Обзор рынка

Зарубежные рынки

Волна продаж бразильских акций и валюты, а также признаки нестабильности на других развивающихся рынках обеспокоили инвесторов и привели к ралли в американских гособлигациях на повышенных объёмах. Рост технологических акций прервался, Nasdaq показал наибольшее снижение за три недели.

Нефть

Нефть в четверг дорожала на фоне опасений относительно сокращения экспорта из Венесуэлы. Над Венесуэлой висит угроза санкций со стороны США, а внутри страны в разгаре экономический кризис. Данные свидетельствуют о том, что Венесуэла отстаёт на месяц по обязательствам поставок нефти, в то время как добыча в стране уже некоторое время находится на исторических минимумах. Баррель Brent вечером котируется на уровне 77,0 долл.

Российский рынок

Несмотря на подорожавшую нефть, российский рынок в отсутствие иных драйверов торговался без особой динамики на фоне умеренно негативного внешнего фона. На фоне ослабления рубля основные индексы завершили сессию разнонаправленно: Индекс МосБиржи закрылся практически без изменения (+0,03%), РТС потерял -0,55%.

В лидерах роста были Лента (+8,1%), Ростелеком (ао +3,9%, ап +1,4%), М.Видео (+3,2%) и Трансконтейнер (+3,2% на фоне сообщений о возможной продаже доли FESCO). Обыкновенные акции Россетей прибавили +0,2%, префы выросли на +4,2% на фоне планов компании выплатить промежуточные дивиденды.

Продавали бумаги En+ (-5,5%), QIWI (-2,0%), Московской биржи (-1,9%), Яндекса (-1,8%) и НМТП (-1,5%).

Новости

Татнефть опубликовала операционные результаты за 5М18. Предприятиями группы в мае добыто 2,446 млн т нефти, за 5М18 - 11,910 млн т нефти, что на 0,9% меньше г/г. За 5М18 по новому бурению построено и сдано 242 скважины (2017: 317 скв.), в том числе эксплуатационное бурение – 150 скв., бурение на битум – 92 скв.

СМИ со ссылкой на источники сообщают, что группа FESCO (32,5% принадлежит «Сумме» Зиявудина Магомедова, арестованного в конце марта по подозрению в мошенничестве, растрате и организации преступного сообщества) собирает заявки на покупку у неё 25,07% в ПАО «Трансконтейнер». Главными претендентами называют структуры, близкие к Роману Абрамовичу и Александру Абрамову, уже владеющие 24,5% «Трансконтейнера». Их наиболее вероятным конкурентом считается UCL Holding Владимира Лисина.

По словам генерального директора Россетей Павла Ливинского, компания готова выплатить ещё промежуточные дивиденды в этом году с тем, чтобы общая сумма оказалась не ниже выплаченных в 2017 дивидендов.

Сбербанк опубликовал результаты по РСБУ за 5М18. Чистый процентный доход банка увеличился на 7,2% г/г и составил 510,9 млрд руб. Рост обусловлен увеличением объёма работающих активов и снижением стоимости привлечённых средств клиентов. Чистый комиссионный доход увеличился на 23,7% до 164,9 млрд руб. Наибольший прирост комиссионного дохода приходится на операции с банковскими картами и эквайринг (+31,8%), расчётные операции (+21,2%) и реализацию страховых продуктов (+52,7%). Операционные расходы увеличились на 9,4% – это ниже темпа роста операционных доходов до резервов, который составил 13,0%. Переход к более равномерному распределению расходов внутри года продолжается. Отношение расходов к доходам улучшилось: показатель снизился на 0,9 п.п. г/г до 28,3%. Расходы на совокупные резервы составили 110,8 млрд руб., что на 7,0% меньше г/г. Созданные на 1 июня резервы превышают просроченную задолженность в 2,6 раза. Прибыль до уплаты налога на прибыль составила 416,4 млрд руб., чистая прибыль составила 328,8 млрд руб., в том числе за май – около 67 млрд руб. Активы в мае выросли на 0,7% до 24,3 трлн руб. Основной драйвер – рост кредитного портфеля как корпоративных, так и частных клиентов.

Полюс подтвердил оценку капитальных затрат на строительство проекта Сухой Лог в размере 2-2,5 млрд долл. Предварительные мощности проекта запланированы на уровне 30 млн т руды в год. Прогноз по производству золоту уточнён до 1,6 млн унций в год. Компания ожидает запуск проекта примерно в 2026.

Открытие, QIWI и «Точка» (цифровой банковский сервис, предлагающий спектр услуг для малого и среднего бизнеса) объявили о создании совместного предприятия по развитию бизнеса «Точки» в качестве мультибанковской платформы. Открытие получит 50% плюс одну акцию в СП, QIWI будет владеть 40%, остальное будет принадлежать менеджменту «Точки». В рамках сделки Открытие и QIWI внесут в СП свои активы, включая торговые марки, программное обеспечение и оборудование «Точки», а также предоставят денежное финансирование.

Группа ТКС на Дне инвестора заявила, что её чистая прибыль может показать рост на 20-40% в год в ближайшие два года.

РусГидро опубликовала результаты по МСФО за 1К18. Общая выручка выросла на 6,5% г/г до 110,097 млрд руб. EBITDA увеличилась на 5,9% г/г до 32,022 млрд руб. Чистая прибыль выросла на 22,0% г/г до 22,951 млрд руб., скорректированная чистая прибыль увеличилась на 2,5% г/г и составила 20,893 млрд руб.

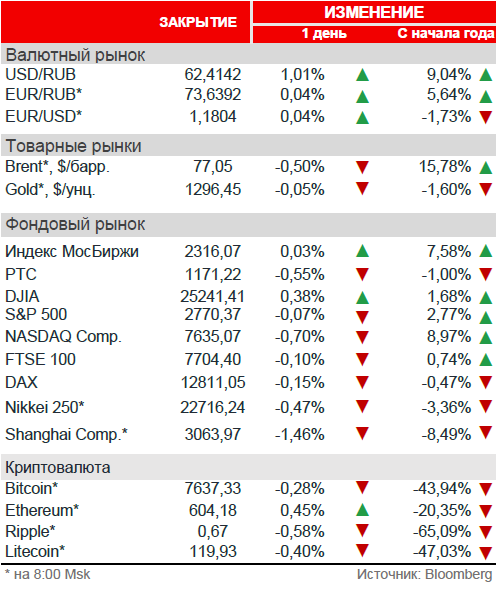

Рыночные индикаторы

Календарь корпоративных событий

| 08.06 |

Черкизово |

операционные результаты 5М18 |

| |

АЛРОСА |

операционные результаты 5М18 |

| |

Группа ГМС |

результаты МСФО 1К18 |

| |

НЛМК |

ГОСА |

| |

Сбербанк |

ГОСА |

| |

Северсталь |

ГОСА |

Календарь ключевых макроэкономических событий

| Пт |

8 июня |

✔ Япония: текущий баланс, ВВП

✔ США: количество буровых установок

|