Overnight Snapshot

The Day Ahead

0900hrs UK SW Swedish FSA Press Conference on Financial Stability

0930hrs UK EU ECB Governing Council Member & Bank of Italy Governor Ignazio Visco speaks in Rome

1000hrs UK SW Riksbank Deputy Governor Henry Ohlsson speaks in Orebro, Sweden

1030hrs UK EU ECB Executive Board Member Yves Mersch speaks in Frankfurt

1500hrs UK US Conference Board Consumer Confidence (est 127.74 vs previous 128.7)

1530hrs UK US Dallas Fed Manufacturing Activity (est 23.79 vs previous 21.8)

1630hrs UK EU ECB Executive Board Member Sabine Lautenschlaeger speaks in Frankfurt

1700hrs UK EU ECB’s Villeroy & Benoit Coeure speak in Paris

From the US we have earnings from Salesforce.com

No major earnings releases from the UK or Continental Europe

HEADLINE NEWS: UK GOVERNMENT TO REDUCE STAKE IN ROYAL BANK OF SCOTLAND AS EARLY AS THIS WEEK

The Day So Far….

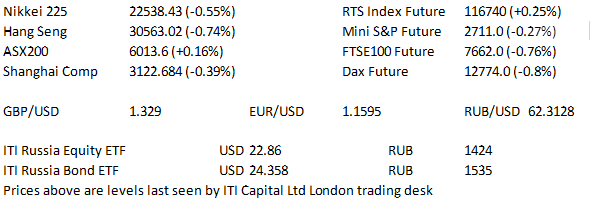

STOCKS: Weakness in S&P futures during the Memorial Day holiday seeped in to Asian bourses overnight. JPY gained & political unrest in Europe continued to weigh on risk appetite. The Nikkei 225 shed over 1.0% before recovering some of the losses into the close, finishing the day 122.66 points lower at 22358.43, with the electronics space weighing on reports surrounding Apple's preferred display type for its new iPhone. It was only the defensive consumer staples sector that traded higher on the day. The Hang Seng followed suit and lost 0.6% into the lunch break, trading sideways in the afternoon session as the telecoms sector applied the most weight. Once again consumer staples provided the only notable source of respite. China's Shanghai Composite also saw losses heading into the lunch break, but has seen much of the negative move eroded as the market approaches the close. The ASX 200 bucked the trend posting a small gain as the financial sector led the way higher, although the IT & telecoms sectors capped the gains. US index futures have traded flat for most of the overnight period, but both Mini S&P and the Mini Dow have dropped sharply into the European open.

US TREASURYS: US Tsy futures have operated in a choppy manner following the re-opening of the cash Tsy space after the elongated holiday weekend, although the T-Note's range has been relatively contained. - Yields sit at/just off of session lows at present, following a bout of broader risk off flows in Asia-Pacific dealing, although there was no particular headline/fundamental catalyst to spark the move. - The Italian and Spanish political situation underpinned risk off flows on Monday after a brief relief rally. - The Eurodollar strip continues to trade higher, with the white and red contracts trading 1.0 to 3.5 ticks better off.

OIL: WTI trades around a $1.00 softer than Friday's settlement at $66.77, with worry over the production levels of the OPEC+ nations going forwards as Russia & Saudi Arabia signalled that they are mulling the easing of production curbs for the group. Brent trading a fraction higher at $75.42.

GOLD: The yellow metal had a brief look above $1300/oz in Asia-Pacific dealing on broader risk off flows but failed to consolidate there, last trading virtually unchanged at $1298.

FOREX: JPY strength was the overriding theme from the overnight session as EURJPY carved out another fresh YtD low. - A bout of risk off flow was apparent as US Tsy yields moved to lows & the PBoC fixed the USDCNY cross over 6.4000, with little news flow apparent at the time. This saw USDJPY briefly cross below 109.00, while the AUDUSD & NZDUSD came under pressure, although the Antipodeans now trade off of worst levels. - Price action was fairly limited elsewhere with Yonhap running a story noting that a North Korean senior official has headed for Washington for possible working-level talks, which may have limited the risk off flows later in the session

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk