Overnight Snapshot

The Day Ahead

0930hrs UK UK Consumer Price Index (est 0.38%mom / 2.46%yoy vs previous 0.4% / 2.4%)

0930hrs UK UK Core CPI (est 2.07%yoy vs previous 2.1%)

0930hrs UK UK Retail Price Index (est 280.83 vs previous 279.7)

0930hrs UK UK RPI (est 0.42%mom / 3.38%yoy vs previous 0.5% / 3.4%)

0930hrs UK UK PPI Output NSA (est 0.53%mom / 2.85%yoy vs previous 0.3% / 2.7%)

1000hrs UK EU EuroZone Industrial Production (est -0.55%mom / 2.6%yoy vs previous 0.5% / 3.0%)

1000hrs UK EU EuroZone Unemployment (previous 0.3%qoq / 1.6%yoy)

1200hrs UK US MBA Mortgage Applications (previous 4.1%)

1200hrs UK UK Prime Ministers Question Time

1330hrs UK US PPI Final Demand (est 0.29%mom / 2.83%yoy vs previous 0.1% / 2.6%)

1330hrs UK US PPI Food & Energy (est 0.21%mom / 2.33%yoy vs previous 0.2% / 2.3%)

1500hrs UK US Atlanta Fed Inflation Index

1530hrs UK US DOE Crude Oil Inventories (est -1086K vs previous 2072K)

1530hrs UK US DOE Gasoline Inventories (est 907.5K vs previous 4603K)

1815hrs UK UK Bank of England MPC Member Anil Kashyap speaks in London

1900hrs UK US FOMC Rate Decision (est 2.0% upper / 1.75% lower vs previous 1.75% / 1.5%)

1930hrs UK US Federal Reserve Chairman Jerome Powell holds press conference

No major earnings releases today

In the UK, the following FTSE100 stocks go Ex Div tomorrow; 3I, Mediclinic, NMC Health, Persimmon, Severn Trent, WPP

HEADLINE NEWS: AT&T WINS CASE TO GET GO AHEAD FOR $85BLN TIME WARNER TAKEOVER

The Day So Far….

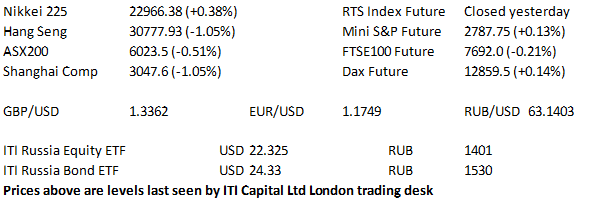

STOCKS: Wall Street shares edged ahead yesterday, boosted by gains in utilities and tech names as investors exercised caution ahead of the FOMC policy decision. Consensus is for the Fed to raise rates 25bps this evening, but investors are waiting to see how Jerome Powell speaks at the after event press conference, looking for hints if the Fed will raise rates 3 or 4 times this year. A 1.3% rise in utility sector shares and a 0.6% gain in the tech sector lifted the S&P by 4.85 points to close at 2786.85 whilst the Nasdaq100 closed 40.704 higher at 7209.18, whilst the Dow closed 1.58 points lower at 25320.73. The historic US-North Korea summit appears to have been largely ignored by the financial markets as the joint statement gave very few details about how the Koreans would make good on their de-nuclearisation pledge.

Asia-Pacific stocks were lower in the main, ahead of today’s FOMC MonPol decision. The Nikkei 225 bucked the trend, adding 0.25% in the morning session as the telecoms and real estate sectors allowed the index to outperform, although the energy sector weighed on the average. The gains were consolidated in the afternoon as further slight gains added a total 88.03 points. Elsewhere industrials and health care weighed on the Hang Seng which has dipped sharply as we approach the close, while the materials and energy sectors weighed on the ASX 200 from the open before trading sideways from mid morning through to the close.. The most notable story in the space was the heavy sell off in ZTE after the stock resumed trading following a 2-month halt re: US trade matters, with the name losing around 40%.

- US index futures have edged higher, aided by the clearance of the AT&T-Time Warner deal, with Mini S&P up 4 points and Mini Dow up 14 points.

US TREASURYS: US Tsys have stuck to a tight range in early Asia-Pacific dealing, trading a touch lower after a batch of positive tweets from US President Trump re: the outlook for North Korean relations. - A Fed hike later today is baked into markets, with attention set to fall on the language deployed in the accompanying statement & the Fed's economic projections.

OIL: WTI spiked lower just after the re-open but has recovered the bulk of its losses, currently trading 46c lower at $65.89, while Brent has lost around 50c. Oil came under pressure after the latest API inventory estimate reportedly revealed a headline crude build and after a BBG report suggested that Russia will propose that OPEC+ oil production returns to October 2016 levels.

GOLD: The yellow metal stuck to a tight range, still operating below $1300/oz overnight. Front month futures seeing very low volumes, last printing 70c lower at $1294.4

FOREX: FX trade was relatively confined in Asia-Pacific hours as participants await the latest FOMC MonPol decision, with a hike baked into market pricing. - USDJPY garnered an early bid as US President Trump reeled off a batch of upbeat tweets re: North Korea, which allowed the pair to tick higher after it managed to close above its 200-DMA for the first time since mid-May. The pair last deals at 110.65, just shy of hourly support from May 22 (110.72). - AUDUSD had stuck to a tight range until RBA Governor Lowe took to the wires. Lowe reiterated that next move in the cash rate is likely to be higher, but conceded that even though Q1 GDP was stronger than the RBA expected, the move will not come for some time. He also highlighted increased tail risks owing to global developments. Ultimately AUDUSD eased to session lows just ahead of the June 04 low (0.7552), before paring some of its losses.

- The USD was marginally stronger elsewhere. EURUSD traders focus on some EUR 3.8bln worth of FX option expiries between 1.1700-1.1725 at today's 10AM NY cut.

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk