Overnight Snapshot

The Day Ahead

0930hrs UK EU OECD Economic Forecasts

1000hrs UK EU EuroZone Consumer Confidence (est 0.2 vs previous 0.2)

1200hrs UK US MBA Mortgage Applications (previous -2.6%)

1300hrs UK GE Flash German Inflation

1330hrs UK CA Canada Current Account Balance (est -C$18.15bln vs previous -C$16.35bln)

1330hrs UK US GDP (est 2.26% qoq vs previous 2.3%)

1330hrs UK US Personal Consumption (est 1.13% vs previous 1.1%)

1330hrs UK US Advanced Trade Balance (est -$70.93bln vs previous -$68.3bln)

1330hrs UK US Wholesale Inventories (est 0.56% vs previous 0.4%)

1500hrs UK CA Bank of Canada Interest Rate Decision (est 1.25% vs previous 1.25%)

1545hrs UK SZ Swiss National Bank President Thomas Jordan speaks in Solothurn, Switzerland

1900hrs UK US The Federal Reserve releases the Beige Book

2000hrs UK US The Fed holds a board meeting to discuss changes to the Volcker Rule

From the US we have earnings from AXA Equitable, Box and Michael Kors

In Russia, Sberbank report earnings

In the UK, Marks & Spencer, National Grid and Taylor Wimpey all go XD tomorrow

HEADLINE NEWS: BAYER CLEARED BY DOJ FOR $66BLN MONSANTO BID / RBS CFO EWEN STEVENSON RESIGNS FOR ANOTHER OPPORTUNITY ELSEWHERE

The Day So Far….

STOCKS: Both the S&P500 and the Dow Jones registered their largest one day drops (percentage terms) in the last month yesterday as the political wrangles in Italy generated concerns over stability of the EuroZone, with the falls led by the financial names. The Italian election in March saw no party with a majority, but did see the rise of anti-establishment parties that support leaving the Euro. However the Italians have been unable to form a government since as the most recent nominee for Prime Minister did not receive the backing of other parties. This crisis in Rome and the consequential threat to the Euro saw investors turn to safe havens such as US Treasuries which dragged on yields and caused financials to fall. Shares in the S&P Financials sector registered their biggest fall in 2 months, as the S&P500 closed down 31.47 points at 2689.86, the Dow registered a loss of 391.64 points to close at 24361.45, whilst the tech Nasdaq100 index fared better, it still closed 34.375 points in the red at 6926.544

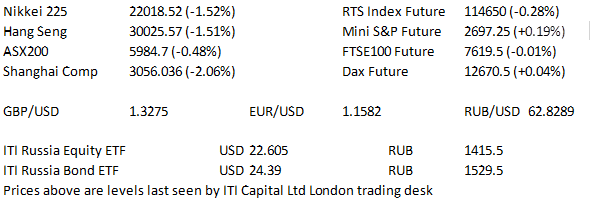

Asia-Pacific indices followed the lead of their global counterparts and traded sharply lower on Wednesday. The White House has also reignited fears of a Chinese trade war as the US Govt backtracked on plans to ditch tariffs on Chinese products. The Nikkei 225 lost 1.9% from the open during a volatile morning session as all the major sectors gave up ground. As mentioned, the losses were broad based, although electronic appliance related names were particularly heavy. A slight rally after lunch saw the market spend the afternoon trading broadly sideways. The Hang Seng also saw the lows soon after the open as all of the major sectors operated in the red. The consumer discretionary sector added the most weight. China's Shanghai Composite had a tough day hitting lows over 2% down on yesterday. An attempted rally after the mid session break failed and the market approaches the daily lows into the close. Australia's ASX 200 was 0.5% worse off with financials and telecoms leading the declines, although utilities & health care provided a degree of respite. US index futures were a little more positive with the e-mini S&P 6.75 points higher, while the mini-Dow adds 85 points as we approach the European open.

US TREASURYS: US Tsy yields have ticked higher during Asia-Pacific hours with the belly underperforming. Benchmark US 10-Year Tsy yields are nearly 4.0bp higher on the day, while T-Note futures operate well off of their early session highs. There has been no fundamental catalyst for the move, perhaps traders are deeming Tuesday's Tsy move on Italian issues as a little overdone. - The Eurodollar strip has also moved away from best levels with the white & red contracts 2.5 to 5.5 ticks lower.

OIL: Oil eased overnight after a brief blip higher in early dealing, with WTI futures losing $0.20 to trade at $66.50, while Brent shed $0.55 to trade at $74.90. Worries re: additional OPEC+ output continue to weigh on the space, while broader risk aversion is also adding pressure.

GOLD: The yellow metal seen as a safe haven ticked higher from the Asian open but slipped as the day wore on and last operates just shy of $1300/oz.

FOREX: Risk aversion faded to a degree, as US Tsy yields ticked higher, although they still remain well shy of Friday's closing levels. USD trades mixed against the majors, while JPY has unwound the bulk of its early gains. Worries over Italy continue to circle, with little in the way of fresh fundamental catalysts apparent in the Asia-Pacific session. USDJPY printed a low of 108.35, failing to threaten Tuesday's low, with the cross last dealing at 108.70, virtually unchanged on the day, while EURJPY bottomed at 125.00, once again well above Tuesday's low, last 125.30. - EURUSD has stuck to a tight range, capped by 1.1550, dealing at 1.1535 last. GBPUSD has operated in a narrow window, last 1.3250. The Antipodeans have shaken off most of their early weakness, aided by the uptick in US Tsy yields. AUDUSD last at 0.7495, NZDUSD last ~0.6910. This comes after the RBNZ noted that MonPol is not expected to tighten for some time & that further LVR easing is unlikely until next FSR at the earliest.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk