High road of progress

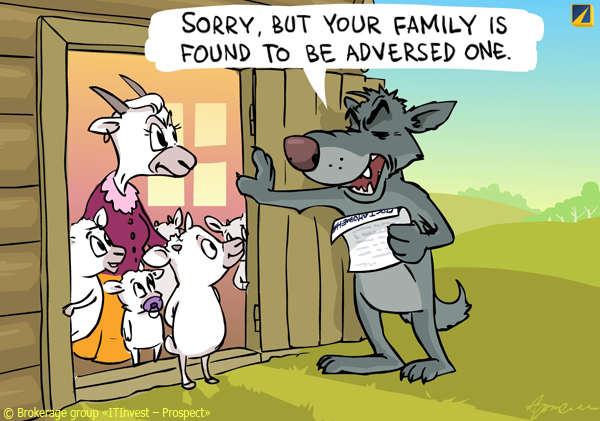

Good afternoon. The political canvas of the past week has been very diverse. Former IMF chief Strauss-Kahn is accused again – now with complicity in pimping: poor guy admitted that he regularly attended parties with prostitutes and led the “extensive sexual life” – but that he was sure that he was not dealing with prostitutes’ network; the detectives were struck with cognitive dissonance – and put Dominic-lover in jail, but released later. The democratic process in Libya has suddenly failed – no, tortures and executions still don’t concern the progressive mankind, but the country’s permanent representative at the UN was careless enough to say that “gays are a threat to the future of mankind”: that is where the human rights community got excited – they encroached on the sacred, bastards! Arabs should follow the example of the nation-leaders – Norway, for example, decided to officially deny family of a priority in bringing up children, handing them to the state: children are already being taken from the families for the “adverse education” on a regular basis (3000 per year – in a country with population of less than 5 million) – but now this process will be institutionalized; Marx and Engels spin in their tombs with fierce jealousy.

Illustration: Artem Popov

The Norwegians are not unique – Russian presidential candidate Prokhorov proposed to transfer schools into 24-hour operation, so those could be the main educators: instead of stagnant families not ready to admit oligarch’s beloved idea of bringing up the “civil society”, but instead trying to instill some anachronisms in children – such as the chimera called conscience. Meanwhile juvenal workers launched a hefty network of paid informers, with the help of which already 180 thousand families are said to be “disadvantaged” – so that their children could be withdrawn at any time: say thank you to the “Orthodox national leader” for this rapid movement of God-protected homeland via the high road of progress and freedom. But not everyone appreciates modern innovations – some, instead, do only trifle: for example, Institute of Physicochemical and Biological Problems in Soil Sciences of the Russian Academy of Sciences for some reason germinated the seeds of catchfly, which had lain in the Kolyma’s permafrost for 30 thousand years – what is that itching them? They should switch from the pointless seeds to mammoths – they should resurrect at least one: and Putin, surrounded by screaming sycophants, would kiss it in the hairy belly – that would be truly innovative, creative and progressive!

Treasuries for plutonium

Monetary markets. The People's Bank of China reduced the reserve ratio by 0.5% for the second consecutive time – down to 20.5%; another sign of cooling in China was 29% fall in bank loans in January versus the same month last year – also, for the first time since 2007, bank deposits decreased. Minutes of last meeting of the Bank of England were “dovish”: all board members voted for the expansion of asset repurchase program – two of them (Miles and Posen) would even like a marked increase in emissions (by £75 billion instead of £50 billion which were the final figure); vote to keep rates at 0.5% per annum was unanimous. But in the Fed there are confusion and vacillation: in the last discussion of the discount rate the FRB of Boston called for its reduction while the FRB of Kansas City – for the increase; the percentage actually remained unchanged. Fitch raised the rating of Iceland; S&P confirmed the figure of Japan – keeping the negative forecast. The markets were much amused by the adventures of the European scams – who tried to sell counterfeit US treasuries from 1934 at nom for $6 trillion, transported in a spectacular “antique” boxes: culprits hoped to foist fakes off on Swiss banks – and spend the proceeds partly on partying, and partly to buy… plutonium; presumably, soon it will be “suddenly” discovered that the aforesaid euro-fraudsters were hired by crafty Iranian ayatollahs.

EU has finally finished the discussions on Greece – and graciously agreed to provide them €130 billion. Losses of private holders of Athenian securities would amount to 53% - and if anyone would refuse these conditions, the Greeks will nevertheless cut down the yields by this sum; new bonds (in exchange for the old ones) will include even the GDP-tied bonds (if the economy falls investors would lose even more) – in general, default is obvious although the Europeans do their best to represent this robbery as “voluntary consent”. However, Fitch does not think so – it immediately assigned Greece the default rating: this means that there may be complications in efforts to evade paying yields on credit default swaps – and yet this is exactly what the whole “voluntary” game was all about. And the Greeks are true to themselves: right after assuring Europe in their readiness to cut spending and getting the loan, the Athenian authorities immediately informed that their budget deficit this year will be not 5.4% of GDP, as was planned, but 6.7% - however, the EU leaders are no longer angry at these things, for they now take it for granted that Greece lies anytime, anywhere and on any occasion. It’s not calm outside Greece too: Spain asks EU to allow her to have budget deficit not of 4.4% of GDP in 2012, but 5.0% - otherwise it would be really hard; Portugal is eager to revise the bailout conditions – in general, everything is sad. However, the markets breathed a sigh of relief – but for how long?

Currency markets are still not very rapid. Key rates went about their business: the euro and the Swiss franc rose, the pound and the yen (going above 80 per $) crouch; the ruble strengthened again – basically everything goes not very quick and not too confident. Expect the explosion later this year?

Source: SmartTrade

Stock markets. Major indexes strengthened a little – though trading volume is very modest. Fundamental info is definitely not for the growth of exchanges – so their stubborn growth threatens with rather sharp down-surges in the future (though hardly “tomorrow”). Reports are very grim at the end of the season – only Home Depot generally met the market expectations; the world's largest retail network Wal-Mart Stores upset with revenue (profit dropped too), as well as with modest forecast for the current year; serious problems in the market for personal computers undermined the positions of Dell and Hewlett-Packard – the latter also issued a puny forecast for the current quarter; we note the loss of Royal Bank of Scotland (plus sales drop by 17%) and 12-billion loss of Dexia. Of course, we can mention good figures of AIG – but this patient has long been more dead than alive, so it will have to please the market for a long time for it to believe the resurrection of the hapless insurer. In general, companies that are included in the S&P-500 index showed an increase in profits of 9% y/y after 15% in the preceding quarter – and for the first quarter of 2012 it is projected to increase by only 2%.

Commodity markets.Iran halted oil exports to the British and French companies – this is a response to the sanctions of Europe and America; tensions over the Persians threw price of Brent crude oil to $125 per barrel; WTI reached $109 – while the US natural gas continues to stand at perennial lows: its current price is equivalent to $95 per 1,000 cubic meters – lower than even the internal Russian prices of Gazprom, not to mention the export price (which is generally 3.5-4.0 times higher). Industrial metals have grown – especially palladium and platinum; gold reached almost $1,800 per ounce. Grain market stagnates – but forage and oil-yielding crops get expensive actively (particularly rape-seed). Beef is irresistible – new record every week: the price has doubled in the last 3 years; on the contrary, milk is actively getting cheaper –it has lost more than 15% in the last 1.5 months. Sugar, cocoa and timber grown a little while coffee, cotton, fruits sat down a little.

Source: SmartTrade

"Innovative intelligence"

Asia and Oceania. The situation in the region continues to be precarious – and it concerns not only the leading countries. Thailand's GDP in the fourth quarter has fallen by 9.0% versus the same period in 2010: of course, largely this is the consequence of the floods – but even with them, the market expected the reduction by only 4-5%. Taiwan's GDP is in positive territory – but very modestly (+1.9% y/y); and in January there was a nightmare: industrial production collapsed by 16.5% against January 2011, export orders – by 8.6%, commercial sales – by 7.2 %. It's not that scary in Japan – but still the index of activity in all sectors of the economy rose by 1.3% in December after falling by 1.1% a month earlier; leading indicators rose by 0.3% after declining by 1.1%; trade balance in January had a record deficit of ¥1.5 trillion – exports shrank by 9.3% y/y (including those in China – by 20.1%), while imports swelled by 9.8%; sales in supermarkets were 1.2% lower in January than last year – the sixth consecutive decline, although it was partly influenced by the strong snowfalls. The index of business activity in the manufacturing industry of China according to HSBC was slightly better in February than in January – but remained below 50 point mark separating growth and decline. The same rate for the services sector of the New Zealand has grown – as well as leading indicators of Australia from Westpac and the Melbourne Institute. Australian wages accelerated growth in October-December – but +3.6% y/y is still below the level of real (without official distortions) inflation.

Europe. Revised estimates of the GDP of Germany and the UK coincided with the preliminary ones – minus 0.2% for both; the British lowered the annual dynamics for the fourth quarter and the quarterly - for the third. Production in the construction sector of the eurozone rose by 0.3% m/m and 7.8% y/y in December – the latter figure is explained by base effect (it was very cold at the end of 2010 and a year later – on the contrary, abnormally warm, especially in Germany): considering the general trend, it is sad – in fact the figure is at the crisis low. Eurozone industrial orders increased in December by 1.9% against November – thanks to Italy, where there was a surge by 5.5%, although it couldn’t help annual dynamics a lot (-4.3% versus December 2010); in Britain, balance of orders has improved dramatically in February although remained in the red – and the dynamics of foreign demand was the best since August. Business activity index (PMI) for the eurozone was worse than expected in February – all sectors came back to the area of recession, although did not gone very far into it. French business confidence remained weak in February – but the Germans (business climate from IFO) still get stronger. Strong Franc has undermined the January trade balance of Switzerland sending it back into deficit. Inflation continues to slow down in Europe – though not particularly fast. UK mortgage lending was active from – and the housing signals of a rise in prices; not bad are the January budget figures. Consumer sentiment improved in February after the collapses of the first half of winter – that is said by the performance figures of Belgium, the Netherlands, Italy, France and the eurozone as a whole; in general, the situation on the continent has calmed down – but hardly for a long time, which is hinted at by the failure of retailers in Italy.

