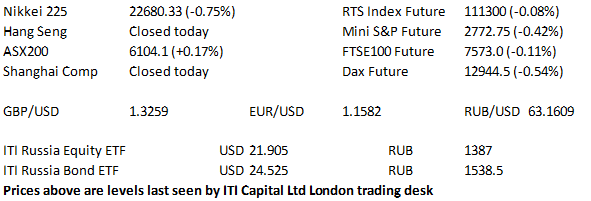

Overnight Snapshot

The Day Ahead

1345hrs UK US New York Fed Retiring President William Dudley speaks in New York

1500hrs UK US NAHB Home Builder Index (est 69.82 vs previous 70)

1745hrs UK CA Bank of Canada Deputy Governor Lynn Paterson speaks in Toronto

1800hrs UK US Atlanta Fed President Raphael Bostic speaks in Savannah, Georgia

1830hrs UK EU ECB Governor Mario Draghi speaks in Sintra, Portugal

2100hrs UK US Incoming New York Fed President John Williams speaks in New York

No major earnings releases from the US today.

DS Smith in the UK report FY earnings

HEADLINE NEWS:

CHINA IMPOSES 25% TARIFF ON $50BLN US IMPORTS

: REPORTS US LED COALITION AIRCRAFT BOMB SYRIAN MILITARY POSITIONS IN EASTERN SYRIA

The Day So Far….

STOCKS: Wall Street’s leading shares ended lower on Friday, capping a day of heavy trading with investors mostly pulling back from initial concerns over the escalating trade dispute between the USA and China. President Donald Trump unveiled an initial list of strategically important goods that would be subject to a 25% tariff effective from 6th July, a move that China’s Commerce Ministry called “a threat to China’s economic interest and security.” China have issued their own list of tariffs on US goods, targeting soybeans, aircraft, autos and chemicals. Friday also marked a quadruple witching day – the quarterly expiry of stock and index futures and options which would have provided a boost to volumes as positions were rolled out to further expiry months. Volumes hit their highest level since early February when the S&P500 sank to its lowest level so far this year. The S&P500 ended the day down just 2.83 points at 2779.66 and virtually unchanged on the week, the Dow closed 84.83 softer at 25090.48 and down 226.05 points on the week, whilst the Nasdaq 100 closed 23.836 easier at 7255.76, although posting a gain of 103.135 points (1.44%) over the week.

Asia-Pacific stocks were lower in the main on Monday as US-China trade war worries hampered risk sentiment. The Nikkei 225 shed 0.8% in the morning session as the utilities and materials sectors led the way lower, while consumer staples was the only sector to post (modest) gains. Afternoon trading saw some minimal gains from the lows. Australia's ASX 200 bucked the trend to close positively as the real estate sector led the charge, while telecoms, materials & energy weighed. Hong Kong (Tuen Ng festival) & China (Dragon Boat Day) were closed for market holidays. Dow futures shed over 100 points, while the e-mini S&P has lost 12 points.

US TREASURYS: Risk assets have taken a hit in early dealing as the US-China trade issue dominates traders' thoughts, lending some support to fixed income, although liquidity is diminished with China & HK out on holiday today. - 7-Year paper has experienced some modest outperformance. - Back on Friday Fed non-voter Kaplan stated that he only sees three hikes in total in 2018, despite a median of four dots from FOMC (but he remains open minded re: a fourth hike); while outgoing NY Fed Pres Dudley came off more hawkish stating that the Fed needs to keep a check on growing inflation.

OIL: Crude has fallen afoul of weekend reports that Saudi & Russia will push for an increase in OPEC+ crude production in Q3, although the likes of Iran, Iraq & Venezuela are pushing back against such suggestions. - OPEC+ producers will meet in Vienna later this week. WTI's decline has outpaced Brent, with the former shedding $1.04 to $64.02 & Brent losing $0.45 to $72.99. The latest Baker Hughes rig count data, released Friday, showed 1 additional US rig online in the most recent week.

GOLD: The yellow metal steadied after Friday's sharp decline, with risk off flows supporting gold, with August futures last trading just shy of $1283/oz.

FOREX: Risk off flows prevail. Risk off flows dominated in Monday's Asia-Pacific session, with JPY demand (particularly via the EURJPY cross) underpinning the broader theme as the US-China trade issue dominated traders' thoughts, although liquidity was diminished with China & HK out on holiday. Elsewhere, USD was stronger vs. the majors although CAD managed to shake off the OPEC+ production inspired pressure from crude, and AUD/USD managed to move back into unchanged territory after printing within 15 pips of YtD lows. NZD was the underperformer, owing to its sensitivity to Chinese trade and with NZ Q1 GDP data due later this week. DXY needs to close above 95.131 to confirm another uptrend.

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk