Papa of demos

Good afternoon. The last summit of G20 was something quite outstanding even compared with the usual stupidity of such activities – there is a crisis around, but the world leaders are only able to put a single more or less concrete thing into the final communiqué: you know, they want to fight tax evasion! Bu there’s a lot of news around the Sabbath: reporters overheard a private conversation of Obama and Sarkozy – the latter said that Israeli Prime Minister Netanyahu got his goat, rousing a full understanding of the former. In general, Nicolas has been recently sick of everyone (swore at the British PM Cameron) – but he was presented with a daughter, with what he was congratulated by Obama, though originally: I hope, he said, the child will be like mother, not father – high diplomacy! “The treasures of Benghazi” – collection of Hellenic antiquities, including thousands of gold and silver coins – disappeared from the repository of the Libyan national bank: all revolutionaries are alike – the profit for them is holy a “Armand Hammers” of all sorts love revolutions. CIA is on the watch: it monitors social networks around the world – a department called “Library Ninja” was created for the matter. Of natural elements we note earthquakes in Japan (this time in the south), USA (Oklahoma), Turkey and Nicaragua.

![]()

Illustration: Artem Popov

Italy, France, and beyond?

Monetary markets. Bank of England left on the same level both interest rate (0.5% per annum) and the plan for purchase of assets (£275 billion) – as expected. Otherwise, the eurozone dominated the news – to understand why it suffices to note that, for example, the largest US firms (those included into the S&P-500 index) sell on average 29% of its products in Europe: therefore, crisis in the latter is fraught with serious fall in demand for goods and services of companies around the world. European stabilization fund began to issue bonds on the market –45% of the first issue was sold in Europe and 25% in Asia; the Japanese bought 10% of the emission, which amounted to €3 billion. Greek Prime Minister Papandreou has finally left his post – he was thought to be replaced by the Speaker of Parliament, but politicians have decided that the government will be headed by former vice-president of the ECB Lucas Papademos – well, who if not the owner of such a name is to become Pope to the demos of the ancient whimsical country! Meanwhile, Moody's lowered the rating of Cyprus by 2 points – her banks are heavily tied with the Greek debt; and since Cyprus is used in the major cash-streams of our crooks and thieves, the authorities Russians immediately gave the country a loan of €2.5 billion – well done!

Now the crisis is in Italy: Berlusconi is attacked by all, including members of his coalition – as a result, Don Silvio also had to resign, albeit with a delay until the parliament adopts the new plan for budget savings. Bond yields of Italy reached a peak since 1996 at over 7% per annum – it is at this level when Greece and co started to whip; but it will be something really big if the country with a debt of nearly €2 trillion will ask for a bailout – in the meanwhile, leading clearing houses (LCH.Clearnet, CC&G) have raised margin requirements for Italian bonds. French are anxious – by the mid-year their banks accumulated 416.4 billion worth of Italian securities (106.8 billion public, 309.6 billion corporate), so now the yields creep up here too as do the rumours about rating reduction. In response, Prime Minister Fillon prepared a budget for 2012 which he compared with the budget of 1945 in terms of austerity measures; severe cuts are already in place (deficit has gone down) – that reflects badly on economic indicators (of which below). Germany and France want to divide the eurozone in half – the Northerners will continue to integrate, while the periphery will be given off to their fate; a new norm being prepared to be able to expel the country out of the eurozone, without exception from the EU. That is symptomatic...

![]()

Source: TradingEconomics.com

Currency markets. Head of the SNB Hildebrand said that he does not like franc rising in price again – traders got scared and the franc fell. The yen began to rise again – the Japanese would be happy to repeat the intervention, but it is not easy: last time they bought as much as $60 billion - and to do regular interventions of such an epic proportions is very risky. Euro fell due to the difficulties of its periphery, but took revenge quickly – like the pound; in general, FOREX is calm.

Stock markets. The leading indices fell - although not hard and they recouped briskly; however, the Tokyo Stock Exchange is at the lows since after the earthquake in March and repeated in September. The market is anxious to understand future developments in the eurozone – and not only there. Reports aren’t numerous - we only note good indicators of Cisco Systems, as well as the overall optimism of Walt Disney and Nvidia.

![]()

Source: SmartTrade

Commodity markets. Oil rose due to new rumours – now they say that the global champions for the good (someone else’s, of course) are going to bomb Iran; the natural gas, however, continues to fall in price. Metals (both precious and industrial) sat down slightly; cereals have fallen into a stupor – except for rice, which fell; pulses and forage got cheaper; meat (especially beef) and milk, in contrast, continue to rise in price; cocoa and timber are still not in demand.

Sheep and dips

Asia and Oceania. Orders of Japanese engineering companies fell in September by 8.2% after 11.0% surge a month earlier; activity in the services sector, leading indicators and the index of economic observers continue to decline; consumer sentiment stagnate at low levels; bank loans, however, showed an annual increase for the first time in 23 months; trade balance at October 1-20 has suddenly went into deficit – exports is negative versus the same period in 2010, while imports jumped by 15%. Business activity in the Australian construction sector remained in the area of depression; business and consumer confidence was cheered up by the central bank’s rate cut; the trade surplus slightly shrank in September versus August; mortgage lending continues to expand, while the number of vacancies – to go down; employment grew slightly in October due to active hire by energy companies in Queensland (without this there would be a negative). The annual dynamics of exports from South Korea and the Philippines reached the 2-year bottom – the same happened with China, where the trade balance recovered a little from the dip in September, but was much worse than expected. Capital investments in China are staying strong – but the bank loans resources to fund these investments are slowly exhausting: debts are many, and their quality is low; however, for a while the credit continues to expand aggressively – but monetary aggregates are slowly subsiding; industrial production and retail sales are slowing down – in response, prices calm down too.

Europe. Spain's GDP in the third quarter showed zero growth – the numbers of other countries will, probably, confirm the stagnation in the eurozone (except for Germany, where something like +0.5% is expected); the European Commission has cut GDP forecast for 2012 from +1.8% to +0.5%. In September, production had fallen in Norway (by 0.1%), Italy (by 4.8%), France (by 1.7%) and Germany (by 2.7%); in Britain it remained unchanged, and only increased in Sweden – but +1.3% is not impressive after -3.1% in August, industrial orders fall here too. French business optimism evaporates, while investor confidence of the eurozone from Sentix fell to the lows of autumn 2009. In September, in the trade balances grew both surpluses (Germany) and deficits (France and Britain); London’s negative has become record worst – and the figure for August was revised significantly downwards. Wholesale prices in Germany shrank in October by 1.0% and have not changed in Britain – but consumer prices did not retreat: they grew everywhere – except for Switzerland (-0.1% because of the still expensive franc) and the British retail (strong competition for a shrinking demand creates waves of discounts). The British housing has fallen in price – but sales have grown: the sellers come to terms with reality and no longer seek unrealistic bargains. Consumer sentiments have become clearly worse in Switzerland (SECO) and Britain (Lloyds); the latter also saw the balance of vacancies with permanent employment going into negative, according to KPMG/REC. Of course, in such circumstances, the demand nailed: Euro-retail fell in September by 0.7% m/m and 1.5% y/y. And it has nothing to do with the periphery: the Germans, even according to official data, had the peak of sales in 1992 – and when adjusted for inflation distortions, real retail has already rolled back to the levels of late 1960s’ and early 1970s’.

![]()

Source: OECD, independent evaluations

America. In the USA, confidence of the small business has grown up a little in October as did the index of economic optimism from IBD/TIPP in November; indicator of financial conditions of the FRB of Chicago was almost unchanged at the beginning of this month – all these figures fluctuate at very low levels; exactly the same can be said about the index of consumer sentiment from the University of Michigan. US trade deficit declined unexpectedly in September due to progressive growth of exports; Canada suddenly went into surplus – thanks to swollen export, especially to the United States. In October, US imports and exports prices declined, the housing became cheaper too – while in Canada it still gets more expensive, while the number of developments is impressive, exceeding 200 thousand. US consumer comfort slightly improved in early November, according to Bloomberg – but that is simply associated with holiday season, while the evaluation of financial situation was the worst since October 2009. Wholesale sales are still growing – but inventories decline: traders expect the fall in demand – and are in no hurry to fill the stores with goods. Retail sales also grew in early November – but in general over the last year they swelled in size even smaller then the official inflation rate (+2.7% from ICSC-Goldman Sachs and +3.1%, according to Redbook): Americans do not have enough money.

Applications for unemployment benefits are less – but not because there less unemployed, but because the terms of payments are limited (people drop out of the beneficiaries); local programmes fix the matter a little – and yet, for the first time in a very long time, less than half of the people officially recognized as unemployed are eligible for benefits; this, of course, further undermines the private demand – but what should you do? Demand outside the USA is bad too; for example, in Brazil, car sales are in the red for 7.4% y/y – because of this, manufacturing in the industry fell by 10.7% in October against the same month of 2010. Cars and education have inflated consumer credit in September (from autumn of last year, student loans aren’t paid by the banks but by the state) – Americans are trying hard to keep the familiar standard of living, borrowing more than they should. And the mortgage overdue has went up again – according to TransUnion, in July-September a minimum of two payments was missed by 6.44% of homeowners against 5.82% in April-June and 5.88% a year ago. And if we take the incomes of Americans without regard to loans, then there is a new record for the number of poor – there are now 49.1 million under the revised methodology of Census Bureau; the main increase was given by elderly; poverty rate among Hispanics surpassed the figure for the blacks for the first time in history. The state's ability to help people is almost exhausted – last week there happened the biggest municipal bankruptcy in the US history: Jefferson, Alabama, went bankrupt with $4.1 billion due. Wait for more!

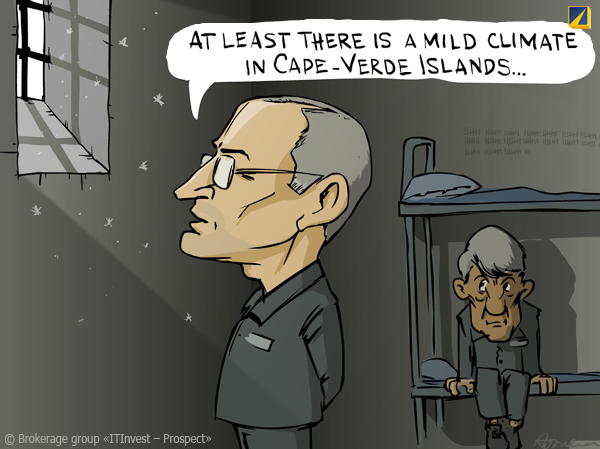

Russia. As we expected, by early October the situation with the liquidity of banks has improved slightly – but weaker than expected; moreover, judging from the components of the monetary base, given by the Bank of Russia, at November 1 the situation has became worse again – money departed from the accounts again, while prospects do not look brilliant. The base itself declined in October by 2% m/m, while annual growth was only 4.4%. Another rating of business conditions placed Russia at number 120 – a year ago it 124, so the progress is obvious: instead of Uganda, our competitor now is Cape Verde – here it is appropriate to recall the old hit-song of Alla Pugacheva “We are outrun by all those who wish, people are laugh at us. Only once did my father bravely took and passed a bike”. Tajiks of St. Petersburg were inspired by something else – perhaps by Paganel, who said “one day, instead of throwing out my cigar, I’ll throw out myself!”: on bringing the body of dead relative, they reported that he tried to kill a sheep with the knife, but instead killed himself, and exactly in the heart - investigators did not believe, and quickly found out that there was no sheep, but another Tajik who killed his fellow countryman. Pilots of Yakutia airlines have used marijuana and hoped, in such condition, to take Boeing from Magadan to Moscow – fortunately, they were caught: but the fact itself, um...

![]()

Illustration: Artem Popov

Authorities are still prone to feats. They want sweet wine not to be called “wine” – this will allow imposing duties on them; since this segment is dominating in our market, fat profit is expected. In Vladivostok, sewage treatment facilities were pompously opened – with a strong emphasizes of the enduring role of EdRo in their construction; soon, as usual, the new construction collapsed – near the broken sewage tube someone maliciously wrote in red ink “The dip of the United Russia”. Not less pompous the Bolshoi Theatre was opened - the first show was only seen by union members, sorry, those with invitations from the presidential administration, then after that the mere mortals have been given access: they were proposed with an innovative performance of “Ruslan and Ludmila”, where Ruslan wore jeans and this was the most innocent of innovations – at the finale, the lovers of the classical opera booed the director, while music fans have freaked out against the repair which killed all the acoustics. The ratings of tandem continue to fall – the authorities react nervously: Medved complains about the stupidity of media, while officials are increasingly and openly hyping the program “Money in exchange for votes for EdRo” – but what should they do if the president threatens to dismiss governors for bad figures? Loony-house...

Have a nice week!