Overnight Snapshot

The Day Ahead

0730hrs UK EU ECB’s Peter Praet speaks in Berlin

0815hrs UK SZ Swiss CPI (est 0.3%mom / 0.92%yoy vs previous 0.2% / 0.8%)

1000hrs UK EU European Banking Authority Chairman Andrea Enria speaks in Lisbon

1000hrs UK EU ECB Governing Council Member / Dutch Central Bank chief Klass Knot speaks in The Hague

1100hrs UK UK Bank of England MPC member Silvana Tenreyo speaks in Belfast

1200hrs UK US MBA Mortgage Applications (previous -2.9%)

1330hrs UK CA Canadian International Merchandise Trade (est -C$3.42bln vs previous -C$4.14bln)

1330hrs UK US Trade Balance (est -$49.37bln vs previous -$49bln)

1430hrs UK EU The ECB’s Pentti Hakkarainen speaks in Lisbon

1530hrs UK US DOE Crude Oil Inventories (est -2174.62K vs previous -3620K)

1530hrs UK US DOE Gasoline Inventories (est 160.5K vs previous 534K)

1600hrs UK UK Bank of England’s Ian McCafferty speaks on LBC Talk Radio (dial in)

1810hrs UK EU The ECB’s Ignazio Angeloni speaks in Brussels

From the US we have earnings from Thor Industries and Okta

From the UK we have earnings from RPC Group

The following UK stocks go XD tomorrow; Associated British Foods, Evraz, Johnson Matthey, Sainsburys, Scottish Mortgage Inv Trust, and Vodafone

HEADLINE NEWS:

BHP BILLITON RECEIVES BIDS FOR ITS SHALE PORTFOLIO FROM MAJORS INCLUDING BP & CHEVRON

TAKEOVER BATTLE LOOMS AS GOVERNMENT GIVES GO AHEAD TO SKY-FOX MERGER

VOLATILITY MAY HIT WALL STREET AS GOOGLE PARENT ALPHABET & FACEBOOK LEAVE THE TECH SECTOR

The Day So Far….

STOCKS: Technology and Consumer sectors spurred most of Wall Street on to further gains yesterday as investors eyed solid US economic data. However bank stocks eased back along with Treasury yields as bonds were bought in preference to defensives such as utilities and consumer staples. The US services sector activity pointed to robust economic growth in Q2, although trade tariffs and a shortage of workers could pose a threat.The S&P500 gained 4.5 points to end the day at 2748.8 and the Nasdaq100 finished 23.182 higher at 7166.752, although the Dow lost ground by closing 13.71 points lower at 24799.98

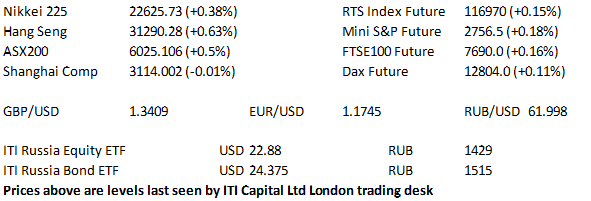

The benchmark Asia-Pacific indices were higher in the main, although the gains were limited. Japan's Nikkei 225 added 86 points, with telecoms leading the advance as industrial names weighed. The Hang Seng has added over 180 points as we near the close, as heavyweight Tencent moved higher, although a heavy consumer discretionary sector limited the gains. China's Shanghai Composite underperformed trading slightly in the red , whilst Australia's ASX 200 added just over 30 points, as the energy and materials sectors led the way higher, while the banking scandal weighed on financials.

US TREASURYS: Tsys are lower, although ranges remain tight, aided by fresh flows after the US cash re-open with risk appetite stemming from an ABC sources piece which suggested that US Treasury Secretary Mnuchin has urged Trump to exempt Canada from the steel & aluminium tariffs. Although the piece noted that not all of the advisers present, including trade hawk Peter Navarro, were in agreement, according to two sources familiar with the conversations. They say the group has been known to harbour ideological differences on major economic issues and the meeting adjourned without any clear resolution to the matter.

OIL: The major crude benchmarks managed to post slight gains, consolidating the move away from Tuesday's lows. - As a reminder Tuesday saw reports suggesting that the US has asked the OPEC+ nations to hike their production by ~1mln bpd. - Reports also pointed to a headline crude draw in this week's API inventory estimate, ahead of Wednesday's DoE release. - Oil continues to operate around ~2-month lows, as uncertainty surrounding OPEC+ production continues to weigh on the market.

GOLD: The yellow metal stuck to an extremely tight range, operating just below $1300/oz.

FOREX: Risk appetite picked up after an ABC sources piece suggested that US Treasury Secretary Mnuchin has urged Trump to exempt Canada from the steel & aluminium tariffs. Although the piece noted that not all of the advisers present, including trade hawk Peter Navarro, were in agreement. USDCAD moved to session lows of 1.2928 on the story, breaching the initial recovery high from Jun 04 at 1.2946, with the next level of support noted at Tuesday's intraday low of 1.2914. - AUD has benefitted from a stronger than exp. Aussie GDP print, although the heavily watch household expenditure metric missed. AUDUSD topped out at 0.7665, shy of the April 23 high (0.7682). NZD has lagged the AUD, but gained vs USD. - The JPY has been the underperformer, although USDJPY hasn't managed to mount a meaningful re-test of 110.00 as of yet, with USDJPY last at 109.85. The pair had a couple of looks at the figure on Tuesday, with no notable break above seen, meaning that strong resistance is expected into the 200-DMA (100.20).

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk