Successes of Civil Rights Movements

Good afternoon. There was not much politics last week. Head of the central bank of Afghanistan, Fitrat, fled to the United States of “fear for his life” – it is understandable: the clever rascal ruined the country’s largest Kabul Bank, participating in the bank’s highly risky investments into foreign assets. But the former governor of Illinois, Blagojevich, hasn’t escaped anywhere and was convicted of racketeering, fraud – and even in that he was trying to sell Obama’s seat in Senate, vacated after Barack’s election to presidency. The successes of tolerance: the Stockholm kindergarten Egalia cancelled boys and girls, so they do not “fall into gender stereotypes” – now they are asexual “friends” who play exclusively in black dolls; at the same time they are being read a fairy tale about a pair of male giraffes, who found joy of parenthood after finding a crocodile egg – it is a pity it does not say what happened next. However, as it turned out, the success could be not of tolerance, but of civil rights: as stated by US Secretary of State Clinton, legalization of same-sex “marriages” in New York was a major victory in “one of the most important civil rights movements in history” – soon it will turn out that slavery in the United States disappeared only because of the heroism of militant homosexuals. According to the New York Times, the case against former IMF head Strauss-Kahn has crumbled – the Guinean maid lied and was proved to be a highly dubious individual: she was persuaded to accuse the official by a friend-criminal and he also was the sponsor – who provided a “poor black woman”, with a hundred thousand bucks. But all this has emerged only after Lagarde, protégé of the global party of crooks and thieves, has become the new head of the IMF – and on July 8 the court can begin criminal proceedings against her for collaboration with the fraudster Tapie in 2007, which had cost the treasury of France €285 million.

![]()

Illustration: Artyom Popov, ITinvest

Countess Cherry of the Athens County

Monetary markets. ECB head Trichet reaffirmed the “high alert” (the rate will be raised by 0.25% next Thursday), and chief of the Bank of England King admitted possibility of a new round of emission, although spoke about the threat of inflation – according to a survey of Citi/YouGov, long-term inflationary expectations have soared to Britain’s historic maximum of 4.1% y/y in June; Bank for International Settlements urges all central banks to raise rates urgently. Emission in the United States is finished – the result is sad: money multiplier fell to a record low (-21.5% y/y, -40.3% in 2 years); in recent weeks there happened an inflationary acceleration of M3, but with a lag from monetary base (+5.0% and +33.8% y/y, respectively); average return on assets included in M2 fell to historic minimum of 0.235% per annum – pension funds are “grateful” to the Fed; optimism in the markets, coupled with the end of QE-2, begat the surge of yields (for example, for 10-year treasuries they jumped in 5 days from 2.86% to 3.22%, recouping half of April’s fall) – and the last auctions for placement of the US government bond in fact failed. S&P has stated that if the debt ceiling will not be increased soon, the rating of States will be cut from the best level of AAA to the worst D (“default”); talks about the ceiling tired finance minister Geithner, and he rashly threatened to resign – but quickly changed his mind. In Minnesota, the debate reached a dead end – government institutions were dissolved into indefinite leave on the eve of July 4 national holiday. A new sign of China’s problems – local authorities have accumulated debt to $1.65 trillion (27% of GDP) and have nothing to pay with; the real estate bubble is big; the size of demand swelling can be judged by the fact that money supply has overtaken the US in absolute value, and in the relative value the contrast is enormous: Chinese M2 is at 180% of its GDP, while the US – only at 60%.

![]()

Source: U.S. Federal Reserve, independent evaluations

Greek parliament has adopted the plan of austerity measures; but in any case, exchange of bonds is a fraud – instead of short securities investors will receive 30-year papers under silly 5.7% per annum; but the Greeks must pay on their debt around 10% of GDP each year – in a similar situation of 1998 Russia has defaulted, and Greece is unlikely to escape this fate. Actually everything is worse than it looks, because of the compression of costs and raising of taxes the economy will fall, reducing the budget revenues – but that is not enough for some people: the head of the Bank of Greece Provopoulos demand more cuts in government spending – in the end there will be the story of Cherries Countess from “Cipolin” – with the help of Signor Tomato and Signor Parsley they imposed taxes and penalties on air, precipitation and perturbations of the subjects. Athens authorities waged a mega-sale to replenish the treasury: for sale are aircrafts, ports, airports, stables, casinos, post offices, water supply systems, mining companies, metal manufacturers, gunsmiths, gas workers, electricians, telecom operators, banks, roads, land, beaches and even the old Olympic arenas. It is not only outrageous, but also useless – investors don’t want to invest even in tempting objects, while the risks for the whole country are unpredictable; i.e. all these resources could only be sold extremely cheap – but then what’s the point? Meanwhile, the storm came to Spain: the Catalan nationalists left the ranks of allies of the ruling Socialists on the issue of budget austerity – and now the no-confidence vote and early elections are quite possible in September. On November 1, ECB will be headed by Mario Draghi – but the board already has an Italian Bini Smaghi: President Sarkozy of France tried to reconcile the election of Draghi with the expulsion of Smaghi, but was told that they all are independent – this isn’t a place to show your nationalism.

Currency markets. Rejoiced with the Greek “salvation”, euro fought of the competitors, soaring against dollar from 1.4100 to 1.4550 in 3 days; cross-rates skyrocketed too – especially against pound and franc. Only the Australian and Canadian dollars have been able to pick up impulse of the European currency – in the rest, FOREX was quiet. Quarterly review of the IMF showed that the proportion of bucks in global reserves fell to a minimum for all 12 years of observations (60.7%), the euro’s share rose to 26.6%, but remained well below dollar.

.png)

![]()

Source: SmartTrade

Stock markets. The leading indexes have powerfully adjusted upwards due to Greek joys (which were rather reminiscent of a wake); it is yet soon to speak of a trend reversal – but the rebound is impressive. Global funds that invest in corporate bonds are in shock – in the last 2 years they bought up the bonds of Chinese firms for $33 billion, and now it turned out that a considerable part of these companies are cons who had no intention of paying the debts: the biggest example was Sino Forest with obligations for $2 billion. London Stock Exchange could not eat the one of Toronto – snide experts ask if someone would eat the British themselves. Bank of America agreed with the buyers of their mortgages to pay $8.5 billion of compensation – since the beginning of the year such agreements have reached $12.7 billion; but it is far from the finish – in the end the issue would be about $20 billion; in the meantime, the bank reported that for the second quarter it will show a loss of about $9 billion. Stops of the markets’ rapid growth were sufficient enough to compress the speculative profits of the world’s financial bigwigs – and since other activities are only giving loss, they have began to cut staff: in the last days, layoff were announced by Goldman Sachs, Credit Suisse, Lloyds, HSBC and Barclays – middle managers are being cut actively, and the total number of laid off in the sector could amount to tens of thousands.

