a trend in the car sector), but a very significant one – in a protracted crisis the business enlarges seeking maximum harmonization and removal of all intermediate transactions: in the end all that remained are solid “high-efficiency” holdings (analogous to the ancient estates) – and the smaller businesses suffer losses and ruins en masse. That's the way Roman Empire died...

Source: BigCharts

Commodity markets. Food and feeder go dear – thanks to the eternal emission. Industrial metals mostly stood still and the precious ones rose, but then collapsed: particularly impressive was gold, depreciating by $100 per ounce in a few hours. Oil fell by 4% in a couple of days, soared to $128 and fell again. All this has not made any impression on natural gas – it went further down: the price in the US reached $85 per 1,000 cubic meters. Given that the price of Gazprom for Europe are 4-5 times higher, it becomes clear that soon the monopoly (and, hence, the Russian budget) will be in a serious trouble – such difference is too attractive for arbitration: rapid growth of production and export of liquefied gas around the world (especially in the USA) have made the market much more flexible than before – this is also indicated by the fall of European purchases from Gazprom in 2007-2010 by 13%, although the total gas consumption in the Old World has increased in that period. Plus, despite all the machinations, slate gas production continues to grow – it already accounts for a quarter of the total gas production in the USA, the global industry’s leader-country; and there are other areas of research, promising new prospects for the next 5-10 years – all this spells a disaster both for Gazprom (extremely inflexible and wallowed in very expensive pipeline projects) and the Russian economy in general.

Source: SmartTrade

The successes of medical insurance

Asia and Oceania. Industrial production in South Korea took a minus in the annual dynamics; India's GDP slowed down to a 3-year low (+6.1% y/y) – production and activity of industrial sector weakens too; similar problems in Turkey (PMI fell below the key mark of 50 points). The situation in China is ambiguous: according to HSBC, manufacturing sector continues to slow down – but the officials reported acceleration; to blame the seasonal factors, not considered by the government – after their new year there is always an increased activity. According to the China Securities Journal, new loans slowed down, steel production weakened, the real estate sector and export cooled down – so the economy clearly lowers the speed. In Japan investment unexpectedly rose at the end of 2011, in January orders in the construction industry jumped, industrial production has surpassed expectations – as well as retail, provoked by subsidies for the purchase of low emission cars (sales in car sector soared by 24.3% y/y) and cold weather (demand on clothing rose). However deflation was preserved, unemployment rose and household spending declined – however, their income increased, so there is hope. Building permits rose in the New Zealand and fell in Australia; consumer credit and retail on the Green continent expanded a little in January.

Europe. Swiss GDP in October-December rose by 0.1% q/q and 1.3% y/y. Orders for machinery and equipment decreased in Germany – they have weakened on average in November-January by 8% against the same period a year earlier. Indices of activity came to 50 points everywhere – from the top (Poland, Sweden, UK), and somewhere from below (the Czech Republic, Switzerland and the eurozone); only in Norway there is optimism. Business confidence fell to the low since November 2009 in Italy – but the figures of eurozone and Switzerland have improved slightly. Import prices in Germany jumped sharply in January; producer prices have increased in France; consumer prices accelerated everywhere in February, except for Spain. House prices in Britain are in place while mortgages grew in January – tax breaks for first-time buyers have expired. British consumers remain gloomy – but the Germans are ever jollier, though it is still not easy: unemployment didn’t fell in February, and according to the ILO it increased in January – however, there is clearly a seasonal mess up (employment also grew up). Unemployment is swelling in Italy, France and the eurozone as a whole, where it peaked since 1997 (10.7%) – the leader is Spain (23.3%), whose parameters (not only on the labor market) are order less than in the times of Franco: even from the grave the damn totalitarianism doesn’t do justice to the bright ideals of democracy! Swiss consumption indicator has worsened – as well as household spending in France; German retail sales fell in January (but last month was revised up), while the British one was unexpectedly cheerful in February – for how long?

Source: Eurostat, OECD

America. US GDP per capita grew by 0.5% q/q and 0.9% y/y - but if you remove the statistical distortions, we get -0.1% and -1.7%; the main contribution (+0.5%) to the official positive figure was given by swollen inventories and salaries revised up sharply – though, in spite of the latter, the real income of the average worker remained at the level of half a century ago; per capita GDP crawls below the lows of the early 1990s’ and is on 24-year minimum. The Fed’s "Beige Book" reported “modest to moderate” economic growth in January and February – slowing was only noted by the FRB of New York. Orders for durable goods plummeted by 4.0% m/m in January – decline was noted on all fronts, including net capital orders (-4.5%). Regional indices of manufacturing activity rose in unison – and the employment component of the Chicago PMI came out to be maximal in 28 years; making even more surprising the noticeable decline of similar national index where the components of new orders and employment have fallen – how is this possible? The current account deficit of Canada fell in October-December – but weaker than analysts expected. US house prices from S&P/Case-Shiller continue to fall; pending transactions on the secondary housing market recouped the December fall in January; construction spending unexpectedly declined – affirming the Fed’s conclusion that the realty remains the weakest sector of the economy. The feeling is that the recent surge in activity is blowing away.

Source: U.S. Bureau of Economic Analysis

However, consumer confidence soared in February up to the skies – but would it help to activate the demand? In January real disposable incomes of Americans fell even in the official version, which underestimates inflation, while spending stagnated; the number of weekly sales in stores are modest – on the other hand, sales of cars reached a 4-year peak in February. Cheering too are the successes of healthcare – here are the new examples. Texas doctor has developed a network of swindlers: he wrote out prescriptions for home treatment of patients (or even accidentally found homeless), the medical firms provided bogus medical services, the government paid for this “treatment” within the framework of Medicare – the “profit” was divided between the company and the doctor-manager; the resulting damage to the state reached $375 million, while the doctor almost escaped – when detained he was found to possess a book with a spectacular title “Hide your assets and vanish: step-by-step guide on how to disappear without a trace”. A similar scheme in the State of New York was implemented by the immigrants from Russia – doctors and lawyers: they “treated” fake road car accident victims not even worrying about the reliability of the legend (“patients” were sent to non-existent clinics) – this time the damage ($279 million) was done not to the state, but private insurers; here it will be harder to return all the money – as it should be for the Russian nouveaux riches, a large part of the kidnapped was squandered. What can we say: insurance medicine has once again proved that from a systemic point of view it is a no-sense.

Illustration: Artem Popov

Russia. According to the Bank of Russia, on February 1 the money multiplier (the ratio of M2 to M0) has reached the historic peak of 4.2 – the USA though is far away: M0 as a share of GDP there is almost half that in Russia, while the M2 is nearly 1.5 times larger – but it is a question if it’s actually good. Rosstat report on foreign investment is not happy: if you take the net (without previous investments) investments of foreigners into Russia and deduct the Russians’ investments to abroad then for 2011 it will be +6.7 billion; and the actual investments (“direct investments”) are done much more by Russians abroad than by foreigners here – it’s more loans and financial speculation which are not exactly investments to the economy. Justice News: if you were beaten in the police, do not expect compensation - the courts say that the government has not told them to beat you (this is a personal initiative of the sadists), so there is nothing to ask for. Another “assassination attempt” on Putin was revealed – they occur exactly once in 4 years (right before the elections), although there is some progress: in 2008 there was some miserable Tajik with a rifle, and now a terrible Chechen from Odessa – we guess, the following would be a respectable Anglo-Saxon from the CIA with a self-exploding stone. WikiLeaks told that the Prosecutor General Chaika was an informant of American intelligence – he told about “clan wars” in the Kremlin: no reaction from the authorities.

Source: Bank of Russia

Other things are phantasmagoric: Berezovsky “repented”, the composer Penderecki was confused with Central Election Commission Chair Churov at the opera, Zhirinovsky again went off into hysterics, and at the elections rehearsal in Moscow Election Commission, Peter the Great took victory over Alexander of Macedon, Genghis Khan, Napoleon and Churchill. The outcome of the elections is obvious, the only question is what will happen after – politics are of little matter, but a lot of interesting can be expected in terms of socio-economic decisions, though hardly joyous. Among other things: two consecutive increases in utility and transport tariffs (in the summer and autumn-winter); rise in fees for child nurseries and the deterioration of conditions in them; recently introduced (semi-explicitly) tuition fees for schools; further “optimization” of the health system; financial sustainability of theaters, museums and libraries; the rise in prices for petrol and diesel fuel; removal of the few remaining benefits – the list goes on. Of course, Putin’s election program speaks about other things (“make everyone happy”) – but we understand that they have nothing to do with reality. The reality is that the budget is facing deficit – and if the above-described process on the global gas market will start (although this is hardly a matter of months, probably more), the costs would have to be even steeper. This means that the political “fun”, it seems, is just beginning...

Have a nice week!