Nobel Medved

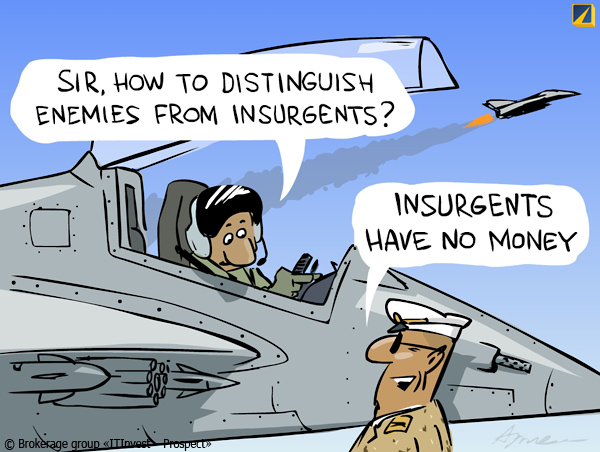

Good afternoon. Strong earthquakes (magnitude 6.7-7.4) have occurred in the Pacific (Japan, Aleutians) – without serious consequences. Radiation situation continues to deteriorate in Fukushima – and then there happened problems at the plant in Gravelines, France, due to which the reactor had to be stopped. Powerful floods happened in central China (in some places they were the most powerful for half a century) affecting some 3 million people – in some areas, due to loss of crops, the food prices have soared while being pretty high as they are. In the New Zealand authorities have estimated damage from the earthquake in Christchurch – it has reached 8-9% of GDP, and PM Kay noted that this magnitude of losses from a single natural disaster so far has not been experienced by any developed country. And then the Americans noted the exceptional weakness of sunspots, promising, in their view, the repetition of the so-called “Little Ice Age” that has occurred in 1645-1715. The war in Libya continues: the opposition has run out of money, besides, for some reason it was bombed by NATO, while Russia has offered humanitarian aid.

![]()

Illustration: Artyom Popov, ITinvest

Margelov, formally referring to the Tunisian officials, has offered to award Medvedev the Nobel Peace Prize for peace efforts in Libya – of course, after Obama, the prize can be given to anyone for anything but still, it’s too much. However, at home the obliging bureaucrat was noted – and he is now promised the post of Federation Council’s Head instead of expelled renegade Mironov. The mood of the Vanuatu’s authorities is volatile – the former prime minister, who recognized Abkhazia, was fired by a court, and the new one has reversed the act and even wished to establish diplomatic relations with Georgia. Authorities and opposition in Japan have finally agreed on the fate of Prime Minister Kan – he will retire at the end of August, when the immediate budget issues will be decided in Parliament. And the rating of the Australian Labour government fell to a 40-year low only a year after the current PM Gillard, with the help of commodity lobby, initiated a party coup to oust the former leader Rudd – now the latter is supported by twice as many people as the senseless pro-oligarchic usurper.

"Chaim, look for Nobile!"

Monetary markets. Norges Bank has not change the rates – but warned that they “could be raised faster than expected”. Minutes of the meeting of the Bank of England, by contrast, are soft: the man from Goldman Sachs Broadbent, who came instead of the hawk Sentence, joined the camp of moderates, so there were only two votes for the rate hike – while the others decided that if the economic situation will worsen, they would think about a new round of quantitative easing. The Fed meeting ended with nothing – as expected, the emission will end in time (late June), and the rates will remain low for a long time; assessment of the economy is reduced, and inflation – increased, but there comes a proviso that this is allegedly due to “temporary factors”; Bernanke is cautious in his statements – but made ??it clear that he is ready for any actions require by the situation. Some people elaborated the statement: according to the head of PIMCO Bill Gross, on the late August annual conference of the Fed in Jackson Hole, Wyoming Bernanke will hint on the launch of a new program of quantitative easing – a hair’s breadth as a year ago, for that is where the Fed chief announced QE-2. And the Republicans are not asleep: they demand to limit the powers of the Fed – leaving it with only the inflationary control and concerns about a strong dollar. In the meantime, the world situation is deteriorating; in May, hedge funds incurred a loss of 1.2% (on average); the largest UK lenders drastically cut back loans limits to banks of the eurozone (they are too mired in bad papers of the periphery) – the Americans are opting to do the same.

Last Sunday, the financial authorities of G7 held a teleconference, which resulted in the appeal “to resolve the crisis as soon as possible” – o, how fresh is that! Finance ministers of the eurozone socialized with the same result: the question is postponed until the EU summit on July 3. In response, the IMF said that it will not give money to Athens before the EU decide on its intentions – but if by July 15 Greece will not receive the promised 12 billion, she would go bankrupt. PM Papandreou won a confidence vote in parliament (155 votes against 143) – but to approve a new package of austerity measures will be a more difficult endeavor: there are too many opponents, who see that the cuts through the economic downturn gives rise to loss of incomes; according to the Kathimerini newspaper, the majority of population is opposed to the reforms and wants early elections. The Greeks offered were offered a loan on security of state assets – but they refused, saying that “it would lead to political chaos” - read: “See what they had come with! Everyone knows that we do not plan to return the money”. Fitch “pleased” the EU officials – if the plan of payment extension would be accepted, it will be seen as “credit event” (i.e. default): CDS holders then could require full payment from insurers. And in the meantime the “credit event” happened at the Allied Irish bank, which missed payments on its bonds had. Moody’s has threatened to cut the rating of Italy; Spain asks Russia to buy her bonds, and the crowds of Spaniards protest in all big cities of the country. In general, the situation in the eurozone is deteriorating day by day – but the officials are not doing anything with that.

Currency markets were behaving as in the joke: “Chaim, look for Nobile. If you won’t find, buy two bags of grain”. Whether the emission starts, or if it finishes; whether the markets rise or fall – in any case, one have to sell euro-franc! This cross-rate has already come to 1.18 – and there is no end in sight. Euro fell due to the problems of Greece, the pound did not like the softness of the Bank of England – and only the yen did not care at all: it proudly stood on the spot. Meanwhile, in the USA, the idea is actively discussed to repeat the experience of 2005, freeing the companies from taxes on foreign earnings for a year in case of their repatriation – then it has caused a sharp growth of bucks, and now it will do the same even better, for the price of the issue has rose to $1 trillion; however, it is just a suggestion.

![]()

Source: SmartTrade

Stock markets. The general uncertainty continues to negatively affect the stock exchanges – though still nothing particularly dramatic happens to them. From corporate news, we can note the intention of Bank of America to sell half of its stake in China Construction Bank (the entire package draws up to $21 billion) to fund its own equity – in anticipation of the introduction of new, more stringent, regulation rules in the sector. A landmark event happened in the USA, where women staff of the world’s largest retailer Wal-Mart Stores filed a lawsuit against their employer, accusing it of sexual discrimination – saying that the lion’s share of well-paid jobs are given to the damn man: that’s not right! Everything would have been fine, but the claimants have try too hard and filed a group suit by 1.6 million people – the US Supreme Court considered this arrogance excessive and with a majority of only 5 votes to 4 decided to review each complaint individually, which would sufficiently impede the achievement of outcome desired by the working ladies. And it pleases, for although large corporations are, of course, the essence of evil, but all kinds of feminists – are a far greater evil.

Commodity markets finally woke up and appreciated the reality. It happened after the Fed meeting, at which, on the one hand, weakness of the economy was stated, and on the other – there was the promise of new incentives. The International Energy Agency added the heat, by announcing, on par with the USA, the oil interventions from their reserves next month – to compensate for the stop of supplies from Libya. Oil fell to $105 per barrel of Brent and $90 – WTI; gold fell less; silver and platinum fell markedly; industrial metals declined very reluctantly. Grains and legumes, timber, coffee and cocoa flew from their peaks by 20-35%; and the forage and vegetable oil – on average by 10%. But at the same time meat, sugar, fruits and cotton rose in price aggressively, while milk stands firmly at the previously reached peaks.

![]()

Source: SmartTrade

Where's the money, Dima?

Asia and Oceania. The economic news continues to “please” – especially the G8, who recently cried out that “the recovery is gaining momentum and becomes stable”. In Japan, the index of activity in all sectors of the economy recouped less than a quarter of the March collapse in April (+1.5% after -6.4%); leading indicators collapsed by 3.4% m/m - the figure for Australia has an average zero dynamics in spring. The index of China’s business activity from HSBC fell in June to an 11-month low of 50.1 – remember that the 50 mark divides the zones of growth and recession; worsened the components of employment, new orders, and (especially) export orders that have already begun to decline. Current account balance of the New Zealand in the first quarter recorded a deficit of 4.3% of GDP against 2.3% in the last quarter of 2010. Japanese trade deficit rose in May compared to April – although a year ago the balance was confidently active; exports were 10.3% lower than in May last year, while imports – 12.3% higher. Prices for the services of Japanese corporations continue to fall – demand is weak, and that could not be overdone even by expensive raw materials. China cuts tariffs on imports of fuels, metals and raw textile materials – in an attempt to lower their prices. Statisticians of China report that each month the process of slowing growth in house prices is strengthening: among 70 major cities, 14 reported of stagnant or falling prices (in monthly dynamics) in April, and in May – already 20.

Europe. Ireland’s GDP in the first quarter grew by 1.3% after falling by 1.4% in the previous quarter; but in this country, because of the very low corporate tax, many global firms hold their offices, so GDP that excludes this factor is quite interesting: it fell by 4.3% after gain if 0.3% a quarter earlier; annual dynamics are in negative territory by 0.9%; domestic demand falls – only net exports keep the economy afloat. Italian industrial orders fell in April by 6.4% mm after rising by 8.0% in March; annual increase was compressed to 5.8%. In general, the eurozone in April increased by 0.7% after falling by 1.5% in March; if you remove the distortive heavy transport, then there will be a decrease by 1.1% in March and by 0.6% in April. In Germany, construction orders fell by 3.2% m/m – down to a minimum since January. But in Britain the balance of factory orders came to micro-plus in June. Preliminary business activity indexes (PMI) of the eurozone dipped considerably in June – France disappointed particularly; indicators of economic expectations from ZEW sharply fell to negative values in Germany, eurozone and Switzerland. The May decline in raw materials’ prices moderated the gallop of manufacturers – in Germany, the annual increase fell from 6.4% to 6.1%, in Spain – from 7.3% to 6.7%. According to real estate website Zoopla, 3.5 million British homes purchased in the last 5 years, now cost less than at the time of purchase – and from the homes acquired in 2007, 93% are now cheaper; market activity is low. Also weak is the consumer confidence across Europe; bad are finances of household - hence the weak demand. Economies of the region are held by government incentives, but the public debt is too bloated – example of Greece shows that if you try to hard in this sphere, the consequences will be dire.

America. The final estimate of US GDP has changed little – an increase of less than 0.5% against the previous quarter; corporate profits grew a little – and that’s all. In May, orders for durable goods rose by 1.9% - but have not recouped the April decline of 2.7%; and without transportation orders the mini-growth will be replaced by a mini-fall – and these are all nominal values, i.e. without inflation. The index of business activity in the area of the Federal Reserve Bank of Chicago did not really recovered in May – despite the aspirations of experts who wrote off the problem of April over Japan. In May, sales on the secondary real estate market fell by 3.8% against March – the value of which was also reduced. Sales of single-family houses decreased by 2.1% - and all the turbulence of last year takes place at the very minimums, which are even below the lows of 2009, not to mention the earlier depressions; in general it may be noted that from the peak of 2005 sales have fell by five times – and froze near this record minimum. The index of consumer comfort from Bloomberg turned down again in the second half of June. Primary applications for unemployment benefits have increased, and about the recurring it was solemnly announced that they have fallen by a thousand – the Labor Ministry has only forgotten to mention that it has revised the figure for the previous week up by 24 thousand. April’s retail sales rose in Canada by 0.3% m/m after falling by 0.1% in March; excluding cars there was a zero increase after declining by 0.2% - and these are all nominal figures, which don’t take into account the very high inflation of March-April.

![]()

Source: U.S. Census Bureau

Russia. Rosstat and the Ministry of Economic Development published reports for May – the first is dry, the second is poetic: Nabiullina’s office stated that “despite the decline in real incomes, the growth in domestic demand continues, both in investment and consumption”. How is this possible? Very simple - the recipe was provided by Greenspan in 1980s’: you pump up the demand with loans – and the people take it. So it is: the consumer credit have soared - savings rate of Russians has fallen to the bottom since the crisis months of the end of 2008; sales of non-food items jumped by 10.7% y/y (purchase of food – by 0.5%); reckoning is inevitable - but later. MED happily reports that in May in many areas the growth has resumed, after it was interrupted in April – we hasten to help: in April of this year there was one working day less than in the same month a year earlier, and in May, on the contrary – one day more; maybe some people have to look in a calendar more often? This factor gave a hand to timber harvesting (+7.6% y/y after -2.4% in April), construction (+1.9% after -1.9%) and freight transport (+5.6% after +2.1%); we note a decline in agriculture (0.3% m/m seasonally adjusted). Annual increase in consumer prices was 9.6%, of a fixed basket of goods and services – 12.8%, producer prices – 19.2%, tariffs on cargo transportation – 7.4%. Rosstat revised its figures for retail sharply upwards, starting in 2009 – we wonder on what basis? Services allegedly continue to grow (especially utilities and housing), import swells faster than exports, real incomes of people fall down (officially by 7%, and in fact by 10%) – but unemployment somehow reduces.

Calculations of nominal GDP are akin to circus: the MED gives a large number, Rosstat adjusts it down – but a year later, it “suddenly” appears that the adjusted estimates are much higher than the real ones. Physical indicators and sector dynamics are more interesting – on their basis and adjusted for underreporting of inflation (because of what circulation of trade and services are overstated), we can judge that from October the real GDP grows at a constant rate of about 2% y/y. But Rosstat has +4.1% in the first quarter, and the Ministry of Economic +3.8% in May – well, well. Recycling program for old cars is ending – after which the indicators of the sector (and the whole industry) will go dim. Medved spoke at an economic forum – he praised the successes of the past 20 years, scolded the stagnation and corruption, and urged to help the regions and to bring the capital officials outside of Moscow, and then suddenly resumed: “We have yet much to go on the way that the Chinese economy passed in last 25 - 30 years"- does the President understands what he says? It seems not – and the Finance Minister Kudrin was angry with the new draft for government expenditure and promised to make an appointment to Medved in order to find out, “Where’s the money, Dima?” The Putin’s Front decided to accept the entire Russian postal service en masse – now the mailmen would engage in election campaigning. As soon as the governor of the Tver Zelenin was kicked out, his successor Shevelev willed to ban a rock festival due to swine plague: apparently, he decided that the rockers are in too close contact with animals? – anyway, the ban was soon lifted. In the Saratov region rains flooded the town of Marx – nearby town Engels did not suffer: it seems that the clouds joined the opposition – and gave birth to a politically pernicious example of the famous split in tandem, if not in the current one.

![]()

Illustration: Artyom Popov, ITinvest

Have a nice week!