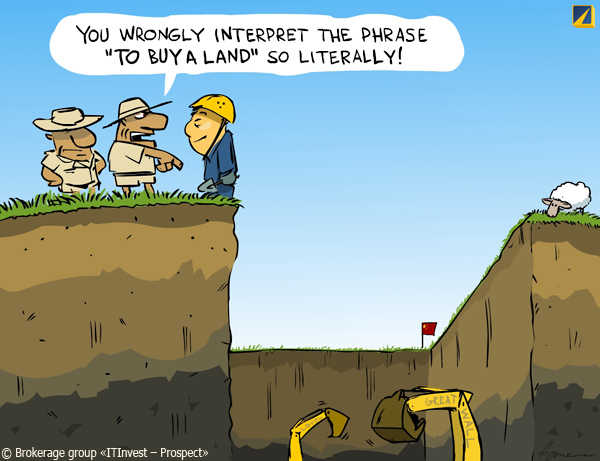

Commodity markets. The optimism came to the markets of natural resources: Brent oil, which had fallen to $103 per barrel, soared above $112 – and dragged up petrol; industrial metals rose in price – but if the aluminium behaved modestly, then copper, nickel, palladium and platinum flew up; gold and silver slipped slightly. Cereals became considerably cheaper – except for rice; meat keeps high – while milk, fruits and sugar even showed fresh peaks; coffee, cocoa and timber rose in price; cotton is stable. Scandal in Australia – the Chinese have bought 43 farms in New South Wales – and want to mine coal there; regional authorities demand the national ones to launch an investigation – who allowed converting of agricultural lands into coal mines, and for the foreigners?

![]()

Illustration: Artyom Popov, ITinvest

"Gogol Bordello"

Asia and Oceania. Tankan review of the Bank of Japan reflected the deterioration of business sentiments, particularly in small firms – they used to be unhappy; capital spending forecast has improved – recovery after the earthquake requires investments. It also contributes to some records – industrial production jumped by 5.7% m/m in May, which has not happened since March 1953; but annual dynamics is weak (-5.9%), and the take off is due to car sector (+36% against April). Business activity has weakened in June, but remained in the area of expansion; and the same in China, where the PMI indices showed the 11-month (HSBC) and more than 2-year (official) lows barely holding above 50; but a similar Australian figure for the first time came into the growth zone in February. Japanese retail swells: in May sales jumped by 2.4% m/m after +4.1% in April – but the March collapse is so great that the annual dynamics remains negative (by 1.3%), while large retailers even worse numbers (-2.4% in May after -1.9% in April). Household incomes fell by 2.2% y/y, and consumption – by 1.9%; unemployment shrank in May – but the same did the employment. Consumer prices are in plus only because of the tobacco tax, which shot up the sector’s prices at 38.6% y/y. Australian real estate is getting cheaper (except for Sydney): last year, prices in Melbourne fell by 2.9%, in Brisbane – by 5.9%, and in Perth – by 7.5%. A high-ranked Chinese official spoke at an important meeting – and promised to double salaries in the country in 2011-2015: the task to force the build-up of domestic demand has now clearly become a priority for the government of China.

Europe. French GDP was cut from +1.0% q/q to +0.9% due to the weakness of private demand; figures of 2010 were also downgraded. In Britain, quarterly dynamics is unchanged (+0.5%), but the annual has deteriorated from +1.8% to +1.6%; private consumption fell due to the fall of real disposable incomes by 2.7% y/y (anti-record since 1977); if not for external demand (contribution to GDP is +1.4%), the economy would be in fair minus. The British service sector slipped in April by 1.2% m/m; in June, business sentiments were gloomy across Europe – but not dramatic; business activity was collapsing too – especially in Switzerland, and Britain’s PMI fell to a minimum since September 2009. Prices of manufacturers and importers were falling – but the annual dynamics remained impressive; consumer prices have stagnated. Prices for the UK real estate is stable and grows in London; mortgages are barely alive – half the level of its average long-term value; Bank of England notes the deterioration of credit conditions – assuming that it will continue. The English sentiments deteriorated, and the German have improved, and understandably so: for the Briton it is more difficult to find a job (among university graduates the average number of applicants for each vacancy has doubled in last 2 years) – but in Germany the number of unemployed is ever less, although the decline has obviously slowed down; in France, employment unexpectedly slipped in May. Demand conditions are bad: Spanish and German retail sales fell in May (-2.8% m/m for the Germans); consumers spending tumbled in France (-1.4% in April, another 0.8% in May) etc. Government incentives are on their limit – national debt of France is already at 85% of GDP, deficit of Italian budget is now 7.7% GDP: further growth is dangerous.

