Overnight Snapshot

The Day Ahead

0700hrs UK UK Nationwide House Price Index (est 0.18%mom / 3.01%yoy vs previous 0.2% / 2.6%)

0800hrs UK SZ Swiss National Bank Vice President Fritz Zurbruegg speaks in Zurich

0930hrs UK UK Bank of England Mortgage Approvals (est 63.44K vs previous 62.9K)

1000hrs UK EU EuroZone Unemployment Rate (est 8.44% vs previous 8.5%)

1000hrs UK EU EuroZone Core CPI (est 0.96% yoy vs previous 0.7%)

1100hrs UK US St Louis Fed President James Bullard speaks in Tokyo

1330hrs UK CA Canadian Quarterly GDP Annualized (est 1.83% vs previous 1.7%)

1330hrs UK US Personal Income / Consumption (est 0.32% / 0.37% vs previous 0.3% / 0.4%)

1330hrs UK US Weekly Jobless Claims (est 227.86K vs previous 234K)

1445hrs UK US Chicago Purchasing Managers Index (est 58.4 vs previous 57.6)

1500hrs UK US Pending Home Sales (est 0.46%mom vs previous 0.4%)

1600hrs UK US DOE Crude Oil Inventories (est 244K vs previous 5778K)

1600hrs UK US DOE Gasoline Inventories (est -946.18K vs previous 1883K)

1720hrs UK CA Bank of Canada Deputy Sylvain Leduc speaks in Quebec City

1730hrs UK US Atlanta Fed President Raphael Bostic speaks in Orlando

1800hrs UK US Fed Governor Lael Brainard speaks in New York

From the US we have earnings from Dollar General, Sears Holdings, Workday, and Costco and others

No major earnings releases in the UK or Europe

In the UK, Marks & Spencer, National Grid and Taylor Wimpey all go XD today, knocking 6.06 points from the FTSE100

HEADLINE NEWS: TENCENT HIRES BANKS TO LIST MUSIC UNIT IN NEW YORK – POSSIBLE $30BLN VALUATION

The Day So Far….

STOCKS: US stocks ended higher yesterday with the S&P500 and the Dow Jones both registering their biggest percentage gains since the 4th May as signs began to emerge that the political turmoil in Italy was starting to ease, coupled with a surge in oil prices. The gains in the S&P500, which closed 34.15 points higher at 2724.01 more than erased the losses from Tuesday’s session, with a similar story emerging in the Dow, which closed 306.33 higher at 24667.78, but both indices still below levels reached last week. Fears about the instability in Italy and the potential for the country to exit the EURO program sent investors to safe haven assets on Tuesday. However Italy’s Five Star Movement yesterday made a renewed attempt to form a coalition, calling for Euroskeptic Paolo Savona to withdraw his candidacy for Finance Minister. A successful auction of 5 and 10 year BTP’s also helped to ease the concerns about Italy’s ability to raise finance after the biggest rise in yields on 2 year bonds in 26 years. A jump in oil prices saw the Energy stocks posting the biggest gains of the S&P sectors, rising 3.1%.

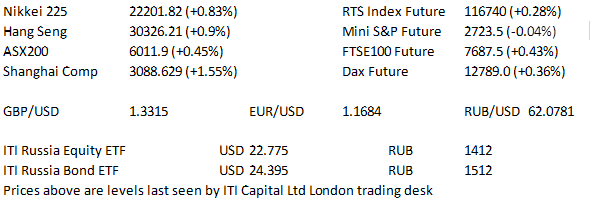

Asia-Pacific stock indices followed their US counterparts higher after the fear surrounding the Italian political situation abated, at least for now. The Nikkei 225 added 183 points as automakers and chemical names led the advance, although the utilities sector was provided a notable drag on the index. The Hang Seng has added around 270 points so far as the energy sector led the charge, followed in close order by consumer staples, while telecoms lagged. China's Shanghai Composite was the regional outperformer adding over 45 points so far as the country's official PMI suite posted stronger results than expected.

The energy & materials sectors led the ASX higher, with the benchmark index adding 27.165 points, although real estate and health care names curtailed gains. US index futures posted marginal losses overnight, with Mini S&P futures currently -1.25 points and the Mini Dow just 9 points lower.

US TREASURYS: US Tsys have stuck to a tight range in Asia-Pacific trade operating around closing levels. The curve sits a little flatter with the long end outperforming. The Eurodollar strip has traded in a lacklustre manner.

OIL: The major oil benchmarks operated below their closing levels with WTI $0.10 softer at $68.10, while Brent crude shed $0.30 to deal at $77.20. - Reports of cracks within the OPEC cartel and questions over their production curbs continue to weigh on sentiment. - Elsewhere reports suggested that the latest API crude inventory release pointed to a headline Crude build, alongside a build in distillates and a drawdown in gasoline & Cushing stocks.

GOLD: Gold stuck to a tight range and operates just above $1300/oz in spot dealing., whilst the front month futures currently trade $4.5 higher at $1306

FOREX: USD operated in mixed fashion as JPY outperformed, though it has eased from best levels as China noted that it will open up certain sectors to foreign investment, but reserved the right to retaliate to any US trade measures. CAD was the early mover adding 20 or so pips to trade to highs of 1.2895 following a report from the Washington Post which noted that US President Trump is set to announce steel & aluminium import tariffs on Canada, Mexico & the EU on Thursday & suggested that import taxes could take effect as soon as Friday. Resistance in front of 1.2900 held and the cross trades back at 1.2870. Australia's capex print was weak in terms of both the headline & breakdown, which added weight to AUD, while NZD experienced some brief headwinds from a softer than exp. Biz confidence survey. EUR ignored the trade.

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk