Carpet them with bombs!

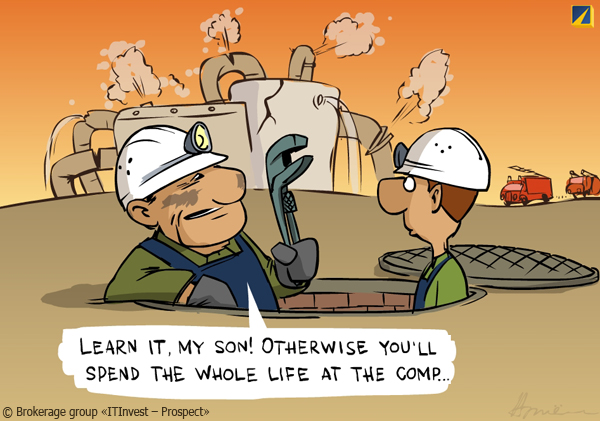

Good afternoon. Last Sunday the elections were held for the Spanish Parliament – moderate right People's Party won over the Socialists who were ruling for nearly 8 years, having obtained an absolute majority: thus, over the last year, the power was given over in all the problem states of the Euro-periphery described by an acronym PIIGS. Wealthy states have different politics – for example, in Australia, visited by President Obama a week before: simple-minded kangaroo-people threw away the plan of his travels around the country immediately after his departure – which, of course, is a secret document – a local journalist found it in a gutter 100 meters from the Parliament building in Canberra; there were the private telephone numbers of the officials of both countries – it is "under investigation". In the States the crisis takes a surreal form – a week ago, malfunction happened in the computer control system servicing the water pumps in Springfield, Illinois: so the local knights of cloak and dagger accused... Russian hackers! - That's for sure "if there is no water in the tap" in a new way. And this is not something new – the Pentagon says that attacks on computer networks should be viewed as an "act of war" with all the consequences: we’ll carpet Russian hackers with bombs, you’ll get your Olympics, ohohohoho!

![]()

Illustration: Artem Popov

Dull markets

Monetary markets. The People's Bank of China lowered the reserve requirements for five credit cooperatives – and although the influence of these organizations is small, it is still a symbolic act marking the turn of monetary policy from tightening the easing. Minutes of last meeting of the Bank of England showed that all voted to keep rates and the size of the emission at the same level – and many would like to increase bond purchases, but noted with regret that the capacity of even such a powerful market as the debt market is not enough for their appetite. Minutes of the Fed look similar – there are many wishers of further easing, but for now they prefer to wait. The Congress waits too – but this does not befit it: a special committee on budget sequestration could not agree on anything – i.e. the absolute failure. S&P and Moody's did not cut the rating immediately because of it – but Fitch threatens to do so (or to worsen the forecast) in the coming week. And the demand for US treasury bonds is great – where else to run if everything collapses? So now 5-year papers were placed under the record low yield of 0.94% per annum. Meanwhile, the threat of recession and the euro-crisis forced the Fed to start a new stress-test of banks – it is scheduled for January 9, 2012, will apply to all banks with assets greater than $50 billion (US has 31 such) and will involve a very severe assumptions (growth of unemployment rate up to 13%, drop in stock indexes by half, and housing prices – by another 20% odd). That is more realistic!

S&Pthinks of reducing Japan’s rating; Fitch cut the figure for Portugal down to junk level - as Moody's did for Hungary. Moody's threatens France – if not on the rating, but the forecast: bond rates are too big. Interest is growing throughout Europe: Spain was only able to place 3- and 6-month papers at more than 5% per annum; Italy sold six-month papers at 6.5%, and 2-year – at 7.8%. Germany continues to reject demands for greater yields – because of this the last time she managed to place only €3.6 billion in bonds instead of the planned 6.0 billion. Belgium cannot provide the necessary guarantees for Dexia bank – she asks France to share the lot, but she has mouthful of her own concerns, especially against threats to her rating. Assistance was requested by Hungary now – and urgently: when a request to the European Commission remained unanswered (EU officials aren’t in a hurry), Budapest sent a letter to the IMF and told the world about it – as a result the EU has got itself in a "family way". IMF initiates emergency lending program for Europe in terms of from six months to two years - and the size of loans can be much (by 5-10 times) higher than the recipient country’ contribution to the Fund. However, the optimism about this announcement was short-lived – it turned out that the aid is not intended for the periphery, but for those who suffered from the credit crisis “for company”: for example, for the countries of Central Europe. Well, yes: no one is going to solve all problems for the EU – and is it itself going to do something?..

Currency markets. Euro fell again – dragging the pound and commodity currencies (Australian and Canadian dollars, roubles etc.), euro-dollar came to 1.32, pound – to 1.54, Aussie – to 0.9650, rouble fell to 31.7 against the buck and 42.1 to euro – and yet it seems for us that in the first half of the winter there can be a serious correction, in which the dollar may partly give away its position.

![]()

Source: SmartTrade

Stock markets. The leading indexes continued to decline – even with some acceleration; European indices are close to the lows of September, and the Japanese broke through them – getting below the March post-earthquake bottom. And yet "Santa Claus rally" is still possible. Season report was concluded by Hewlett-Packard – and quite impressive: profit fell by 10.5 times, revenues – by 3.7%; forecast for the current quarter and year were as a whole dramatically reduced to the levels much worse than expected – in general, the corporate sector is recently being very sad.

![]()

Source: SmartTrade

Commodity markets. Oil keeps up bravely, despite the overall pessimism of the markets; precious metals sat down – and the industrial metals industry continues to topple. Grains and pulses, forage and vegetable oil are getting cheaper, while meat gets more expensive; milk fluctuates up and down at its very maximums. Cotton, sugar and cocoa fell; fruits are growing; timber ceased to fall in price.

Kremlin circus

Asia and Oceania. Singapore's GDP in July-September rose by 0.5% q/q – thus recouping only a minor part of the fall in April-June (when it was -1.6%). The World Bank cut China's GDP forecast for the next year – and even expects a “hard landing”, despite the recent stabilization. This has its reason: according to HSBC, in November, business activity in the manufacturing sector of China's economy has fallen to 32-month low – both in general, and in the component of manufacturing; and in both cases the index went into a recession zone below 50 points (48.0 and 46.7 respectively); similar figure from MNI for the entire economy (including services) remained in the area of growth, but dipped from 58.5 to 54.4 – orders are in the red. All the sadder are things in the “other China”, i.e. Taiwan: production and sales are slowing down, while unemployment is rising. Activity in all sectors of the Japanese economy has accelerated its decline in September; the trade balance for October has a deficit; sales at department stores and supermarkets continue to fall – though not as fast as before; consumer prices excluding fresh food again went into the negative – and if you remove the fuel, it will be -1.0%. In general, development of negative trends in the region is obvious.

Europe. GDP in Germany and Britain have confirmed the preliminary estimates – but the filling is different: the German domestic demand surged, playing back the recession of the previous quarter, while the British main contribution to the increase were the stocks growing actively; and in both cases, the construction sector has had the negative impact – this was confirmed by the September data, showing a sharp slowdown in orders in the German industry. Eurozone industrial orders collapsed in September by 6.4% - all the big four has distinguished: Germany slipped by 4.4%, Spain – by 5.3%, France – by 6.2%, and Italy – by 9.2%. In the UK in November the balance of factory orders fell to a minimum since October last year, including exports – since January 2010. Business sentiment worsened in November in Belgium and France, but Germany was again the exception – the index of business climate from IFO institute grew suddenly, albeit for a symbolic 0.2%. PMI of the eurozone behaved differently: the manufacturing sector deteriorated, services have improved – but the industry remains deeply in the area of recession. Mortgage permissions rose slightly in Britain – as well as consumer confidence in Italy: in both cases, the former excessive decline was being recouped; the mood of the Europeans continues to deteriorate – especially bad is the dynamics in France. Outside the eurozone it is also gloomy: unemployment began to rise in the hitherto successful Sweden and Norway – and in general analysts expect the beginning of the economic downturn on the continent already in the current quarter. Private demand is weak everywhere – here typical is the fifth consecutive monthly fall of retail in Italy.

America. The second estimate of US GDP came out much worse than the first – and although it was said that this was due to the sagging inventories, promising even greater growth in the fourth quarter, far more important is this: in the last six months private income have tumbled actively – and costs were rising, because they are cannot be cut (basic allowances go into utilities and healthcare, where it is almost impossible to save anything – as much as requested is have to be given); the savings rate fell to 4-year low – but it can’t continue for long, so spending would inevitable fall, if the spike in revenues does not happen. And there are no reasons for the latter: Americans' wages are falling for almost 12 years, losing 25.4% of the initial value (taking into account the real inflation) and have reached a minimum since as much as the autumn of 1955. But even with the immoderate surge of spending, real GDP is still in the red, if the statistics are to be cleaned of the standard distortions: the decline is 0.2% q/q and 1.2% y/y, with gross domestic income sinking by 0.9% and 1.6% respectively. In terms of per capita decline in real GDP has reached 0.4% q/q and 1.9% y/y, and for gross domestic income – 1.1% and 2.3% respectively. However the financial sector still thrives: its share in total corporate profits of the country is 48.7% - while the aggregate demand continues to shrink.

![]()

Source: U.S. Bureau of Economic Analysis, an independent evaluation

In October, spending of the Americans began to decline: however, the officials show a mini-growth – but it clearly underestimates inflation. Orders for durable goods fell in October by 0.7% m/m after falling by 1.5% in September; excluding the transport component the increase is 0.7% after a gain of 0.6% a month earlier; net capital orders (civil, excluding aircrafts) fell by 1.8 %. Regional indicators of business activity (from the Federal Reserve Bank of Chicago, Richmond and Kansas City), roughly speaking, zeroed in November – new orders and employment are bad, but production still lives on the previous demand. Sales of existing homes rose in October due to the newly accelerated foreclosures. Consumer sentiment on versions of Bloomberg and the University of Michigan have changed slightly in late November – and were generally very gloomy. Number of recipients of unemployment benefits rose last week by 68 thousand, and with the revision of previous numbers – by 83 thousand. Wholesale and retail sales in Canada looked beautiful in September – mostly due to the recouping of falling supplies after the earthquake in Japan. Sales at US stores haven’t gladdened in mid-November – but the holiday season may still breathe a little life into them.

Russia. Elections are getting closer – and the fun flares up. Rosstat revised the numbers for last year’s construction: -0.6% turned into +3.5% - not bad, ah? Because of this “adjustment” the third quarter of this year sagged – they were already sharply dropped: the annual increase in July became 12.8% instead of 17.6%, in August – 5.5% instead of 12.4%, in September – 4.8% instead of 16.5%. It seems that in this case one would need to weaken the GDP growth in July-September: there it was – it remained unchanged at +4.8%. Then the dynamics of wholesales in the first half of this year went under revision: in the first quarter it was -1.5%, but now +3.4%, and in the second from +3.1% was created out of -2.1%. Even the insanely inflated retail has swollen – though much weaker (added 0.3% in January-March and 0.2% in June-September). The parade of postscripts was joined by the Ministry of Economic Development: in October its GDP grew by 5.6% versus the same month in 2010 – in the previous review we supposed that number, while in reality the economy has expanded by only 3.0-3.5%. This is despite the fact that even according to official data real disposable incomes of Russians fell by 0.6% m/m (in fact, the fall is at least of 2.5-3.0%), and the unemployment rate adjusted for seasonal and calendar factors rose from 6.6% to 6.8% - but GDP still gallops, ordered by Putin! Presidential elections are due in March? Well, a further 3 months of statistical pandemonium are guaranteed.

Political clowning is already in full swing – the Canadian Circus du Soleil has settled in the Kremlin for the next 2 months: apparently, it was given the sacred knowledge of mass cheating techniques – now so valuable to the Kremlin inhabitants. And some do not hesitate at all: for example, the guys from the OGK-3 energy giant, led by Boris Kovalchuk, put their money on deposit with record-low interest rates into Gazprombank and Rossiya banks, which coincidentally are controlled by Boris's father, Yuri Kovalchuk – scoffs recall that there is also Kurchatov Institute, headed by Yuri’s brother Mikhail Kovalchuk. Adviser to the government, prominent liberal Mau, gave an interview to Spanish newspaper El País – on the charges of growing gap between the rich and the poor he replied that “the Russian don’t like social justice”: is not such rudeness good enough for the proverbial 282-th article? In fact, various articles threaten others: MSU students were arrested again – they had the audacity to protest against the Student Union’s entry into the People’s Front; by the way, the article on this topic has quickly disappeared from the site of one of the leading news agencies of the country – apparently it was called from some place. Besides students, the authorities are hampered by international observers – those recently rebelled about the exact match in posters design of the Central Election Commission and EdRo: the former’s head Churov slander the critiques, and now came up with a punishment – he wants to force foreigners into the tundra, so they could check upon the integrity of Taimyr reindeer breeders’ voting.

Nizhny Novgorod election commission banned the Communist comics about Putin – he can only be illustrated with his written consent. But the United Russia’ Young Guard concocted a whole calendar from the comics about the opposition – and lo! It was published without any permission. All of this angers the public – United Russia’s rating falls; the president, as usual, got lost – and, realizing that the bear could not catch the mice, Putin took it over himself. He explained to colleagues in the party that if they do not win elections, then Russia will live as the USA and Europe (what a nightmare!) - Because the crisis there is due to absence of their own United Russia, “consolidating the society”. But the premier’s better times are gone – even in the parliament (which is known from Gryzlov, is “not a place for discussions”), Putin was met with opposition’s demonstration of disloyalty. Premier was placid, congratulated with the “100th anniversary of Russian parliamentarianism” – but then met with the United Russia fraction where admitted that in the midst of crisis he thought to deprive Duma of authority. Putin also came to a box fight, visitors of which are usually appreciative to his rudeness – but there his speech was met with hostility. The bosses swept in search of explanations: the Press Secretary, of Nashi said that the guilt is on “22 000 beer-full bladders” – presumably, when the EdRo agitator was booed at a hockey match, the men, too, hurried to the bathroom. The CEC should urgently check the toilets at all polling stations – or, God forbid, even Taimyr reindeer breeders would not vote for EdRo in front of the foreign observers’ eyes!

![]()

Illustration: Artem Popov

Have a nice week!