Overnight Snapshot

The Day Ahead

0730hrs UK SW Swedish FSA Director General Erik Thedeen speaks in Stockholm

0900hrs UK EU EuroZone Manufacturing PMI (est 55.53 vs previous 55.5)

0930hrs UK UK Manufacturing PMI (est 53.64 vs previous 53.9

1100hrs UK SW Riksbank Governor Stefan Ingves speaks in Landskrona

1330hrs UK US Non-Farm Payrolls (est 191.1K vs previous 164K)

1330hrs UK US Unemployment Rate (est 3.9% vs previous 3.9%)

1330hrs UK US Average Hourly Earnings (est 0.22%mom / 2.63%yoy vs previous 0.1% / 2.6%)

1355hrs UK US Minneapolis Fed President Neel Kashkari speaks in Minneapolis

1445hrs UK US Manufacturing PMI (est 56.54 vs previous 56.6)

1500hrs UK US Construction Spending (est 0.78% mom vs previous -1.7%)

1500hrs UK US ISM Manufacturing Index (est 58.29 vs previous 57.3)

1500hrs UK US ISM Prices Paid Index (est 77.58 vs previous 79.3)

1520hrs UK EU European Commission Vice President Jyrki Katainen speaks in Stockholm

1800hrs UK US Baker Hughes Rig Count (est 1045 vs previous 1059)

G7 Finance Ministers and Central Bankers continue a meeting in Whistler. Press conference 2nd June

From the US we have earnings from MiMedx and others

In the UK Heathrow Airport, W Resources and John Lewis and in France Laurent Perrier release numbers

HEADLINE NEWS: TRUMP LAUNCHES POTENTIAL TRADE WAR WITH TARIFFS ON STEEL & ALUMINIUM

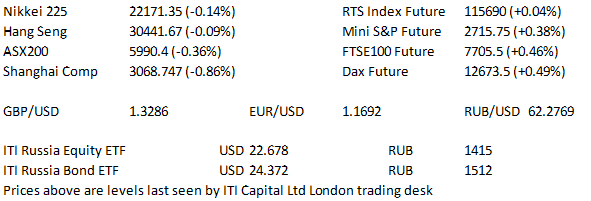

The Day So Far….

STOCKS: Wall Street stocks fell yesterday after the USA moved to impose tariffs on imported metals from Mexico, Canada, the UK and the European Union therefore prompting retaliatory measures. This did not stop both the S&P500 and the Dow from posting the best monthly gains since January, whilst the small cap Russell 2000 posted it’s best percentage gain since last September. The S&P500 closed down 18.74 points on the day but +2.16% on the month, finishing at 2705.27, whilst the Dow closed down 251.94 points on the day but +1.05% monthly, closing at 24415.84. The Tech heavy Nasdaq100 fared somewhat bettr, ending the day just 8.637 points lower at 6967.729, but closing the month an impressive 5.48% higher. Meanwhile at the White House, rather than Nero who fiddled while Rome burned, President Trump tried to get to the ‘bottom’ of his woes in a meeting with Reality TV star Kim Kardashian.

Asia-Pacific stocks traded in mixed fashion with trade war worries dominating sentiment. The Nikkei traded flat as the energy & materials sectors provided the largest boost, while utilities dragged. The Hang Seng has lost 60 points so far as the consumer discretionary sector weighs after a volatile morning session, although the real estate sector provided a modest cushion. The Shanghai Composite is down 30 points as we approach the close as trade tensions overshadowed A shares' inclusion in the MSCI indices. The ASX 200 shed around 30 points (0.5%) from the open as telecoms and financials weighed, but recovered some losses before trading sideways for much of the day.

- US index futures lodged gains, with the mini Dow 50 points higher and the e-mini S&P 7 points higher.

US TREASURYS: Tsys continued to ease in the early part of the Asia-Pacific session. - The selling accelerated after the BoJ trimmed the size of its 5-10 Year Rinban operations, with the belly of the US curve underperforming the extremes. US Tsys had been on the back foot in late NY trade after the effects of month end extension waned. - The Eurodollar strip has followed Tsys lower. - Traders are seemingly more assured re: the Fed hiking cycle after the Italy inspired uncertainty seen earlier this week.

OIL: WTI & Brent shed around $0.15 to deal at $66.85 & $77.40 respectively in earlier trade, but have since staged a recovery with WTI flat at $67.04 and Brent up 24c at $77.80

GOLD: Gold continues to gyrate either side of $1300 in general, with a weekly hi of $1306.8 and lo of $1291.4, with today’s trading so far pinned to the $1298 level

FOREX: The USD has edged higher overnight. After a knee jerk lower JPY crosses have moved higher. The initial move came after the BoJ reduced the size of its Rinban operations covering the 5-10 Year bucket by Y20bln. It is worth noting this is a relatively small reduction, given that the BoJ raised the size of purchases in this sector by Y40bln back on Feb 02 2018. USDJPY last at 109.15. The JPY's reaction may give the BoJ more confidence to further reduce its purchases, as it had been worried about any ensuing JPY app'n after such moves. Italy's 5SM/Lega coalition is set to be sworn in on Friday after a ministerial rejig. Spanish PM Rajoy is expected to lose a confidence vote later today. EURUSD last at 1.1680. Reports have suggested that UK Brexit Min Davis is planning on giving Northern Ireland joint EU-UK status to alleviate the border issue, the story was carried by a UK tabloid and couldn't prevent cable from falling overnight. USDCAD is now flat after an early relief rally following Thursday's losses. AUD & NZD were softer vs. USD.

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk