Drug crisis

Good afternoon. Political news was mostly exotic last week. In Ukraine, Tymoshenko was sentenced – for selling off to the Muscovites who severely infringed gas interest of the country. Yanukovich blindly copies Putin – but in a petty and farcical form; the long-braid Julia found herself the EU defenders – so perhaps she will be pardoned: she is not Khodorkovsky. In Australia, the popularity of the ruling Labour Party has dropped to 28% versus 43% a year ago (19% lower than the opposition) – as the sensible people have warned last summer when Madame Gillard overthrew PM Rudd: in 12 months the cantankerous woman managed to mess up with the economic (especially industrial) policies, prices, national security, education and health care – although the Treasurer Secretary Swan being named the world’s best finance minister; however, for Kudrin, his predecessor in the title, the honour has soon turned to sorrow. There are also issues with the national security in Britain – Defence Minister Fox carries with him his co-habitant male “wife”: the press wondered whether the “friend” and “flatmate” (as he was tolerantly styled) had access to secret papers – for the minister pretended him to be a formal “adviser”. In the United States, the drones suddenly got ill – they were infected by computer viruses on the Air Force Base in Nevada; but the Pentagon asserts that the insidious enemy will be defeated!

Finance Ministry is closed – all gone on strike

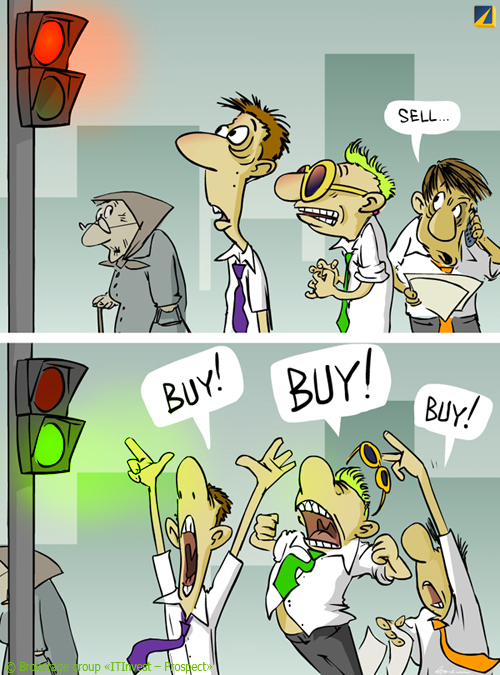

Monetary markets. South Korea’s central bank left the interest rate unchanged at 3.25%. Minutes of the meetings of the Fed and the Bank of Japan showed the growing numbers of the supporters of further monetary easing – however, there is opposition too, especially in the Fed where the division today is unprecedented: two are for the third round of quantitative easing, while three are against the modest “Operation Twist”. Market ups and downs reflected gloomily on the major funds’ balance sheets: for example, John Paulson’s Advantage Plus hedge fund has lost 47% of its assets since the beginning of the year (19.4% in September alone); the fund speculating in gold shrank in September by 16.4% - although the gold itself has only cheapened by 11%. Sydney-registered Global Trading Strategies hedge fund, founded by three ex-Goldman Sachs traders, was flourishing only until 2008 – when the markets began to fall, it fell down too: now it had to close down altogether, returning money to the clients. In China, there happened a wave of small businesses’ bankruptcies: tightening of the previously loose lending regime took its toll – now the State Council has to step back, facilitating borrowing for the companies; all of this is reminiscent of a drug addicts’ futile attempts to get off the needle – and the picture today is similar across the world. However, this image is risky: Advisor to the Italian Prime Minister Giovanardi discovered the real cause of the crisis – it turns out, the junkies-traders are to blame, for it is they who rock the stock prices; the creative official wants to introduce mandatory testing for cocaine and other drugs for all stock traders, as well many other people, including politicians.

![]()

Illustration: Artem Popov, ITinvest

Greek comedy continues. The trinity (EU/ECB/IMF) has completed the fifth inspection in the country and complained on insufficiency of the austerity measures – yet graciously noted some progress in this sphere and promised to deliver the next €8 billion tranche in early November. Of course, all this is nonsense – the official numbers make that absolutely obvious: in January-September the deficit of the treasury of the Athenian government was 15.3% higher than a year ago – and since economy at that time was collapsing actively, the hole has reached 16% of GDP; if this is a “success” then only an Orwellian one! The Hungarian Prime Minister Orban is surely correct to say that Greece would not be able to pay on her debt – and everyone are well aware of that. So, the question is on what part of the debt the Greeks will default - private institutions are especially worried, having graciously allowed to persuade themselves to the loss of 21% of their investments, while previously they refused to take any such steps; now it turns out that this is already unrealistic – actually we are talking about the truncation of 50-60%; the Prime Minister Papandreou is to discuss details in Brussels - where the EU meeting is scheduled on October 23. In parallel, the EU stabilization fund will be expanded – the last bastion on this path was Slovakia, but after much wrangling she nevertheless endorsed the reform of the fund. All this creates the illusion of activity – but the Greeks would not have been the Greeks, if not to have turned this swarming into a farce: in the midst of all sorts of talks the Greek Ministry of Finance announced... a 9-day strike, which starts on Monday, October 17.

Rating agencies are going berserk. Fitch downgraded the sovereign debt ratings of Spain and Italy, leaving the forecast negative; S&P raised the risk assessment in the banking sector of Spain, and then cut the country’s rating; Moody’s has put Belgium in the list for decreasing; Fitch threatens to cut the rating of Portugal before the end of the year. Spain, as it turned out, was not able to cut the deficit compared with the last year – despite plans of spending cuts. Logically, Fitch and S&P lowered the ratings of the country’ leading banks – including the two largest ones (Santander and BBVA); the former agency at the same time kicked the Italians (including Intesa Sanpaolo), promising to do the same with others (including UniCredit). No matter how the Brits tried their turn had finally come: Moody’s and Fitch cut the ratings of several major banks, including Royal Bank of Scotland and Lloyds TSB – similar fate threatens Barclays. And finally, Fitch cut down UBS and wants to do the same with the global monsters: Bank of America, Morgan Stanley, Goldman Sachs, BNP Paribas, Societe Generale, Credit Suisse and Deutsche Bank. Authorities of France, Belgium and Luxembourg continue the rescue of Dexia – it has bad assets for at least €150 billion, guarantees were issued under these. Leaders of Germany and France, Merkel and Sarkozy, have met once again – and accepted the inevitable: recapitalization of euro-banks is coming. Interestingly enough they haven’t quite agreed yet – the French want banks to have access to the money of stabilization fund, but Angela is yet against: the banks should seek money themselves, and in case of problems they should be helped by Paris, but not the entire EU.

Currency markets. Bucks collapsed for almost the whole week: euro jumped to 1.39, pound – to 1.58, the Swiss franc – in 0.89, the Australian dollar has returned to levels above parity with the US counterpart. The US Senate has passed the bill imposing sanctions against countries that actively decrease its currency’s exchange rate – but the House of Representatives yet jibs, at the Republicans’ initiative. The Chinese are already cursing – a violation of international norms, they say, and, in general, you’ll get the deserved! In our opinion, this is a prototype of what is to happen in the next few years – all countries will take similar measures, for their time had indeed come; therefore, there would be an inevitably and strong pullback in the globalization process – and that is good!

![]()

Source: SmartTrade

Stock markets have turned around wonderfully and took-off – although there is no reason for fun, but the ghostly hopes for euro-mess to calm down. The secret is simple – the invisible hand of the market was helped by the authorities of the leading countries: for example, the Chinese state-owned Central Huijin Investment fund has been actively buying up shares of the country’s largest banks when their prices dropped below the bottom of 2009 – and there are no doubts that the same was done by other powers, but their relationship with different pocket-funds (private ones) is less obvious. Reports season for the third quarter has started with an embarrassment: Alcoa profit is 1.5-1.7 times lower than expected – you'll laugh, but, judging by the company CEO Kleinfeld’s statement, this is also due to the European debt crisis! PepsiCo is not bad – thanks to the acquisition of the Russian Wimm-Bill-Dann, which sharply increased sales and profits of the group as a whole; it is characteristic that the company plans to repurchase $2.5 billion worth of its shares on the market – also a way to raise the stock prices. The report of Google is good, but J.P. Morgan Chase disappointed with declines of profits against the background of stable revenues – and referred to the “grave situation” in the industry. Austrian Erste Group bank shocked with the warning of a loss of €1.5 billion in the third quarter – instead of the solid profits expected. We’ll also note the Russian innovation: the January holidays have not gone away, but in these days, except for 1 and 7 (in 2012 these are Sunday and Monday), exchanges, regulators and the Bank of Russia, conducting all the settlements, will work. The law is not written for the fools?

![]()

Source: SmartTrade

Commodity markets have been growing actively – despite the undermining of optimism by China: she published the size of her reserves – it happened to be that, for example, she has 1.9 million tons of copper instead of expected 1.0-1.5 million: that is more than the USA consumes in a year – and if so, at the deceleration of global demand the Chinese need for metals will fall, for the inventories are already great. China’s policy of foreign expansion has caused envy of the Japanese – they went the same way: the authorities actively encourage the business to use the expensive yen for purchases of foreign firms that produce raw materials and fuel, so desired by the Japanese industry – these operations are financed by the local Bank for International Cooperation, headed by former Deputy Minister of Finance Hiroshi Watanabe; at the moment, the size of the program is $100 billion. Food, forage and raw textile are trying to rebound from the recent local minima – despite the fact that, for example, meat, rice, fruits and sugar have not particularly fell in price, so they are now quite close to their peaks.

Where should the poor “investor” ramble?

Asia and Oceania. According to the OECD, leading indicators fell in August across the world by 0.5% - it is unclear, however, why the indicators are called “leading” if they are published with 2 months delay: again Orwell? Heavy machinery orders in Japan are jumping: in July they fell by 9.2%, but soared in August by 11.0% due to electrical goods (+29.5%). Activity in the service sector of Japan has reduced – as well as the indices of economic observers; in Australia the business confidence remains nailed. Japan’s current account balance was in the three times smaller plus than a year ago in August; the trade balance went into deficit – but it seems to became active again in September (for a while there are data only for the first 20 days of the month). China’s trade surplus continues to contract – in September it was $14.5 billion against $17.8 billion in August and above $30 billion in July; the US trade balance is at its peak – much to the annoyance of the Americans. In Japan the lending is weak – but in Australia it shows the signs of life in the mortgage sector. Consumers of Japan and Australia are a little more cheerful – but still pessimistic. In Australia, the number of jobs is ever smaller – but the employment in September has avenged the August defeat. Monetary aggregates slowed down sharply in China, as did the bank loans and the Treasury reserves (+$4.2 billion for the third quarter – a minimum for 11 years); prices have calmed down too. Chinese growth is due to wild emission – the local authorities’ debt soared in the heavens: at the end of last year it was $1.7 trillion; and at that the authorities of Liaoning province, for example, were overdue for 85% of the debt payments in 2010 – in general, even the officials agree on up to $450-500 billion of potentially non-performing loans, while the independent assessments are three times greater.

Europe. According to the NIESR, in July-September the economy of Britain has revived – GDP grew by 0.5%; but this is temporary. German experts sharply (by 2.5 times) reduced the forecast of economy growth in 2012 – soon it will be a commonplace throughout the world. In August, industrial production grew in most European countries: Italy pleased most (+4.3% m/m), allowing the eurozone figure to jump by 1.2%; slightly less optimistic, but positive are France (+0.5%) and Britain (+0.2%; manufacturing sector -0.3%); Netherlands sat down by 0.6% and Germany – by 1.0%. Business sentiment from the Bank of France has deteriorated again in September; investors’ confidence in the eurozone, according to Sentix, declined again in October. Trade balances were delighting in August: in France, Britain and the eurozone the deficits have declined, and the Germany's surplus has grown significantly – and only Italy let down (passive has expanded greatly). Inflationary roll has continued in September – consumer prices rose in the eurozone by 3.0% y/y, in Germany – by 2.9%, in Italy – by 3.6% (3-year peaks); German wholesale prices have swollen too – but in Switzerland the deflation continues, for the franc is still very expensive, despite the strong fall since September. The British labour market is horrible: in June-August, employment fell at the worst pace since the summer of 2009 (by 178 thousand), while unemployment grew to a maximum since 1994; salaries and bonuses swelled by 2.8% y/y – although even the official CPI is 4.5 %, while in reality it is around 7-8%. Private demand shrinks...

America. In September, the US index of confidence in small business from NFIB grew a little – as did the indicator of economic optimism from IBD/TIPP in October: the figures are still at the recession levels. Canada’s trade deficit has widened in August against July not as much as was feared; the deficit in the United States has remained exactly the same as in the previous month amid rising exports and imports. In Canada, the stagnation in prices of construction developments continues (+0.1% in July and August) – but the volumes have grown dramatically: in September there were 7.3% more new houses than in August. Indices of the US consumer sentiment from Bloomberg and the University of Michigan are ranging around long-term lows; the indicator of employment trends falls down; at the end of September the total number of unemployment benefits’ recipients has hit the maximum since mid-May. Against this background, the failure in the Senate of the Obama's bill with a plan to create new jobs does not add optimism – as does not please the unexpected fall of consumer credit in August: however, the latter fact is not yet a trend. As the bankruptcies of cities – on Thursday, Harrisburg, the capital of Pennsylvania, went busted: it is unable to pay on its debt of $300 million – the creditors (all as one are from the Wall Street) are in a rage, but can’t do anything. And the billionaire Rajaratnam was put in jail for 11 years for fraud and insider trading – the hard times came: where should the poor “investor” ramble? Sales of the Canadian manufacturing jumped in August by 1.4% - thanks to cars recovering after the Japanese earthquake. The US retail sales for the same reason rose in September by 1.1% - without cars and petrol the increase was 0.5% for the second month in a row; and though the real inflation eats it all down, still, in today's situation, the numbers are not bad.

![]()

Source: University of Michigan

Russia. Federal budget surplus reached 5.9% of GDP in September due to the sharp seasonal compression of spending; as a whole for January-September the surplus accounts for 2.9% of GDP. On September 1, the ratio of bank reserves to deposits reached a new low at 32.3% - but judging by the monetary base statistics as of October 1, here should be an improvement up to 34-35%, but that is still much worse than in worst crisis moments of the past years; the very base was 4.0% higher than a year ago. Lack of liquidity in the banking system is seen not only from the feeble reserves, but also from the banks’ policies: they have been actively raising interest rates on loans being placed and deposits attracted – against the background of decreasing inflation this is an unhealthy symptom. Habits of the authorities are former: FSB buys 23 TV sets for an average price of 400 thousand roubles for a piece – businessmen argue that even the models more expensive than the stated ones cost much cheaper: the checkists stand on their own, citing the “operational necessity”. You can’t forbid living nice – before this occasion the knights of cloak and dagger had already got hold of a motor boat, a garbage-lorry and even a hearse: they bought only luxury and top-notch versions. The friends of the deep-drilling office from the party of crooks and thieves, too, have lost no time – trying to sue the blogger Navalny for 1 million roubles for the fact that he has violated their dignity and honour: so far unsuccessfully. But the crooks and thieves of a lesser degree have hard times nowadays: the other day a Sberbank branch was robbed in Moscow – in masks and with guns; the robbers have claimed as much as 100 thousand roubles – apparently, the honour and dignity of Gref weigh an order less than Gryzlov’s!

![]()

Source: Bank of Russia

Have a nice week!