Move e2-e4 - swear to God!

Good afternoon. Libyan war goes on as usual – accompanied by periodic interludes. The latest was a visit to Tripoli by the Kalmyk leader Ilyumzhinov, who also heads the World Chess Federation – brave Kirsan played with Gaddafi and voiced the latter’s offence on his return: the country’s reserves are arrested, as if it were his own money. Here wailed the Duma clerk Margelov, Kremlin’s gag in every international barrel – he allegedly advised Ilyumzhinov what to do: move e2-e4 – swear to God! Say that Gaddafi already has an end game. Another earthquake in Christchurch, New Zealand – smaller than the one in February, but still impressive (magnitude 6.0), and the shocks are permanent. At the same time the region suffered a new problem: Puyehue volcano in the Chilean Andes woke up from a half-century sleep and started to erupt aggressively; eventually air traffic has been paralyzed throughout the southern half of the Pacific (including Australia and the New Zealand), as well as on the coasts of the Atlantic (Argentina, Uruguay).

![]()

Photo: Claudio Santana / AFP / Getty Images

Lying lips

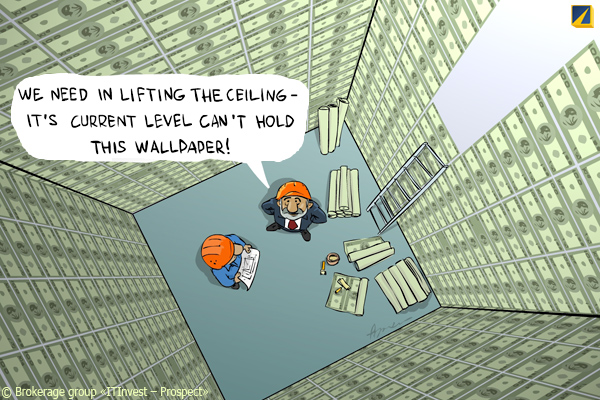

Monetary markets. The People's Bank of China again raised the reserve ratio for commercial banks – now it is 21.5%. The Swiss National Bank left rates’ range unchanged (0.00-0.75%), noting that it is more inclined to the bottom of this range – for the high value of the franc does not allow even a shadow of monetary tightness. Bank of Japan also left rates on the spot – and announced a new plan of lending for the firms affected by the earthquake that do not have conventional collaterals (for example, real estate): within two years they will be handed out ¥500 billion ($6.0-6.5 billion) at 0.1% per annum. ECB is likely to raise rates in early July from 1.25% to 1.5% per annum; Trichet, however, still gives the appearance of an intrigue, but the head of The Bank of France Noyer said that the increase of interest is a done deal. Debates are continuing in the United States o the raise of the debt threshold – threats of rating agencies already made major Wall Street banks to flee government bonds for cash: for the monsters, bonds are the collateral for derivatives – and if the worst happens, quality of these will drop, bringing their owners at least a headache through the inevitable margin calls. Bernanke spoke to Congress with quite a hysterical speech, demanding to resolve issue with the ceiling of public debt urgently, but was ignored; commenting the news, one reader wrote sarcastically: “Is there a man in the world who would believe even one word that comes from this deceitful mouth!?” S&P published a negative forecast for the real estate of China – there seems to have started a large-scale deflation of bubbles, which threatens with a sharp fall in prices and, consequently, take-off of the proportion of bad loans on banks’ balance sheets.

![]()

Illustration: Artyom Popov, ITinvest

Altercations on the extension of Greece’s debt payments continue – everyone looks for a way to mask a default under the outwardly decent shell: whether revising the old bonds, or exchanging them for new ones – the latter option has both voluntary and compulsory variants. S&P cut the rating of Greece by another 3 steps down to the worst?CCC level - just below the level of partial or complete default; also were reduced the ratings of the country’s leading banks. Sarkozy and Merkel expressed solidarity with Greece – and then quarrelled: Angela does not expect the decision before September, while Nicolas promises to decide before August. Former Fed chief Greenspan promised default of Greece, which will “help” the United State to go back into recession. Yileds of 2-year bonds of Greece got over 30% per annum – our bonds in 1998 gave more, so the Greeks still have way to go. And their behaviour has not changed: “suddenly” it was discovered that in January-May the budget deficit was 13.5% above plan - and who would have thought! Authorities trim spending – opposition is furious; PM Papandreou gives a spectacle – you are evil, I will leave you! Nobody persuade him to stay – and he coolly said that he changed his mind; opposition rages and fumes – and yet the PM “scruffles”© the cabinet, making the former Minister of Defence the new Minister of Finance. Bad example is contagious: Ireland demands the IMF to force lenders to lower interest rates on their loans – although recently promised not to do so. The problems spread across Europe – Spain was only able to place bonds under the highest rate over 11 years, while Moody’s threatens to cut the ratings of the leading trio of banks in France (Credit Agricole, Societe Generale and BNP Paribas); to be continued.

Currency markets. Against the background of the eurozone’s problems, euro collapsed –exchange rate against dollar got close to 1.40, but rebounded on Friday on expectations for the bailout of Greece; against the franc the European currency has showed a new historic low below 1.20. The remaining pairs ranged - but overall the dollar has slightly revived, as usually happens in the expansion of the crisis. There are rumours that China will expand the range of yuan – right in time for the anniversary of its exchange rate’s liberalization.

![]()

Source: SmartTrade

Stock markets. The leading indices continued a slower but steady decline – though so far nothing really bad happens: amplitude is traditionally low for the summer. It seems, however, a little later – especially in the autumn! – markets will become much more active.

Commodity markets. Feeling the reality of slowdown in the world economy, fuel and industrial metals have started to become cheaper – except for copper, which showed stability. The same can be said about gold and silver – they are not particularly inclined to go south. Cooling of the realty bubble in China threatens with reduction in construction activity there – that can severely curtail global demand for building materials, as well as for certain metals (especially iron and copper). Cereals, legumes and forage also fell a bit; vegetable oil and milk do not hurry to do the same, while meat set about to go up. Fruits calmed down after growing in price recently, as well as sugar, coffee, cocoa and cotton; timber falls again. Curiously, the cheapened oil hardly influenced the US petrol – it dropped in price from the spring peak only by 12-13%, although that in less than 2.5 years it went up threefold.

![]()

Source: Barchart.com

Deserted worms

Asia and Oceania. OECD has finally found “signs of slowing down” in the global economy – but still saw “steady growth” of the Great Britain. In Japan, in April, production grew by 1.6% against March (initially +1.0% was shown), but y/y it fell by 13.6%. Engineering orders fell by 3.3% m/m and by 0.2% versus April 2010; the previous month was revised from +2.9% to +1.0%. The mood of large companies in the second quarter has expectedly collapsed. In Australia, in May, business confidence deteriorated, and the consumer’s has fallen to the lows of June 2009; the number of construction developments had grown by 3.1% in the first quarter, but has not recouped the previous quarters’ fall, and versus January-March 2010 it is down by 12.9%. In the New Zealand everything is the opposite – optimism in May-June is everywhere: moods improve, activity grows, and realty is being sold fairly, while retail sales swell (but the latter in fact happened in the first quarter). In China, in January-May, capital investments grew by 25.8% over the same period a year earlier – the process has accelerated. By contrast, there is a slowdown in direct foreign investment in May (+13.4% y/y against +15.2% in April and +23.4% in January-May as a whole); slowly subsides the annual growth of industrial production (13.3% in May instead of 13.4% in April and 14.8% in March) and retail (16.9% against 17.1% and 17.4%). New loans slowed down to 551.6 billion yuan in May from 739.6 billion in April, and M2 aggregate money supply – from +15.3% y/y down to +15.1%. Inflation is accelerating: producers’ prices rose by 6.8% y/y and the consumer’s – by 5.5%; and even without food (which rose in price by 11.7%) prices have shown a 6-year peak of growth.

Europe. Italy encourages with the growth of production in April (by 1.0% m/m and 3.7% y/y) – helping out the eurozone’s overall (+0.2% and +5.2%). Consumer prices in Spain fell in May by 0.1% m/m, but rose in Italy by 0.2%, and in France – by 0.1%; overall prices in the eurozone remained at the level of April, and added 2.7% against May 2010. British CPI rose by 4.5% y/y (peak since the autumn of 2008), and retail prices – by 5.2%. In Switzerland there is a deflation in the wholesale sector (-0.2% m/m and 0.4% y/y) – which makes sense at the permanently expensive franc. British realty prices continue to decline slowly – while the market activity is very weak. Nationwide has pleased – the May survey of consumer confidence was held on those days when there were extra weekends, Easter, royal wedding, and an abnormally warm weather: so it is not surprising that the rate has jumped dramatically – with the tendency to expenditures making ??historically largest monthly jump. Employment in the eurozone in January-March has changed little, and in Greece at the same time the unemployment rate rose from 14.2% to 15.9%. Recipients of unemployment benefits in the UK are ever more numerous, and the annual wage growth is ever less; is it no wonder that with such undermining of demand retail falls: in May it slipped by 1.4% m/m, more than recouping the April joys (+1.1%); without petrol the decline is even steeper (-1.6%); food sales have collapsed by 3.7% m/m and 3.5% y/y. In France, sales fell for two consecutive months; authorities did not like it – and the May value was suddenly revised from -2.5% to +0.3%!

America. In Canada, shipping in the manufacturing industry decreased in April by 1.3%, recouping a fair amount of the March gain (+1.9%). In the United States, industrial production increased in May by 0.1% after zero growth in April; the car industry is negative, suffering from the collapse of Japanese imports due to the earthquake – without it, the growth would be of 0.6%; capacity utilization decreased by 0.2%. Regional indices of industrial activity (from the Federal Reserve Bank of New York and Philadelphia) abruptly fell into the red in June, the situation with orders worsened especially badly. Deficit of the current account balance for January-March grew to 3.2% of GDP from 3.0% in October-December. Foreign purchases of long-term securities of America are weak and are not covering the country’s trade deficit. In May, the number of construction developments increased by 3.5% m/m and fell by 3.4% y/y; building permits jumped by 8.7% and 5.2% y/y – guilty is the volatile multi-flat housing, while in the sector of single-family homes an annual decline by 6.9% was recorded. However, these data tend to fluctuate – more demonstrative is the number of homes being actually built now: in a year it shrank by 12.4% (single-family – by 17.5%), and in general since the beginning of the crisis in terms of number of households – by 3.6 times (by 4.1 times); versus the peaks of the 1970s, the fall is huge (by 6 and 5 times respectively); too, each month the number of houses under construction becomes less. National Association of Home Builders indicator fell in June – although everyone thought that it has already been extremely low. Deficit of the Treasury in May dropped sharply – debt ceiling does not yet let the planned spending.

![]()

Source: U.S. Census Bureau

Consumer comfort from Bloomberg remains at low levels - as well as the University of Michigan index. This is understandable – unemployment is high, recipients of benefits are high; and as usual, statisticians are cheating: the report says that benefits have been received by 21 thousand less people than a week ago – but fails to mention that the figure of last week was revised upwards by the same 21 thousand. In April sales of new cars in Canada fell by 1.1% against March and wholesale trade – by 0.1%; commercial sales in the USA rose by 0.1%, lagging behind the pace of inventories’ accumulation (+0.8%). Producers prices for final goods rose in May by 0.2% despite depreciating fuel and food; the annual increase reached 7.3% (excluding the hedonic indexes, 8.6%); for all products, not just the final ones, prices swelled by 10.5% y/y (without hedonism – by 12.0%); these values ??are the highest since September 2008; in the last 8 months prices are rising at an average rate of 1.2% m/m (adjusted – even by 1.4%). Consumer prices YTD are rising by an average of 0.6% m/m; annual growth is maximum since October 2008, amounting to official 3.6%, 3.9% without hedonic indexes, and about 6.5-7.0% if we remove all “changes in the methodology of calculation” after 1990. The latter operation also severely affects the assessment of actual retail: if the officialdom shows that there was a peak in 2006 and decline from there reached 20% (against the levels of 1980s/90s), the correction sets the peak on 2000 and its collapse has exceeded 30% (against the values of 1960s) – so it is.

![]()

Source: U.S. Census Bureau, John Williams' Shadow government statistics

Russia. GDP in the first quarter grew by 4.1% against January-March of 2010, Rosstat’s estimation of the deflator is even higher than ours (+14.6% y/y versus +14.5%) – it’s fantastic. As usual in recent years, nominal GDP will be revised downwards some time later (it is overstated by 1.5-2.0%) - but the gain will miraculously stay the same. We note the take-off of fishing industry by 19.8% and of manufacturing – by 12.9% (of which three-fifths came from government-stimulated cars); education fell by 2.2%, public administration – by 2.1%: it is strange. In May industrial production grew by 4.1% y/y, while the manufacturing sector – by 5.0%; both numbers are minimal since the autumn of 2009. Producer prices added 1.2% m/m in June and 19.2% y/y, consumer prices have not changed in the second week of June – thanks to the cabbage falling in price. The federal budget surplus in May totalled at 4.6% of GDP – glory to the expensive oil! Putin’s United Popular Front gets stronger every day – one can only join it and the withdrawal is impossible: as spokesman for the PM Peskov said, “you do not have to think in terms of the CPSU and hope to get a party membership card, so you could then put it on the table”. Tver Governor Zelenin was fired “at own accord” – worms from Kremlin’s plates got deserted! All the more mess-up in the state exams – at one time, recruited students sit the exam instead of the school graduates, at another, answers leak into the social network, or the officials hand out students ready-made answers. Chief medic Onishchenko banned nearly all food in children’s summer camps - only bread and tea were left. And as the embodiment of Russian absurd – a small plane crashed under Krasnoyarsk: according to RIA “Novosti”, “...the pilot fled the scene, taking with him the debris of the destroyed aircraft!"

![]()

Illustration: Artyom Popov, ITinvest

Have a nice week!