Long and idle speeches

Good afternoon. Political canvas of the past week mainly consisted of the now-usual word-spouting of the officials of different levels – quite meaningless, though abundant; in general, the picture in the more or less developed world is ever more similar to the late Soviet Union – black and thick eyebrows, long and idle speeches. Of the other things we note an unusually soft speech of the Cuban Foreign Minister Rodriguez, who was by all means giving to understand that his country wants to normalize relations with the United States; the Americans answered “let’s see”, making Fidel Castro to plunge in rebuke full of wrath and sarcasm. The authoriuties of China have different problems – they have called on the Dalai Lama “not to reincarnate to just anybody”: Tibetan leader is old and it’s time to look for a successor – but so as not to incarnate anyhow in anyone, but only in one whom the Beijing government will approve! A “sovereign Lamaism”, you see.

Euro-bazooka

Monetary markets. The past week has presented an abundance of lengthy and picturesque speeches. The G20 and the IMF gathered last weekend – as always, the result is impressive: it is reported that “the global economy has entered a dangerous phase” (and who would have thought!), which requires an “exceptional vigilance, coordination and readiness to take bold actions” (IMF); world leaders “are committed to a strong and coordinated international response to address the renewed challenges facing the global economy” (G20) – so let us rejoice with the freshness of thought and the force of spirit of the global bureaucracy! Baton was picked up by the ECB - board member Yves Mersch said that the hope of rate cut is unrealistic: “These wild expectations only show that people lost their sense of direction – the ECB has one needle in its compass”; oh, what an imagery! - But that is not all yet. Lorenzo Bini-Smaghi, Mersch’s colleague on the governance board, assured all that the central bank has the “bazooka”! – and, though, monetary policy is not a panacea, but everyone would like to avoid “the second Lehmann”. The funny thing is that the word “bazooka” was used in July 2008by the then US Treasury Secretary Henry Paulson while asking Congress for money to help the markets: “If you’ve got a bazooka, and people knew you’ve got it... you’re not likely to take it out”; however in practice, just after that the crash of Lehman Brothers has happened – and off they went. It looks like we are to expect the repetition – but such a “verbatim” repetition?!

![]()

Illustration: Artyom Popov, ITinvest

According to the Frankfurter Allgemeine Zeitung, the IMF wants to expand its balance almost by half, with rumours that the fund actually looks for a much greater increase – with what money? And then the US Treasury Secretary Timothy Geithner has blabbed out – he happily announced in a TV interview that he “scared the EU to death”; when it became known with what exactly he did that, even the experts froze open-mouthed in amazement – it turns out, Geithner proposed... to speculate on the European stabilization fund! Many speculators trading on the financial markets have marginal accounts which allow for more open positions than the real money you have would allow: the broker provides the “leverage” – but in the event of adverse price movements in the market he declares “margin call” and forcedly closes positions. So, that is what advised by the American swindler – he says, give out loans from the fund with the shoulder of 10: create a credit derivatives, for which the stabilization fund will be the guarantee – and flood the monetary system with several trillion euros (which actually don’t exist). Freidmanism in a distorted form: if you print a lot of money, then things will get better – and there will be no “margin calls”; and what if there will? This idea beheld the cheater-Timmy already when he was the head of the FRB of New York in 2008 – the Congress considered it inadmissible then, but the Geithner’s passion has not quenched. The Germans were outraged and called the plan “a stupid idea” – telling the USA to restore order at home and only then give advice to others. The advice is good: this kind of projects have already created mortgage chaos which the States have not sorted out yet.

British Foreign Office said: “The euro zone is a burning building with no exits; it’s a historical monument of collective folly” – how do you like to hear something like that from the officialdom? Greek Ministry of Finance pathetically exclaims that if Greece would not be saved, the whole euro zone will perish – and to save her a “Euro-Atlantic axis” has to be created: apparently, so that all the Geithner’s frauds could be easily implemented. Athens Parliament passed another package of austerity measures – including increases in housing tax; a new strike broke out in response – all is familiar. The reality is: the national debt of the country has increased in 2011 by 10% of GDP and has already reached 150%; because of “austerity”, the economy has fallen by 7% this year (and this is not the limit) while unemployment rate has increased to 16%; deficit of the balance of payments accounts for 8% of GDP; depositors are pulling money out of the country’s banks; yields of short bond are over 100% per annum – all the figures are clearly worse than they were in Russia in the summer of 1998, so the default is imminent. Head of the German IFO institute, Hans-Werner Sinn confirmed this with a simple logic: the Greece’s problem with the balance of payments deficit is due to low competitiveness –the latter could be restored only through a 1.5 times deflation in prices and wages which is, of course, impossible; therefore it is necessary to remove the euro and put back the drachma, convert the country’s debt into the latter and devaluate the currency. Sooner or later this will happen – and in the meanwhile the Germans grumble at the “bailout plan”; an Austrian member of the ECB Ewald Nowotny has even warned that Germany feels “it is passed over” – and she can fall into protectionism.

Banks of the euro zone have sent record amounts in deposits at the ECB, fearing to trust them to each other through interbank loans. US banks have introduced fees for payments with debit cards – consumers are dissatisfied. In Asia, Latin America and Eastern Europe the emission of corporate bonds in the third quarter fell by four times against April-June – down to the worst amounts since the peak of the crisis in early 2009. In August, interest rose by a quarter for the yuan denominated mortgage bonds “Dim Sum”, which China emits in Hong Kong – yields have jumped to nearly 6%, a record for this instrument. The United States are deciding what to do next – Bernanke said that as soon as inflation falls a bit, a new wave of emission could be started: who would have doubted. But scepticism grows in the Fed: board member Sarah Bloom Ruskin is dissatisfied with the idea of causing inflation to revive the economy – and the results of monetary easing actions already taken are not encouraging; she was joined by the head of the Federal Reserve Bank of St. Louis James Bullard – while only his Chicago colleague Charles Evans agrees on everything; and these are all the supporters of helicopter-Benny – what is to say about the dissidents? Presidents of the Dallas and Philadelphia Feds Richard Fisher and Charles Plosser believe that “Operation Twist” is harmful rather than useful – it would not save the labour market. But emission is ever more likely everywhere – ranks of supporters grow in the Bank of England (David Miles and Spencer Dale). Placements of treasuries went bad everywhere last week – even Germany was faced with an extremely weak demand for her 5-year papers. In general, the crisis continues to evolve actively.

Currency markets. Euro fell to new lows around 1.3350, but then began to adjust; major currencies have recouped small part of their last week losses – after which the dollar started to grow again. Net short positions in futures for the euro as of the first half of last week have reached the top since the beginning of June 2010 – that could spell even a more noticeable bounce on the cover of these positions, though not necessarily right now. “Commodity currencies” are in the vanguard of the fall – the Australian and the Canadian dollars updated yearly lows against the buck. US Senate will vote next week for the sanctions on China because of currency manipulation – if the bill passes, then in the future all tariffs on imports of Chinese goods will have to include additional penalties for undervalued yuan. Rouble reached 32.5 against the dollar, and 44.0 against the euro, but then calmed down – with the reserves of the Bank of Russia losing $17.4 billion in 3 weeks.

![]()

Source: SmartTrade

Stock markets have slightly adjusted the previous fall – and then fell vertically again: the situation is dangerous – for example, the French CAC-40 index recouped almost the entire growth from the lows of 2009 in just the last 3 months. Spain has extended a ban on short sales of shares, and Italy did the same for the papers in financial sector. The latter continues to fever: hedge funds are ready to commit to sizable losses in the third quarter – for example, GLG Partners fund, owned by the world’s largest management company Man Group, got a loss of $3 billion; the losses for the whole group are twice bigger – assets shrank from $71 to $65 billion. We would also note the resignation of the UBS CEO Oswald Grübel – that was contributed to by the huge ($2.3 billion) loss of a trader-adventurer, of whom we wrote in the second last review; it is expected that the interim manager Sergio Ermotti will be forced to cut a considerable number of jobs in the key divisions of the bank. Layoffs are going on not only in the financial firms, but throughout the economy – for example, in Britain, BAE Systems, a major concern in the defence industry, has announced a reduction of 3,000 jobs; the continuation of this process will certainly follow.

![]()

Source: SmartTrade

Commodity markets. Oil and industrial metals have stabilized after the collapse of the previous week – however, they have not showed a strong propensity for growth. Precious metals showed new lows on Monday (Gold - $1530 per ounce, silver - $26) and then calmed down too. Cereals, legumes, forage and vegetable oil continued to decline, albeit more slowly before – the exception is once again rice, which has not been inclined to fall before, and now has stopped completely. A different picture is in the livestock sector: milk has stabilized, while beef and pork went up. Sugar went up slightly too – however cotton looks rather weak. Among the news, searches in the offices of gas companies across Europe can be noted - Third Energy Package forbids many things favourite to the monopolists; Gazprom is in sorrow – its subsidiaries are the ones mostly suspected of abuses.

Reshuffle

Asia and Oceania. Economic indicators continue to deteriorate – and the lowering of the rating of a seemingly prosperous New Zealand by Fitch and S&P confirms the seriousness of the problem. Industrial production in Japan in August grew twice weaker than was expected, while the indicator of business activity went in September into the area of recession for the first time in 5 months. The index of business conditions from the Australian Chamber of Commerce plunged deeper into the zone of recession in the third quarter; the New Zealand business confidence fell again in September - and China’s manufacturing activity is in the negative for the third month in a row. Trade balance of the New Zealand went into deficit in August, and the Japanese corporate service prices – into deflation; consumer prices are in the positive territory thanks to expensive fuel. Price of housing in Australia continued to decline in July-September; sales of developments stagnated; building permits are jumping back and forth in the New Zealand. Japanese unemployment fell unexpectedly by 0.4% at once – but that is statistics’ fun: employment in the country has also declined considerably. Retail sales in Japan are quickly deteriorating: in July they shrunk by 0.3% m/m, in August – already by 1.7% and the annual dynamics left plus to minus for 2.6% at once; overall household spending is now 4.1% lower than a year ago.

Europe. The final estimate of the French GDP in the second quarter has confirmed the stagnation of the economy – private consumption had fallen by 0.7% as soon as the incentive programs were scraped. Business confidence in Italy reached in September the lowest level since January 2010; the German business climate index marked a minimum since last June; economic sentiment in the eurozone rolled back to the bottom since December 2009 and the business climate fell to an annual minimum. And in September inflation has unexpectedly accelerated in the eurozone: in Germany consumer prices swelled by 2.6% y/y, in Spain and the eurozone – by 3.0%, Italy - 3.5% (peak since the autumn of 2008). Annual growth of M3 money supply in the eurozone has amazed; and in Britain the widest aggregate (M4) still looks nailed – however, lending there is still impressive thanks to low interest rates on the market and a relative cheapness of housing outside London. Consumer sentiment is bad everywhere – in Italy there is deterioration in September; only the Germans keep up more or less. Everything is logical – the incomes of Italians lag far behind the inflation, and employment strives to decrease; while in Germany the opposite is true – in September there happened another significant decline in unemployment. However, the real demand is very, very weak: the Spanish retail sector is in the red for 4.4% y/y, the British continued to shrink, and the German collapsed by 2.9% m/m (anti-record since May 2007); the French spending rose by 0.2%, only recouping a similar decline in the previous month, while in Switzerland the consumption indicator fell to the bottom area for the previous recessions (2002/03 and 2008/09).

America. US GDP was revised up slightly – total is +0.3% q/q and +1.6% y/y; if the deflator was calculated realistically, it would be -0.3% and -1.1%, and -0.5% and -1.9% per capita. Salaries and pensions per employee, adjusted for inflation – the main source of demand – fall for more than 11 years; during this time they shrank by 23.5% and have reached the bottom since the second quarter of 1962. Orders for durable goods in the USA fell in August by 0.1% after jumping by 4.1% in July; the figure is strongly distorted by the civilian aircraft (+23.5% after +49.9%, and almost a three times increase against the previous year) – excluding transportation, orders fell by 0.1 % after rising for 0.7% in the previous month. Regional indices of manufacturing activity are gloomy: only the indicator of the Federal Reserve Bank of Kansas City came back into plus – the others declined or simply stayed in the red (only the Chicago PMI has improved); new orders are bad. US housing prices from S&P/Case-Shiller stopped falling in the summer, but did not grow either (0.0% in June, +0.1% in July); the annual dynamics is in the red at 4.0-4.5%. Sales of construction developments are have fell for four months in a row, reaching a minimum for six months, despite falling prices; pending sales on the secondary market also turned down (-1.3% in July, -1.2% in August). Consumer sentiments from the Conference Board are weak – the percentage of those who find it difficult to find job is maximum since May 1983; a similar indicator of Bloomberg fell to the minimum since January 2009. Actual revenues and expenditures shrank in August – and if we calculate inflation correctly, the dynamics is really bad (-0.6% and -0.3% m/m, -1.5% and -1.3% y/y): demand continues to fall.

![]()

Source: U.S. Bureau of Economic Analysis, independent evaluation

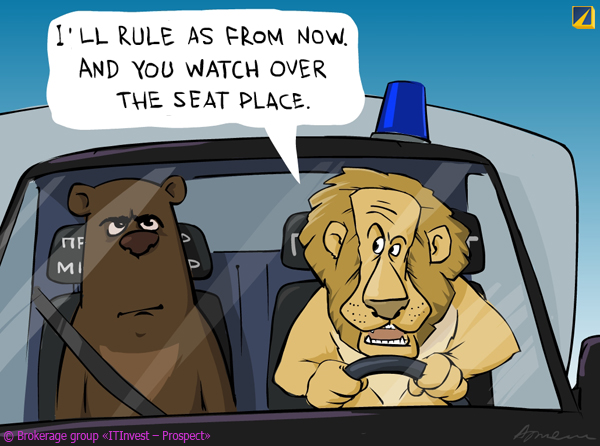

Russia. Growth of M2 money supply continues to decelerate (the annual increment is at the low since January 2010) – despite the fact that consumer credit has inflated a hefty bubble. Banks’ reserves are falling even faster – their ratio against deposits showed a record low in August, and the 12-month average went down to the lows of 1998 and 2008: it is probably should not be reminded what has happened in the two previous cases – it only remains to say that the Bank of Russia learns nothing from history, so, it seems, it does not care about the fact that the country's banking system is again heavily exposed to the lack of current liquidity (for example, in case of the depositors’ panic). All this is on the periphery of the general attention – the spotlight is on the reshuffle in the ruling tandem: Putin will become the president, and Medvedev will be the premier – and what is so interesting? Only Kudrin was excited with cause – rumours for long said that he was promised the post in the head of government; the offended official said (in Washington!) that he would not join Medved’s Cabinet – and the infuriated president ousted the Finance Minister.

![]()

Source: Bank of Russia

Deputy Siluanov temporarily filled the vacant position, and the first vice-premier Shuvalov is intended to help him (as a curator) – evil tongues, taking into account the latter’s reputation, quite specific even against the background of the ruling kleptocracy, say that this is a perfect illustration of the adage “let the goat in the garden”; people with proper knowledge tipped on the Health Minister Golikova as the future head of the Finance Ministry – however, the biography of “Madame Arbidol” is only a little better. Moscow Mayor Sobyanin took a new adviser – Gavriil Popov: he stood out with his ideas to legalized bribery and establish a world government to take natural resources away from the governments, as well as the invocation of General Vlasov’s spirit – with such an assistant the tiling will be merrier. Putin met with writers: entertainers were offended with the term “pulp fiction” in respect of their masterpieces; answering to the question about his friend Timchenko, the PM assured that he has developed his business himself (the question’s author was immediately denied of airtime on the state TV channel); Archimandrite Shevkunov expects Putin to be driven by God and common sense; Surkov also thinks the premier is the messenger of God – he was awarded the Stolypin Medal for that. The army reform continues: barley, millet and the Kalashnikov’s machine gun will be scrapped – we should think that the same “reforms” await the entire country with the new-old president.

![]()

Illustration: Artyom Popov, ITinvest

Have a nice week!