Source: Eurostat

America. Regional activity indices are a bit contradictory: the production index of the FRB of Kansas City improved in February – which is not true for the indicators of the FRB of Chicago (business activity and financial conditions). The official assessments of house prices in November and December showed an increase by 0.7% in each of two months; realty sales in the secondary market jumped in January by 4.3% m/m – but only because the data was reviewed down in December by 5.0%; sales of developments fell – but the previous month was revised substantially upwards. Consumer sentiment from Bloomberg has improved in mid-February – reaching a peak for nearly four years, but at the same time the assessment of the national economy has deteriorated; report of the University of Michigan stated an apparent rise in optimism in late-February. Applications for unemployment benefits continue to decline and have already reached the bottom since the beginning of 2009: then the rescue programs for unemployed haven’t yet been enacted – and now they expire since many unemployed have exceeded the limits of the terms of benefit payments (usually 99 weeks) and were hence deprived of benefits. In Canada, wholesale sales rose by 0.9% in December, more than recouping the fall of November (by 0.3%) – but retail sales unexpectedly slipped down (by 0.2% after +0.4% a month earlier), partly because of the weak automotive sector; weekly index of sales in the US stores has improved in mid-February – but nothing more. Overall US data is however significantly better than in the EU or Japan.

Russia. January report of the Ministry of Economic Development is strange: growth of industrial production, adjusted for seasonal and calendar factors, is 1.0% m/m – while Rosstat showed only +0.4%; but the investments and construction were estimated by the ministry at -9.9% and -5.0% m/m respectively – since not for the first year such strange dynamics are observed in January, there is a suspicion that the Ministry has messed with the algorithm for seasonal and calendar factors. The same applies to agriculture (-3.4%) – because of all of this monthly dynamics of GDP is questionable (-0.1%); but its annual change (+3.9%, considering an extra working day in 2012 compared to 2011) is quite normal for the officials – we have something around plus 2.5-3.0%, so the difference with the official numbers is quite modest. In January, net outflow of capital from Russia has continued – the MED and the Bank of Russia do argue about its size: the former’s version (Deputy Klepach) is $17 billion, the latter’s (Deputy Chairman Ulyukayev) insists on $11 billion – and both believe that in February-March the balance would become positive, which implies that the main cause of money’s flight is the presidential election.

And the election approaches inexorably: closer they are higher are the ratings of Putin – sociologists are already talking about 63-64%. Of course, the public is skeptical about these numbers – but we think that in part they are very real: population, looking at the faces of the opposition, decides to choose their current chiefs – and the flickering of Gorbachev apparently finished the job. Putin wrote a pompous article about the army (as usual, not very glittering in content); his supporters held a series of spectacular rallies – opponents answered with theirs; both sides staged car marathons – causing traffic congestion and legal irritation of the commoners; and finally the activists of government and opposition had a fist fight near Moscow City Hall in the queue for filing applications for rallies. St. Petersburg jewelers casted Putin’s bust in gold – it will be shown in the store for a month and forged into heart shaped pendants afterwards: creativity is amazing. Cult of Putin’s personality was prevented by oligarch Prokhorov’s billboards – the bosses decided that they are too large (bigger than Putin's) and decided to put them down on that basis. Medvedev gushes with creativity at the end of his term: at the meeting with opposition, he endorsed the idea to ban the third presidential term (even with a gap in time), and also admitted that the elections in 1996 weren’t “won by Yeltsin” – Putin’s team is already counting the days when this fountain will finally shut up.

Illustration: Artem Popov

Real politics are as usual – Federal Migration Service sees no reason to give Russian citizenship to multiple Olympic champion Maria Filatova (citizen of Belarus): “not enough merits” to Russia – indeed, she isn’t a hardworking alien from Tajikistan! In Lermontov (Stavropol region) population revolted against the territorial redrawing and administrative mayhem – and the rudeness of power is so unprecedented that the fasting of the city council members was even joined by a representative of United Russia: police refused to obey orders to disperse the disaffected – a disturbing signal for Putin. Institute of Theoretical and Experimental Physics has died finally: first, it was transferred to the Kurchatov Institute (headed by the distinguished member of the “Ozero” cooperative community Kovalchuk), and then there was a raider seizure, for which first a fire was set (scientific equipment for 1 billion rubles was destroyed in the fire) – someone here recently boasted that he took Russia away from the “evil 90s’”? Fundamental science is not needed by the admirers of “stability” – but they need technology, hence the notion: according to knowledgeable source, deputy prime ministers Surkov and Rogozin will launch the “innovative intelligence” project, with a broad network of “industrial espionage” – just like in Soviet times; unfortunately, today’s “Anna Chapman” is not very suitable for such task – but do we have anyone else?!

Have a nice week!