America. In April Canadian GDP remained at the level of March; annual growth was 2.8%. Regional indexes of business activity in the USA are mixed: indicators of Federal Reserve Bank of Kansas City and Richmond grew up (new orders came back to plus); Chicago PMI has improved (but employment has deteriorated); index NAPM Milwaukee dipped, but remained in the growth zone; the indicator of Dallas Fed fell deeper into the area of decline, and ISM in New York, although it had grown, has dramatically upset by the collapsed numbers of new orders and employment. National ISM index rose unexpectedly, as did its main components (employment, orders). Consumer prices in Canada grew in May by 0.3% m/m, and without adjusting for seasonal factors – by 0.7%. US realty prices from S&P/Case-Shiller continued to fall; pending sales of secondary houses jumped in May by 8.2% m/m – but still not recouped the April’s decline (by 11.3%). Consumer sentiment from the University of Michigan and the Conference Board have worsened in June (the Americans are dissatisfied with revenues and cut their spending) - but the Bloomberg’s survey for the 20s’ of June is rosy. Initial claims for unemployment benefits are still numerous; the total number of recipients fell by 12 thousand – but the figures of previous 2 weeks were increased by 21 thousand. Construction spending fell even in nominal terms – adjusted for inflation they slipped by 13% over the last year; in May, housing construction declined particularly strong. Real disposable incomes of Americans shrank in May by 0.1% (as in April), while real spending rose by 0.1% after falling by 0.1% a month earlier – and if you calculate inflation normally, the reduction of spending for these two months will be 0.7%; real demand in the United States have already fallen to the level of 1985.

![]()

Source: U.S. Census Bureau

Russia. According to Rosstat, a quarter of GDP growth in the first 3 months fell on the accumulation of reserves – while net exports made ??a negative contribution, because the expensive rouble made imports jump by 23% y/y. May demographics is gloomy: birth rate fell by 2.5 thousand against the same month a year earlier, while the death rate increased by 2.7 thousand; in general, within 5 months of this year, both measures have decreased. Higher arithmetic of Rosstat is amusing - in Chechnya there were 4 murders and a year ago there was not one: but in the “2011 to 2010 in %” for some reason there is “0.0”. On June 1, the volume of monetary base was higher than in the previous year by 6.0% - minimum since December 2009; gains of M0 and M2 decreased to the bottoms of January-March 2010 - but the Bank of Russia still threats with monetary tightening. This has displeased the Ministry of Economic Development – its Deputy Klepach scold both monetary and exchange rate (costly rouble) policies of the central bank. Authorities decided to make the St. Petersburg Governor Matvienko the Head of the Federation Council – a spectacle is staged for the purpose: she will be elected to a municipal council of the city – and will go from there to preside over a Senate-parody. Duma is good too: a study of political scientists from the HSE Institute found that the consciousness of parliament members, from all strata of society, is closest to the homeless. CEC boasts with innovations: Churov offered to head the precinct election commissions in the Caucasus by the leaders of football fans – he think that throwing bananas will invigorate sluggish electoral process in the country? Fake Medved alarmed the audience on Twitter – he was named False Dmitry after the exposure, and the President has visited a rock concert in Kazan and danced to the yells of a group called “Gogol Bordello”. Very well: our public life today is certainly a complete “Bordello”, worthy a pen of Gogol?..

Have a nice week!

Dynamics of prices over the past week

![]()

Sergei Egishyants, mailto: sae@iqi.ru ,

Chief Economist at JSC "IC" ITinvest ""

http://www.itinvest.ru/

© 1997-2011 JSC “Investment company "ITinvest"”. All rights reserved.

This review is for informational purposes only and does not constitute an offer to conduct transactions in the stock market. The information contained in this report should not be construed as an offer to buy or sell papers. The data presented in the text are obtained from sources we believe to be reliable, but we do not claim that all of the information is absolutely accurate. We are not responsible for the customers’ use of information contained in the above-mentioned materials, as well as for the operations with the papers referenced. JSC "Investment company “ITinvest”" does not assume any obligation to update the information or correct any inaccuracies.